Navigating Cross-Border Transactions with Trust and Transparency

In the realm of international finance, the exchange of currencies plays a pivotal role in enabling global trade and investment. However, navigating cross-border transactions can be a daunting task, fraught with uncertainties and risks. Forward subsidy forex emerges as a beacon of trust and transparency, bridging the currency exchange divide and empowering traders with confidence.

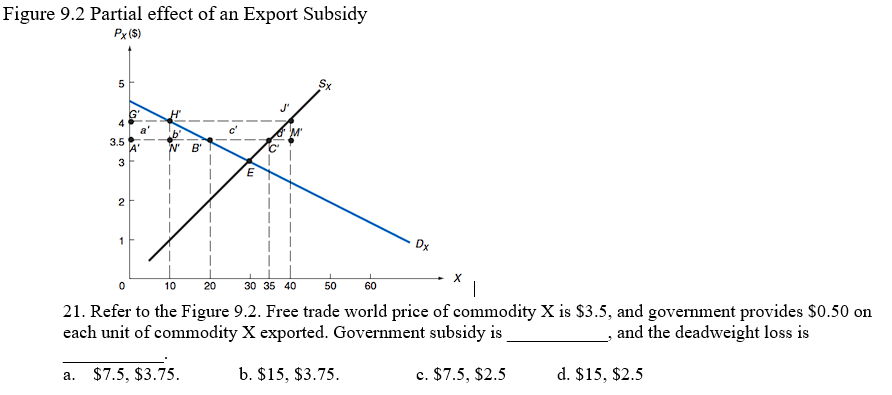

Image: www.chegg.com

What is Forward Subsidy Forex?

Forward subsidy forex is a specialized service offered by reputable foreign exchange (forex) brokers. It involves the locking in of an exchange rate today for a transaction to be settled in the future. This forward contract cushions traders against adverse currency fluctuations, protecting their investments from unexpected losses.

How Does Forward Subsidy Forex Work?

When engaging in a forward subsidy forex transaction, traders select a specific currency pair they wish to exchange. The broker then quotes a forward rate based on market conditions and risk assessment. Upon acceptance, the trader enters into a contract to purchase or sell the agreed-upon currency amount at the predetermined rate on a future settlement date.

Benefits of Forward Subsidy Forex

Forward subsidy forex offers a myriad of advantages that make it an indispensable tool for international trade and investment:

-

Currency Risk Hedging: By locking in the exchange rate upfront, traders mitigate the risks associated with currency volatility, protecting their profit margins and safeguarding their financial stability.

-

Predictable Budgeting: Forward contracts allow traders to plan and budget for future transactions with greater accuracy. The certainty of the agreed-upon rate eliminates the uncertainty and anxiety surrounding currency fluctuations.

-

Enhanced Confidence: The assurance provided by forward subsidy forex fosters confidence among traders. They can engage in cross-border transactions knowing that their financial obligations are clearly defined and protected.

-

Transparency and Trust: Reputable forex brokers operate with the utmost transparency, providing traders with clear and concise contract details and real-time updates on market movements. This fosters trust and enhances the credibility of the forward subsidy forex process.

Image: www.economicsonline.co.uk

How to Choose a Forward Subsidy Forex Broker

Selecting a reliable forward subsidy forex broker is paramount to maximizing the benefits and minimizing the risks associated with currency exchange. Here are some key factors to consider:

-

Regulation and Licensing: Verify that the broker is regulated and licensed by reputable financial authorities, ensuring adherence to industry standards and customer protection guidelines.

-

Reputation and Experience: Look for brokers with a proven track record of providing exceptional service, transparent pricing, and timely support. Referrals and online reviews can offer valuable insights into the broker’s reputation.

-

Market Expertise: Assess the broker’s knowledge and expertise in the forex market. Ensure they have a deep understanding of currency dynamics, economic indicators, and geopolitical events that can influence exchange rates.

What Is Forward Subsidy Forex

Navigating Cross-Border Transactions with Forward Subsidy Forex

By partnering with a reputable forward subsidy forex broker, traders can confidently navigate cross-border transactions and harness the power of global finance. Forward contracts provide a secure and predictable pathway, empowering traders to mitigate risks, plan effectively, and seize opportunities in the ever-evolving international marketplace.

Join the growing number of forward-thinking traders who are unlocking the benefits of forward subsidy forex. Embrace the assurance of locked-in exchange rates, predictable budgeting, enhanced confidence, and transparent dealings. Step into the world of international finance with unwavering trust, knowing that your financial goals are secured and your transactions are in safe hands.