Forex transactions are a common way to exchange currencies for international payments. When executing a forex transaction, it’s imperative to ensure that the beneficiary name matches the account details specified by the intended recipient. Discrepancies in beneficiary names can disrupt the settlement process and lead to potential complications. This article delves into the significance of beneficiary names in forex transactions, exploring its implications, consequences, and strategies for navigating such situations effectively.

Image: www.itbriefcase.net

Importance of Beneficiary Name Accuracy

The beneficiary name in a forex transaction serves as a crucial identifier for the intended recipient of the funds. It ensures that the funds are securely transferred to the correct party, preventing fraudulent activities or misdirection of payments. Typically, the beneficiary name should correspond with the account holder’s name associated with the provided account details.

Discrepancies in beneficiary names can occur due to various reasons. Human error, misunderstandings, or different conventions for naming individuals across jurisdictions occasionally result in the name on the transaction not precisely matching the recipient’s account name.

Consequences of Mismatched Beneficiary Names

When the beneficiary name differs from the account holder’s name, the transaction may face delays, additional verification requirements, or even rejection. Financial institutions prioritize security measures and regulatory compliance. Consequently, mismatched beneficiary names raise red flags, prompting institutions to scrutinize the transaction thoroughly before processing it.

In some instances, the transaction may be blocked until the discrepancy is resolved. This can pose significant inconvenience and delay the intended purpose of the forex transaction. To avoid such setbacks, meticulous attention to detail is paramount when filling out forex transaction details.

Steps to Mitigate the Impact of Mismatched Beneficiary Names

If you discover a discrepancy in the beneficiary name, prompt action is crucial to mitigate potential issues. Contact both your sending and receiving banks without delay. Explain the situation clearly, provide the correct beneficiary information, and furnish any supporting documentation that can substantiate your claim.

In most cases, banks can rectify the discrepancy and facilitate the successful completion of the transaction. However, it’s essential to note that the process may require additional verification steps, leading to delays in the transaction timeline.

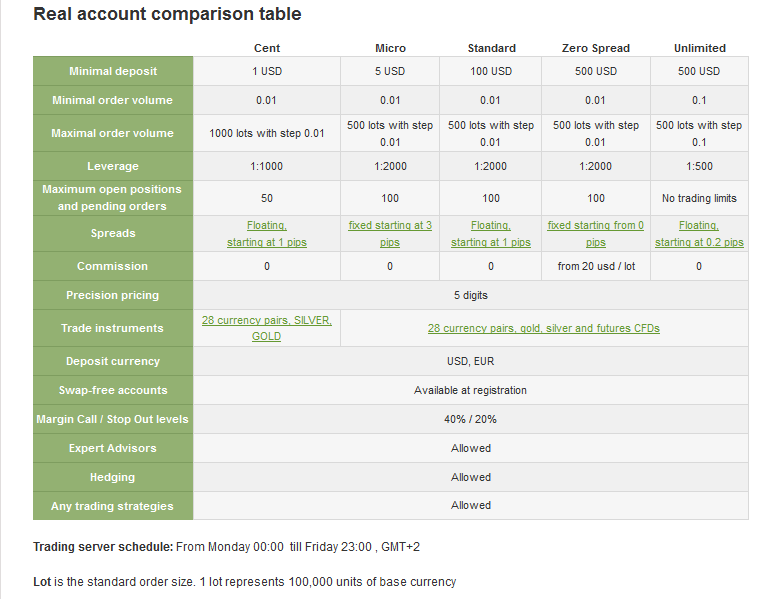

Image: yzyjifoh.web.fc2.com

Alternative Strategies

To avoid the complexities associated with mismatched beneficiary names, consider the following alternative strategies:

-

Confirm Recipient Details: Before initiating a forex transaction, double-check the recipient’s account details with them, including the name, account number, and other relevant information.

-

Use Intermediary Services: If the beneficiary name differs from the account holder’s name due to intermediary services or third-party involvement, inform both banks involved about the arrangement. This preemptive measure helps facilitate a smooth transaction.

-

Provide Detailed Instructions: When the beneficiary name slightly differs from the account holder’s name, provide detailed instructions to both banks. Explain the reason for the discrepancy and include any supporting documents for verification.

-

Use Multi-Factor Authentication: Implement robust multi-factor authentication measures to safeguard forex transactions. This additional layer of security reduces the likelihood of fraudulent activities and protects funds from unauthorized access.

What If In Forex Transaction Beneficiary Name Is Different

Conclusion

In the realm of forex transactions, meticulously matching the beneficiary name to the intended recipient’s account details is paramount. It streamlines the transfer process, ensuring timely completion and preventing complications. By understanding the implications of beneficiary name discrepancies, employing risk mitigation strategies, and adhering to best practices, businesses and individuals can navigate these transactions confidently, minimizing disruptions and maximizing convenience.