Introduction:

As we step into the realm of international finance, the West Texas Intermediate (WTI) crude oil price plays a pivotal role. This light and sweet crude serves as a crucial benchmark for global energy markets, influencing the economies of nations worldwide. In this article, we delve into the complexities of the WTI forex market, examining the latest trends, forecasting future projections for July 2019, and identifying potential opportunities and risks for savvy investors.

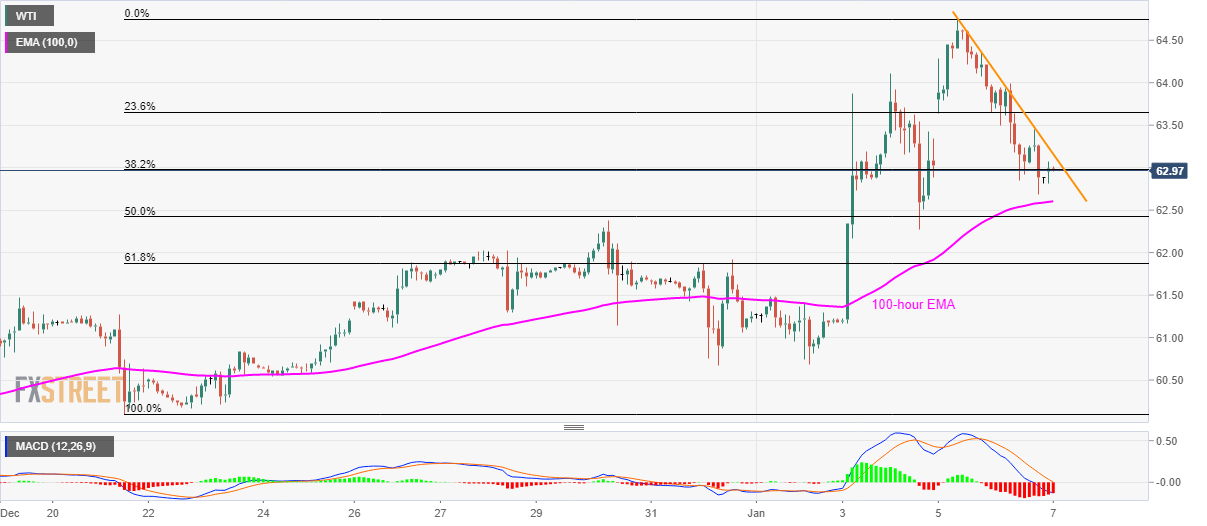

Image: www.researchgate.net

Understanding WTI Crude Oil and its Role in Forex Trading:

West Texas Intermediate (WTI) crude oil stems from North American oil fields, earning recognition as a premium, high-quality crude oil. Its abundance within the United States enhances the country’s energy independence, while its sulfur-poor nature minimizes environmental impact.

In the realm of forex trading, WTI retains immense significance due to its pivotal role as a global benchmark. Its price fluctuations influence the performance of many other crude oil contracts, impacting the strategies of traders worldwide.

Historical Trends and Historical Price Analysis:

A comprehensive understanding of WTI’s historical trajectory offers valuable insights for forecasting future trends. The price of WTI crude oil has experienced significant volatility over the past decade, ranging from a peak of $147.27 per barrel in July 2008 to a low of $26.21 per barrel in February 2016.

These price fluctuations were primarily driven by global economic conditions, supply and demand dynamics, geopolitical events, and unforeseen disruptions. Economic recoveries and increased energy consumption lead to higher demand, driving up prices, while economic downturns and decreased energy consumption often reverse this trend.

Factors Influencing WTI Forex Price Forecast for July 2019:

To accurately forecast WTI prices for July 2019, a comprehensive analysis of key influencing factors is critical.

-

Image: www.forexcrunch.comGlobal Economic Growth:

Healthy global economic growth typically translates into increased demand for oil, elevating prices. A positive outlook for global economies, including China, the United States, and Europe, suggests continued support for WTI prices.

-

Supply and Demand Balance:

A surplus of oil supply versus demand generally depresses prices, while a shortage of supply against demand exerts upward pressure. Factors influencing supply and demand, such as production levels, global inventories, and geopolitical risks, should be closely monitored.

-

Geopolitical Events:

Unrest in oil-producing regions or disruptions to critical transportation routes have historically led to oil price volatility. Tensions in the Middle East, for instance, can potentially disrupt supply and send prices soaring.

-

US Dollar Strength:

The value of the US dollar has a significant impact on the price of oil, as crude is primarily priced and traded in US dollars. A strong US dollar often makes oil more expensive for buyers holding other currencies, resulting in lower demand.

July 2019 Forecast: Expectations and Expert Perspectives:

Based on current market conditions and prevalent expert opinions, WTI crude oil is projected to trade within a range of $55 to $65 per barrel during July 2019. Several factors contribute to this forecast:

-

Optimistic Global Economic Outlook:

Continued economic expansion, particularly in China and the United States, is expected to sustain demand for crude oil, supporting higher prices.

-

Wti Forex July 2019 Forecast

Modest Increase in Supply:

While supply is anticipated to increase, primarily from shale oil production