Introduction: The VIX, a Gauge of Fear

Have you ever felt your stomach sink as the stock market plunges? Or experienced a surge of excitement when prices soar? These emotions, while natural, reflect the inherent volatility of the financial markets. That’s where the VIX comes in, often referred to as the “fear index.” The VIX, also known as the CBOE Volatility Index, provides a real-time measurement of market expectations for volatility over the next 30 days. It’s a crucial tool for investors and traders alike, offering valuable insights into the market’s sentiment and potential for turmoil.

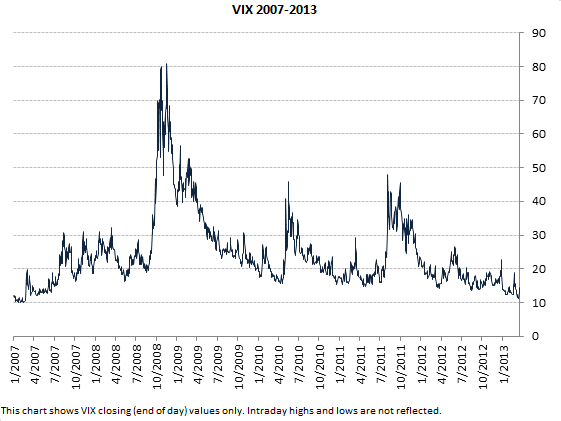

Image: www.stockmaniacs.net

Imagine you’re about to invest in a new stock. You’re cautiously optimistic, but you’re also wary of the potential for sudden price swings. Checking the VIX can help you gauge the market’s overall risk appetite. A high VIX suggests investors are nervous and anticipate significant price fluctuations, while a low VIX indicates a calmer market with potential for stability.

What is the VIX and Why is it Important?

Understanding the VIX

The VIX is a key indicator of market volatility, calculated based on the prices of options contracts on the S&P 500 index. It represents the implied volatility of the index over the next 30 days. Think of it as a “fear gauge,” reflecting investor expectations about the market’s potential for swings. A higher VIX value signals heightened volatility and uncertainty, while a lower value suggests a more stable market.

The VIX’s Significance:

The VIX plays a significant role for investors and traders for several reasons:

- Risk Assessment: The VIX provides a valuable measure of market risk, helping investors and traders assess their portfolio’s potential for losses.

- Trading Opportunities: High VIX levels can present opportunities for options traders, as volatility enhances the value of options contracts.

- Market Sentiment Indicator: The VIX reflects the collective sentiment of market participants, giving insights into their outlook on the economy and the direction of the stock market.

Image: www.macroption.com

Deciphering the VIX Live Chart: Reading the Signs

The VIX live chart is a dynamic representation of market volatility, constantly fluctuating with trading activity. Here’s how to interpret the chart’s signals:

- VIX Spikes: Sudden increases in the VIX often indicate heightened market fear and uncertainty, driven by negative news events, economic downturns, or geopolitical tensions.

- VIX Declines: A drop in the VIX suggests a decrease in investor anxiety and an expectation of calmer market conditions, possibly due to positive economic news or a shift in investor confidence.

- VIX Trendlines: Analyzing the VIX’s long-term trend can provide insights into the overall volatility landscape. An upward trend might signal a general increase in market risk, while a downward trend suggests a more stable environment.

VIX vs. the S&P 500: The Relationship

The VIX often moves inversely with the S&P 500 index. When the stock market experiences sharp declines, investor fear rises, pushing the VIX higher. Conversely, a bullish market tends to lead to a decrease in the VIX as investors become more confident. However, it’s important to remember that the relationship is not always straightforward, and there can be instances where the VIX and the S&P 500 move in the same direction.

Navigating the VIX Live Chart for Informed Decisions: Expert Tips

The VIX live chart offers valuable information for investors, but it’s essential to use it strategically to make informed decisions. Here are a few tips for navigating the chart effectively:

- Combine with Other Indicators: Don’t rely solely on the VIX. Consider using it alongside other technical and fundamental indicators for a more complete picture of the market.

- Context is Key: Understand the context behind VIX fluctuations. A sharp spike in the VIX following a major news event is different from a gradual increase over several weeks.

- VIX Options Trading: Experienced options traders may use the VIX to develop strategies for profiting from volatility. However, it’s critical to understand the complexities and risks associated with options trading.

Using the VIX For Informed Investment Decisions:

For most investors, the VIX is a valuable tool for staying informed about market risks. While it should not be the sole factor driving investment decisions, a high VIX may prompt investors to take a more conservative approach, while a low VIX might suggest opportunities for riskier investments.

VIX Live Chart FAQs

Q: What is the normal range for the VIX?

A: The VIX usually ranges between 10 and 30, although it can fluctuate significantly beyond these levels.

Q: How can I access a VIX live chart?

A: You can find VIX live charts on various financial websites and trading platforms, including Google Finance, Yahoo Finance, and Bloomberg.

Q: What are the main drivers of VIX fluctuations?

A: VIX movements are influenced by various factors, including economic news, geopolitical events, interest rate changes, and market sentiment.

Q: Is the VIX a good predictor of future market movements?

A: The VIX is not a perfect predictor of future market movements, but it offers insights into market expectations and can provide valuable information for informed decision-making.

Vix Live Chart

Conclusion: The VIX’s Role in Today’s Markets

The VIX live chart is a vital tool for understanding market volatility and navigating the ever-evolving landscape of financial markets. It provides crucial insights into investor sentiment and risk appetite, offering a glimpse into the potential for upcoming market fluctuations. By carefully interpreting the VIX’s signals, combining it with other indicators, and understanding the context, investors can make better-informed decisions, enhancing their chances of success.

Are you interested in learning more about the VIX and its impact on your investment strategy? Let us know in the comments below!