Have you ever felt like a pinball, bouncing around in a volatile market? We all know trading can be full of swings, but what if I told you there was a way to bet on those very swings, even if you weren’t sure which way the ball was going to roll? This is the essence of Up/Down Options – a simple yet powerful trading tool that allows you to profit from price movements, regardless of the direction.

Image: www.slideshare.net

Imagine you’re on a rollercoaster. Do you want to bet that it will go up? Or down? This is the basic concept of Up/Down Options. They’re essentially bets on the price direction of an asset over a specific timeframe. They’re an exciting and potentially lucrative way to participate in the market, but it’s important to understand the intricacies to make informed decisions.

A Deeper Dive into Up/Down Options: A Simplified Explanation

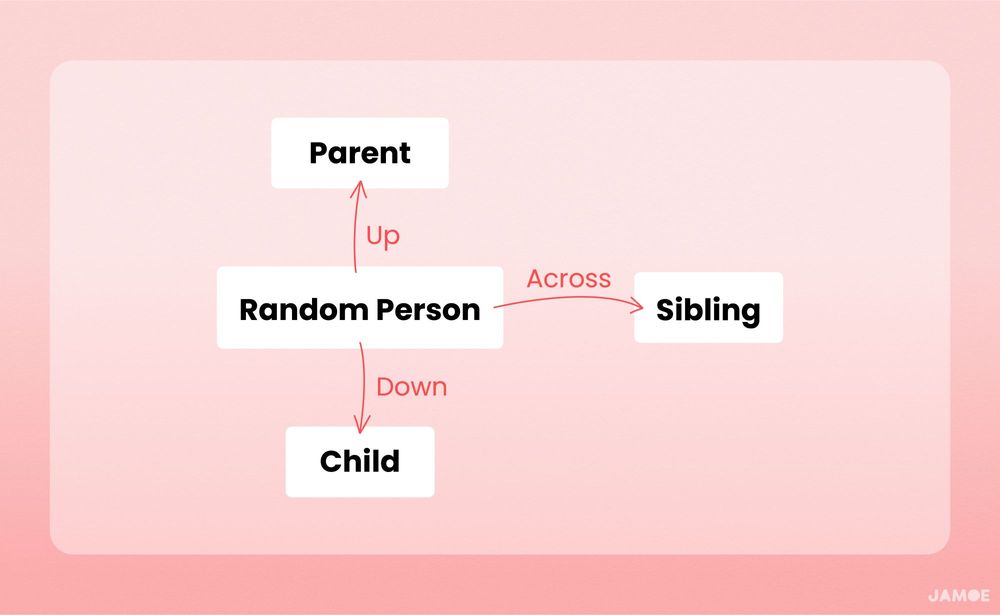

Up/Down Options, also known as “Binary Options” in some contexts, are a type of financial derivative. They are a simple form of trading where you make a prediction about the future price of an asset. You choose whether you think the price of the asset will be “up” (higher than the entry price) or “down” (lower than the entry price) at the end of the trading period. If your prediction is right, you win a fixed payout; if you’re wrong, you lose your initial investment.

Here’s a practical example: Suppose you believe the price of Apple stock will go up by the end of the day. You can buy an “Up” option on Apple stock. If the price of Apple stock rises above the entry price when the option expires, you receive a predetermined payout, even if it rises only slightly. Conversely, if the price of Apple stock remains below the entry price, you lose the amount you invested. The beauty of Up/Down Options lies in their simplicity. You don’t need to predict the exact price movement, just its direction.

Benefits, Risks, and Understanding the Odds

The Upside: Potential for High Returns

Up/Down Options offer the potential for significant returns. A key advantage is the fixed payout structure. Even a small price movement in your favor can result in a substantial profit. This means smaller account balances can participate in larger trades, making this option attractive to beginners.

Image: words.jamoe.org

The Downside: Increased Risk of Loss

However, the potential for high returns is coupled with a higher risk of loss. It’s an all-or-nothing scenario. If your prediction is wrong, you lose your entire investment. This inherent risk makes Up/Down Options an exciting yet challenging trading opportunity.

Decoding the Odds

The payout structure of Up/Down Options, often in the form of a fixed percentage, can vary based on several factors, including the underlying asset, the time to maturity, and market volatility. Understanding the odds presented by the brokerage platform you’re using is crucial. Before you decide to participate, it’s vital to assess the probability of your prediction succeeding. The higher the probability, the lower the payout, and vice versa.

Navigating the Up/Down Options Landscape: Trends and Tips

Emerging Trends: Mobile Trading and Cryptocurrency

The world of Up/Down Options is evolving rapidly. Mobile trading apps, with their intuitive interfaces, have led to increased accessibility. This has made it easier than ever to trade these options from the palm of your hand. Furthermore, the rise of cryptocurrency has brought a new wave of volatility and investment opportunities, making digital assets a popular choice for Up/Down Options trading.

Expert Advice: Stay Informed and Manage Risk

Entering the world of Up/Down Options is an exciting journey. However, it’s crucial to arm yourself with knowledge and understand the associated risks. Here are some tips from seasoned traders to help you make informed decisions:

- Do your Research: Dive deep into the asset you’re considering trading, understanding the factors that could influence its price. Stay informed about current events, news, and market sentiment. Look for reputable sources and consider diverse perspectives.

- Start Small and Gradually Increase Your Stakes: Don’t jump into large trades right away. Begin with small investments to familiarize yourself with the platform and the dynamics of the market. As your understanding grows, and you gain more confidence, you can gradually increase your stakes.

- Set Stop-Loss Orders: One of the most important strategies in trading is managing risk. Stop-loss orders, which automatically close a trade when the price reaches a certain point, can limit your losses, preventing significant damage to your investment.

- Diversify Your Portfolio: Don’t put all your eggs in one basket. Invest in multiple assets and strategies to spread risk. Having a balanced portfolio can cushion any losses and increase your overall chances of success.

- Embrace Learning and Adaptability: The markets are constantly evolving. Be open to learning new strategies, adapting to changing conditions, and refining your investment decisions based on your experiences and market insights.

Frequently Asked Questions (FAQ)

Q: Are Up/Down Options Suitable for Beginners?

A: While Up/Down Options are simple in concept, they involve significant risk, and it’s vital to thoroughly understand the mechanisms before investing. Starting with a learning curve, focusing on educational resources, and practicing with demo accounts can help you build confidence and make informed decisions.

Q: How Do I Choose a Reputable Brokerage Platform?

A: Before you invest, research different brokerage platforms. Ensure they are regulated and offer customer support. Look for platforms that provide transparency about fees, payouts, and trade conditions. Check for security measures, and consider user reviews.

Q: Can I Use Up/Down Options for Long-Term Investments?

A: Up/Down Options are typically short-term trading instruments. They are not designed for long-term investments, as the payout structure and time to maturity make them less suitable beyond short-term market predictions.

Up Down Options

Conclusion: Embrace the Challenge

Up/Down Options offer a unique and exciting trading opportunity. Whether you’re a seasoned trader looking for a new avenue to profit, or a curious investor seeking an engaging way to participate in the market, understanding the dynamics and risks involved is paramount. Embrace learning, refine your strategies, and most importantly, do your research before placing any trades!

Are you interested in learning more about Up/Down Options? Share your thoughts and questions in the comments below!