In the dynamic world of foreign exchange trading, understanding liquidity is crucial. It determines how easily and quickly you can execute trades, directly impacting your trading strategy and profitability. In this article, we delve into the intricacies of liquidity in the forex market, exploring its various facets and providing practical tips to enhance your trading experience.

Image: www.sitepronews.com

When it comes to forex trading, liquidity refers to the ease with which a currency pair can be bought or sold without significantly affecting its price. A liquid market offers tight spreads, enabling traders to enter and exit trades swiftly and efficiently.

Factors Affecting Forex Market Liquidity

Several factors influence forex market liquidity:

- Currency Pair Popularity: Major currency pairs like EUR/USD and USD/JPY enjoy higher liquidity due to their extensive trading volume.

- Trading Time: Market liquidity generally peaks during trading sessions in major financial hubs like London, New York, and Tokyo.

- Market Conditions: Economic news, geopolitical events, and central bank announcements can significantly impact market liquidity.

Importance of Liquidity in Forex Trading

High liquidity offers several advantages in forex trading:

- Reduced Slippage: Liquid markets minimize the difference between the intended trade price and the actual execution price.

- Faster Execution: Orders can be filled more quickly, allowing traders to capitalize on market opportunities.

- Lower Transaction Costs: Liquidity reduces spreads, resulting in lower trading costs.

Identifying When Liquidity Is Higher in the Forex Market

Pinpointing times when liquidity tends to be higher in the forex market can significantly enhance your trading strategy:

- Major Trading Hours: Liquidity is usually highest during the overlapping trading sessions of major financial centers (London, New York, and Tokyo).

- Economic Data Releases: Important economic data releases often attract increased market participation, boosting liquidity.

- Central Bank Announcements: Monetary policy decisions by major central banks can significantly impact market liquidity.

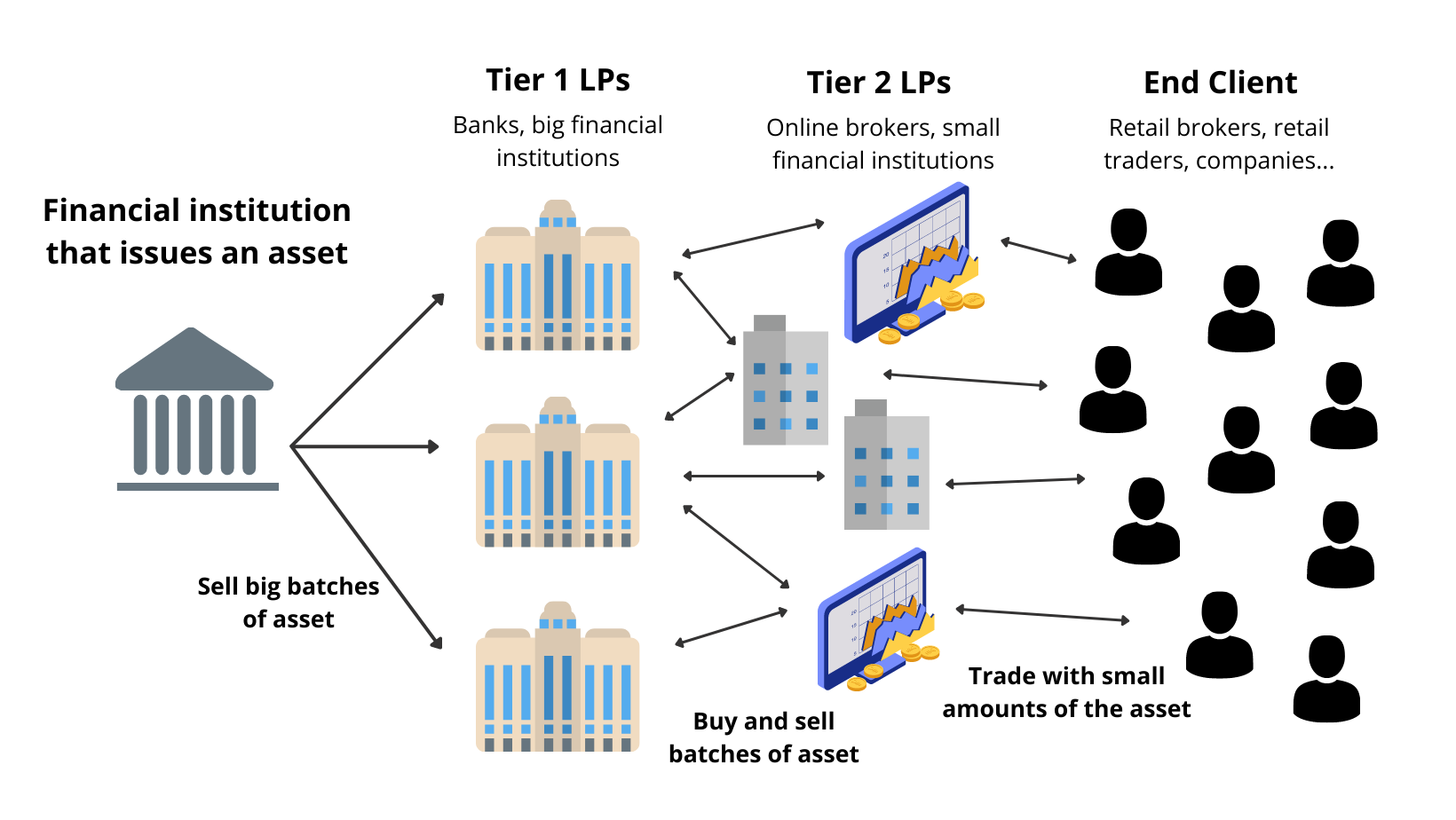

Image: www.daytrading.com

Tips for Trading in Less Liquid Conditions

While higher liquidity is generally preferable, traders must be prepared to navigate markets with lower liquidity. Here are some expert tips:

- Understand the Market Conditions: Monitor economic and political events that may affect liquidity.

- Use Limit Orders: Limit orders specify the maximum price you’re willing to trade, which can help avoid unfavorable price execution.

- Increase Spreads: Consider increasing your acceptable spread to improve the chances of order execution in less liquid markets.

Frequently Asked Questions About Forex Market Liquidity

Q: What happens when liquidity is low in the forex market?

A: Low liquidity can result in wider spreads, higher transaction costs, and increased slippage.

Q: Why is liquidity important in forex trading?

A: Liquidity ensures smoother trade execution, lower costs, and reduced price slippage.

Q: How can I track market liquidity?

A: Several platforms and tools provide real-time information on market liquidity.

When Liquidity Is More In Forex Market

Conclusion

Understanding liquidity in the forex market is paramount for successful trading. By recognizing factors that influence liquidity and identifying periods of increased liquidity, traders can optimize their strategies, mitigate risks, and enhance their profit potential. Remember, liquidity is a dynamic aspect of the forex market, so staying informed and adapting accordingly is crucial. By embracing this knowledge and implementing the insights provided in this article, you can navigate the complexities of forex liquidity and leverage it to your trading advantage.

Tell us below in the comments if you found this article helpful in understanding liquidity in the forex market. Your questions and insights are highly valued. Join the discussion and share your experiences!