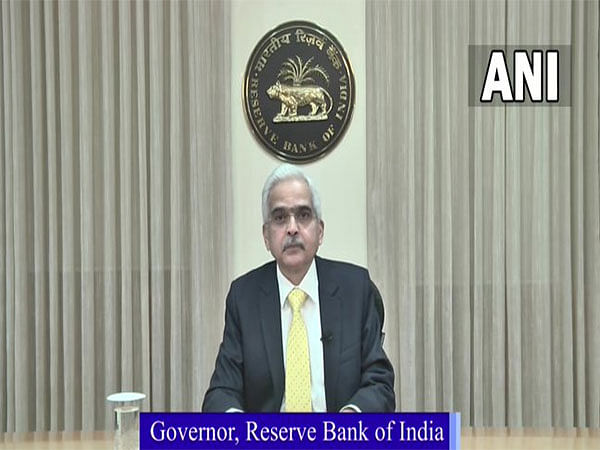

The Reserve Bank of India (RBI), India’s central banking institution, plays a pivotal role in maintaining the country’s financial stability. Among its varied responsibilities, RBI exercises strict control over foreign exchange transactions to protect the Indian economy against potential risks associated with unbridled forex trading.

Image: economictimes.indiatimes.com

Forex trading, also known as foreign exchange trading or currency trading, involves the buying and selling of currencies in the global foreign exchange market. It’s a vast and complex market where traders speculate on currency fluctuations to make profits. However, due to its inherent risks and potential impact on the Indian economy, RBI has implemented regulations prohibiting Indian citizens from directly participating in forex trading.

Understanding RBI’s Rationale for Prohibiting Forex Trading

RBI’s decision to ban forex trading in India stems from several key reasons:

1. Currency Volatility Risks

Foreign exchange markets are notoriously volatile, subject to rapid fluctuations influenced by global economic events, political uncertainties, and market sentiments. Allowing unrestricted forex trading could expose the Indian economy to heightened currency risks. Sharp currency movements can impact export competitiveness, inflation, and overall economic growth.

2. Protection of Foreign Exchange Reserves

India’s foreign exchange reserves play a crucial role in maintaining the nation’s economic stability. They serve as a buffer against external shocks and provide the government with the ability to intervene in the forex market to manage exchange rate volatility. Allowing forex trading could deplete these reserves, making India more vulnerable to economic crises.

Image: theprint.in

3. Prevention of Speculative Trading

Forex trading often attracts speculative traders who engage in high-risk, short-term currency deals. These traders aim to profit from currency fluctuations but contribute little to the underlying economy. RBI recognizes that allowing speculative trading could create imbalances in the forex market and destabilize the Indian currency.

4. Monitoring of Financial Flows

RBI maintains strict oversight over financial flows in and out of India to prevent illegal activities like money laundering and terrorist financing. Allowing forex trading could make it challenging to monitor these flows, potentially creating loopholes for illicit transactions.

Exceptions and Alternatives to Forex Trading in India

While RBI generally prohibits forex trading in India, certain entities are permitted to engage in limited forex transactions for legitimate business purposes. These include:

- Authorized Dealers: Banks and other financial institutions authorized by RBI can facilitate forex transactions on behalf of their customers.

- Corporates: Companies engaged in international trade may carry out forex transactions related to their import and export activities.

- Individuals: Individuals can purchase foreign exchange for travel, education, or other permissible purposes, but the amounts are typically limited.

Additionally, several regulated financial instruments provide alternative ways to gain exposure to the forex market, such as:

- Currency Futures and Options: These instruments allow traders to speculate on currency movements without directly buying or selling currencies.

- Exchange-Traded Funds (ETFs): ETFs tracking foreign currencies or currency indices provide investors with diversified exposure to the forex market.

Why Does Rbi Not Allow Forex Trading

Conclusion

RBI’s prohibition on forex trading in India is a well-considered measure aimed at protecting the country’s economic stability and preventing financial risks. By implementing these regulations, RBI safeguards India’s foreign exchange reserves, monitors financial flows, and minimizes the impact of speculative trading on the domestic currency. While this prohibition limits direct forex trading opportunities for Indian citizens, alternative financial instruments allow for controlled exposure to the forex market.