In the fast-paced arena of forex trading, scalping reigns supreme as a lucrative strategy for astute traders seeking quick profits. It’s an adrenaline-fueled technique that requires precision, agility, and a deep understanding of market dynamics. Join us as we embark on a comprehensive exploration of the winning scalping strategy in forex, unlocking the secrets to consistent profitability.

Image: www.forexstrategiesresources.com

Scalping is a high-frequency trading style that involves taking numerous small profits from tiny price movements within a short timeframe. Unlike traditional trading, scalpers don’t hold positions for extended periods, instead capitalizing on incremental gains that accumulate over time. This strategy demands an eagle eye for identifying fluctuations, pinpoint execution, and unwavering risk management.

The Art of Scalping: A Snapshot

At the heart of scalping lies a profound grasp of market microstructure. Scalpers study order books, liquidity profiles, and technical indicators to predict the immediate direction of price movements. They seek areas of support and resistance to set up favorable entries and exits, capturing pips in rapid succession.

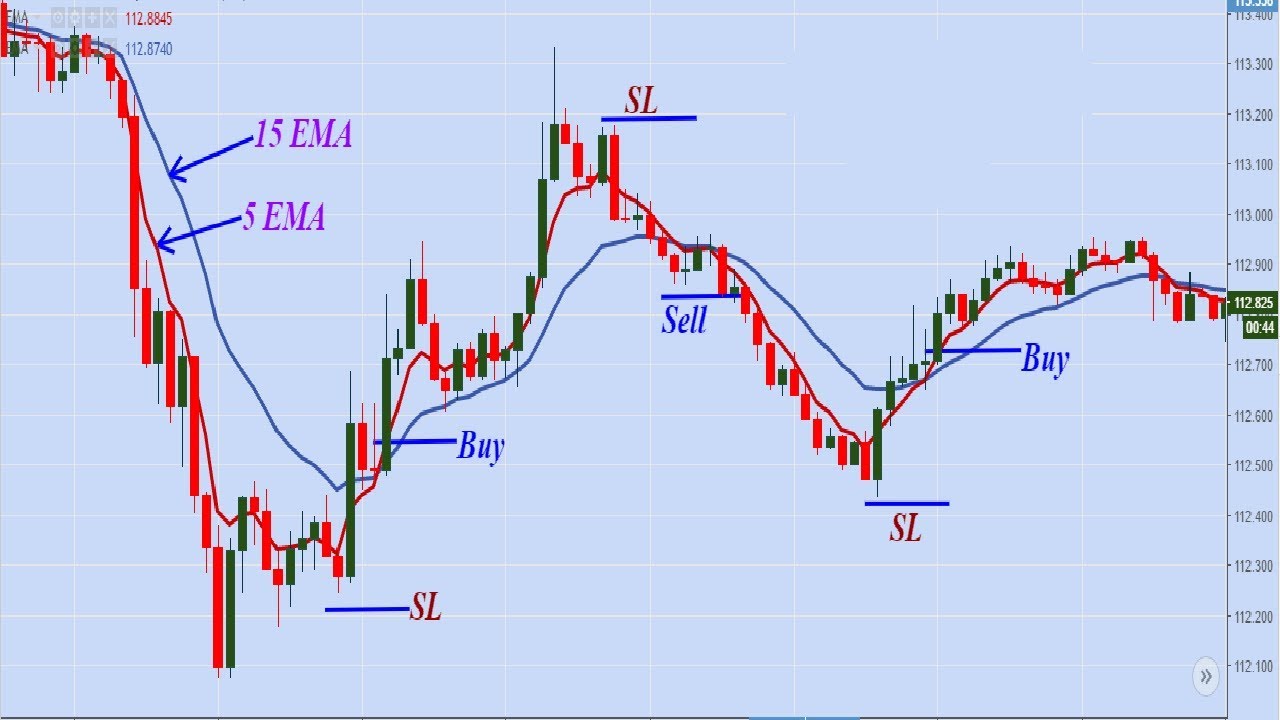

Effective scalping requires a razor-sharp focus on price action. Candlestick patterns, moving averages, and other technical tools provide invaluable insights into the flow of supply and demand. Scalpers typically work within timeframes of one minute to fifteen minutes, where price movements are more defined and predictable.

Essential Elements of a Winning Scalping Strategy

1. Market Selection: Scalping thrives in volatile markets with high liquidity, such as major currency pairs or indices. Look for instruments with ample trading volume and tight spreads to ensure optimal execution.

2. Trade Management: Precision is paramount in scalping. Set clear entry and exit points based on technical analysis and risk parameters. Strict stop-loss orders and take-profit targets safeguard capital and ensure consistent profitability.

3. Risk Control: Scalping involves frequent trades, so risk management is critical. Determine an appropriate risk level, typically 1-2% of your account balance per trade. Avoid overtrading and always trade within your financial capacity.

4. Technical Analysis: Scalpers rely heavily on technical indicators to identify trading opportunities. Use a combination of moving averages, oscillators, and chart patterns to anticipate price movements and make informed decisions.

5. Psychology: Scalping requires unwavering emotional control. Stay disciplined, avoid FOMO, and trade with a clear mindset. Psychological resilience is essential for navigating the ups and downs of high-frequency trading.

Expert Tips for Scalping Success

1. Master Your Platform: Familiarity with the trading platform is crucial. Practice using charts, entry and exit buttons, and order management tools. Seamless execution reduces delays and improves your chances of profit.

2. Discipline and Persistence: Scalping is a demanding strategy that requires consistent effort and discipline. Study market trends, refine your trading strategy, and constantly seek to improve. Patience and perseverance are the keys to unlocking its potential.

Image: www.youtube.com

Frequently Asked Questions (FAQs)

Q: What are the benefits of scalping?

A: Scalping offers several advantages, including the potential for quick profits, high frequency of trades, and the ability to capture incremental gains in small market movements.

Q: What are the risks associated with scalping?

A: Scalping carries inherent risks due to frequent trades and high market volatility. Emotional trading, overtrading, and poor risk management can lead to losses if not executed with precision.

Q: Is scalping suitable for beginners?

A: While scalping can be lucrative, it’s not recommended for complete novices. It requires a solid understanding of market dynamics, technical analysis, and risk management. Beginners should first gain experience with more conservative trading strategies.

Winning Scalping Strategy In Forex

Conclusion

Unleashing the power of the winning scalping strategy in forex requires a comprehensive understanding of market fundamentals, technical analysis techniques, and prudent risk management. By adhering to these principles, mastering the art of pinpoint trade execution, and maintaining unwavering discipline, aspiring scalpers can navigate the turbulent waters of forex trading and reap the rewards of consistent profitability. Are you ready to embark on this exhilarating journey and unlock your potential as a successful scalper?