Tired of exorbitant foreign transaction fees and unfavorable exchange rates when travelling abroad? Look no further than forex cards—your savvy solution for seamless and affordable global spending. In this guide, we’ll delve into the world of forex cards and help you choose the best one for your adventures in Malaysia.

Image: www.youtube.com

Forex Cards: Your Ticket to Cost-Effective Travel

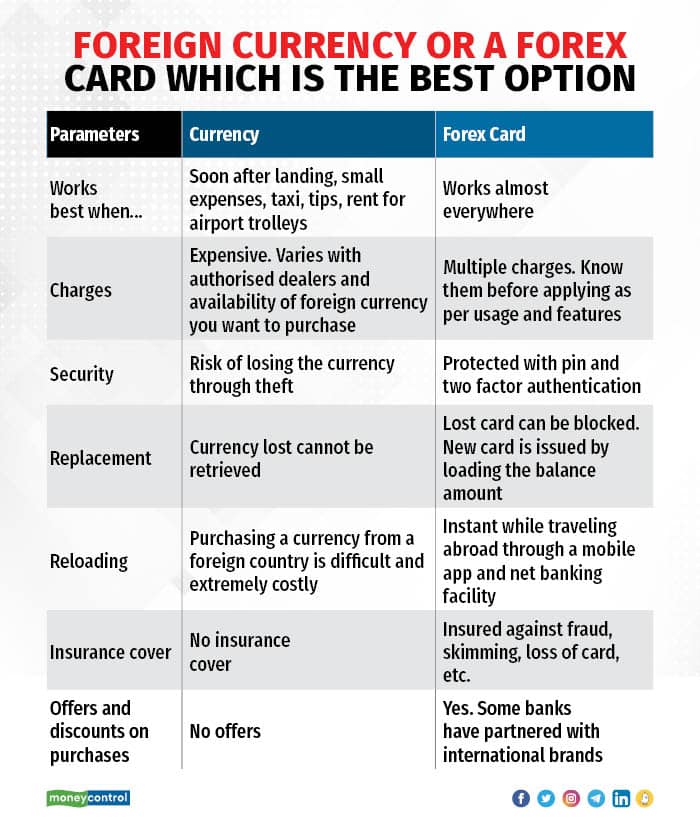

Forex cards, also known as prepaid travel cards, are essentially prepaid debit cards that allow you to load multiple currencies and spend them without hefty bank charges. By locking in exchange rates at the time of loading, forex cards shield you from currency fluctuations and save you a significant amount compared to traditional bank transactions.

Features to Consider When Choosing a Forex Card

When selecting a forex card for Malaysia, several key factors come into play:

-

Currency Support: Ensure the card supports Malaysian Ringgit (MYR) and any other currencies you may need during your trip.

-

Transaction Fees: Look for cards with low or no transaction fees for ATM withdrawals and purchases.

-

Foreign Exchange Rates: Compare the exchange rates offered by different cards to find the best possible deals.

-

Reload Options: Consider cards that allow easy and convenient reloading from your home country.

-

Safety and Security Features: Opt for cards with robust security features, such as EMV chip technology and zero liability protection.

Top Forex Cards for Travel in Malaysia

Now that you’re equipped with the criteria, let’s explore some of the best forex cards for travelling in Malaysia:

-

Wise Multi-Currency Account: The Wise Multi-Currency Account offers exceptional value with its low transaction fees and competitive exchange rates. It also allows you to hold and exchange multiple currencies, providing convenience and flexibility.

-

Revolut Card: The Revolut Card is a feature-rich option that combines low transaction fees, real-time currency conversions, and a user-friendly mobile app. It also offers a variety of premium plans with additional perks.

-

BigPay Card: If you’re a frequent traveller to Malaysia, the BigPay Card is a great choice. It offers a range of discounts and rewards, including free ATM withdrawals in Malaysia and competitive exchange rates.

Image: www.moneycontrol.com

Tips for Using a Forex Card in Malaysia

To make the most of your forex card experience in Malaysia, follow these expert tips:

-

Load Multiple Currencies: Take advantage of the multi-currency feature to lock in favorable exchange rates and avoid conversion fees.

-

Avoid ATM Withdrawals: ATM withdrawals typically incur a higher transaction fee compared to purchases. Use your forex card for everyday expenses instead.

-

Monitor Your Balance Regularly: Keep track of your expenses to avoid overspending or running out of funds.

-

Be Aware of Local Currency Laws: Familiarize yourself with Malaysian laws regarding currency exchange and cash limits to ensure compliance.

Frequently Asked Questions

Q: Can I use a forex card to withdraw cash in Malaysia?

A: Yes, you can withdraw cash from ATMs using your forex card. However, some cards may charge a transaction fee for ATM withdrawals.

Q: How do I load my forex card?

A: Most forex cards can be reloaded online or by bank transfer from your home country.

Q: Is it safe to use a forex card in Malaysia?

A: Forex cards are generally safe to use in Malaysia. However, it’s important to choose a card with strong security features and take necessary precautions, such as keeping your PIN confidential.

Which Forex Card Is Best For Travelling In Malaysia

Conclusion

Choosing the right forex card for your travels in Malaysia can save you a significant amount of money and enhance your overall travel experience. By considering the factors discussed above, you can select the card that best meets your needs and helps you make the most of your Malaysian adventure.

So, are you ready to embark on a cost-effective and convenient journey in Malaysia? Don’t let exchange rates and transaction fees hold you back. Grab the best forex card today and travel with peace of mind!