In today’s global economy, it’s become increasingly easy and important to send and receive money across borders. For those looking to move money abroad, it’s essential to understand the best and most efficient means of doing so. One such option is utilizing foreign remittance through Forex.

Image: www.studocu.com

Foreign remittances are the process of transferring funds from one country to another. They play a crucial role in assisting international trade, education, and family support. Through foreign remittance, individuals can send money abroad for business investments, tuition, medical expenses, or to support relatives living in different countries.

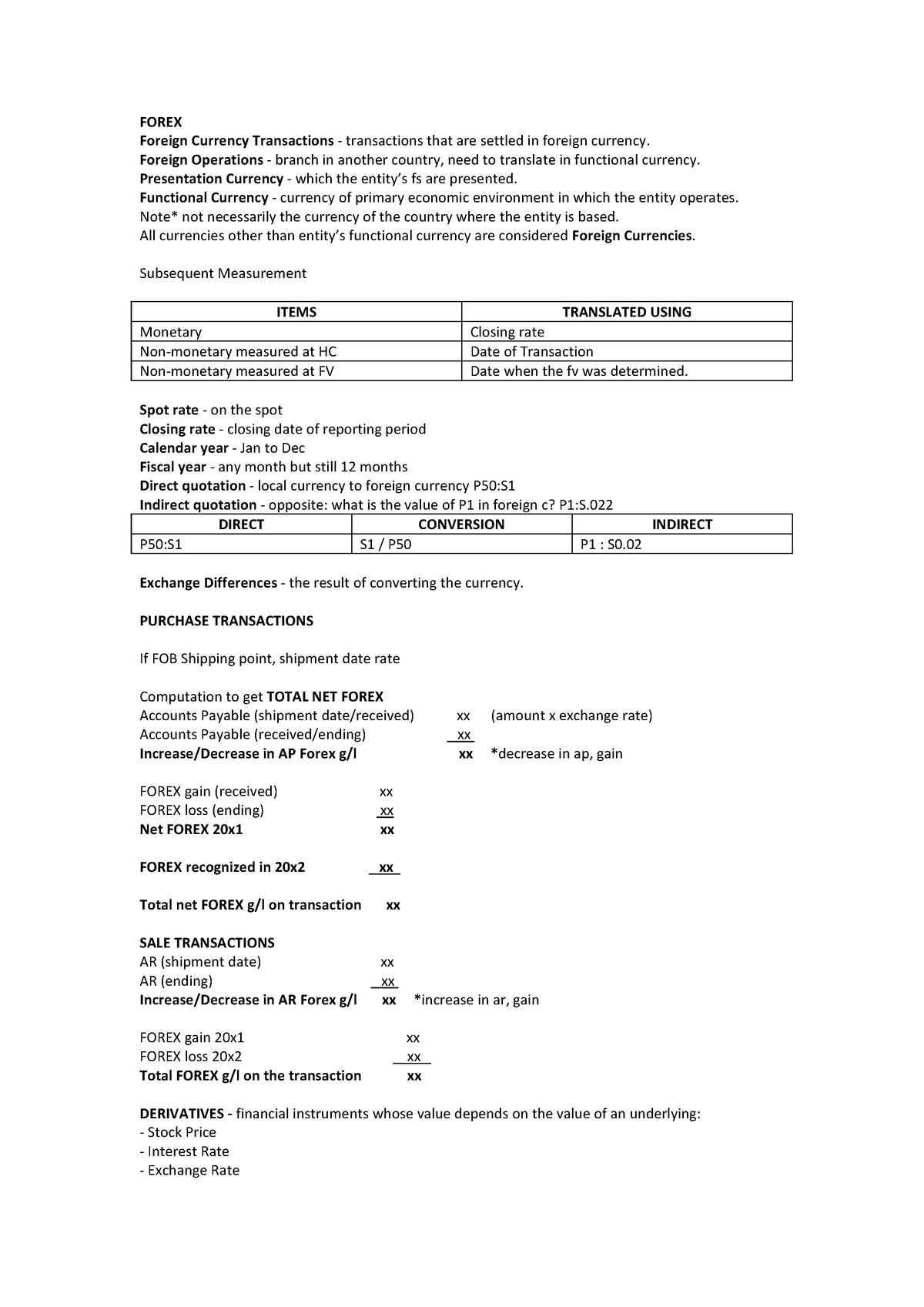

Understanding Forex and Foreign Remittance

Forex, short for Foreign Exchange, refers to the trading of currencies between different countries. Forex trading enables the conversion of one currency into another, serving as the basis for foreign remittance transactions.

When initiating a foreign remittance through Forex, the sender selects their local currency and instructs the Forex provider to convert it into the currency of the recipient country. The exchange rate applied in the conversion determines the amount the recipient will receive. The Forex provider may offer competitive exchange rates to facilitate cost-effective transactions.

Benefits of Foreign Remittance Through Forex

Convenience and Accessibility:

Foreign remittance through Forex offers convenience and ease of use. Individuals can initiate transfers from their local bank, online platforms, or through authorized Forex dealers. The process is straightforward and accessible to a wide range of users.

Image: forexea90accuracy.blogspot.com

Cost-Effective:

Forex providers typically offer competitive exchange rates, which can result in significant cost savings compared to traditional banking methods. The absence of intermediaries and lower fees lead to more favorable exchange rates.

Flexibility and Speed:

Foreign remittances through Forex provide flexibility in terms of transfer size and delivery methods. Funds can be transferred in real-time, ensuring quick access to recipients. Additionally, Forex transactions allow for different delivery options, such as cash pick-up, bank account deposits, or mobile money.

Security and Regulation:

Reputable Forex providers prioritize security measures to ensure the protection of sensitive information and transactions. They comply with regulations and standards, providing a safe and reliable foreign remittance service.

Tips for Effective Foreign Remittance Through Forex

Compare Exchange Rates:

It’s advisable to compare exchange rates offered by different Forex providers before selecting the best deal. Look for providers that offer competitive rates and minimal fees to maximize the value of your transfer.

Choose a Reputable Provider:

Reliability is crucial when selecting a Forex provider for foreign remittance. Research and choose a company with a good reputation, positive reviews, and a commitment to compliance. This helps ensure the timely and secure transfer of funds.

Consider Delivery Options:

Depending on the recipient’s preferences and convenience, choose the best delivery method for the foreign remittance. Options such as bank account deposits, cash pick-up, or mobile money should be considered.

Leverage Online Platforms:

Many Forex providers offer online platforms for seamless foreign remittance transactions. These platforms provide round-the-clock accessibility and allow users to track their transfers conveniently.

Seek Professional Advice:

For individuals requiring larger foreign remittances or complex currency conversions, it’s recommended to consult with a financial expert or Forex specialist. They can provide tailored guidance, ensuring cost-effectiveness and compliance with regulations.

Frequently Asked Questions (FAQs) on Foreign Remittance Through Forex

Q: What are the main benefits of using Forex for foreign remittance?

A: Convenience, cost-effectiveness, flexibility, speed, and security.

Q: How do I compare exchange rates offered by different Forex providers?

A: Use online comparison tools or inquire directly with multiple providers to find the most favorable rates.

Q: Are there any risks associated with foreign remittance through Forex?

A: Exchange rate fluctuations and volatility pose potential risks. It’s recommended to consult a financial expert for large or complex transactions.

What Is Foreign Remittance Through Forex

Conclusion

Foreign remittance through Forex has revolutionized the way individuals send and receive money across borders. By leveraging the convenience, cost-effectiveness, and flexibility offered by Forex providers, one can make international money transfers a convenient and efficient experience. Understanding the key concepts, benefits, and tips discussed in this article, readers can effectively navigate the world of foreign remittance through Forex.

Are you looking to learn more about the vast world of Forex trading or explore the effective strategies for maximizing profits in the Forex market? Let us know in the comment section, and we’ll provide you with the best resources and insights to enhance your trading journey.