In today’s interconnected global economy, seamless and cost-effective currency exchange is paramount. Forex cards have emerged as game-changers, empower travelers with the convenience of managing global finances hassle-free. However, understanding what drives the demand for these versatile cards is a key to unlocking their true potential. Join us on a captivating exploration into the intricate landscape of forex card demand.

Image: uyesyni.web.fc2.com

The Appeal of Forex Cards: A Global Currency Navigator

Forex cards, akin to digital wallets accessible via a physical card, offer a myriad of benefits that have catapulted their popularity. They enable travelers to effortlessly navigate currency complexities, eliminating the need for hefty cash withdrawals or arduous currency exchange processes at unfavorable rates. With the ability to load multiple currencies onto a single card, forex cardholders enjoy significant savings on exchange fees and the freedom to make purchases or withdraw cash abroad with ease.

Drivers of Forex Card Demand: A Multifaceted Equation

The demand for forex cards is a manifestation of a convergence of compelling factors that shape traveler behavior and financial preferences. Here’s a deeper delve into the key drivers that influence forex card demand:

-

Globalization and Increased International Travel: The rise of global interconnectedness has fueled a surge in international travel for business, leisure, and education. Forex cards cater to this growing demand by simplifying currency exchange, a crucial aspect of seamless international experiences.

-

Convenience and Security: Forex cards offer unparalleled convenience compared to traditional currency exchange methods. Their portability eliminates the risks associated with carrying large amounts of cash, while cutting-edge security features protect against unauthorized transactions.

-

Competitive Exchange Rates: Forex cards generally offer more favorable exchange rates than banks or currency exchange bureaus, leading to substantial savings for users. This cost-effectiveness becomes even more apparent with frequent international transactions.

-

Growing Acceptance: The global acceptance of forex cards continues to expand, making them a widely recognized and trusted payment method. This extensive network of acceptance further fuels their appeal among travelers.

-

Growing Awareness and Accessibility: Increased awareness of forex cards and their benefits has contributed to rising demand. Digital platforms and online marketplaces have played a significant role in educating consumers about these financial tools.

Expert Insights and Traveler-Friendly Tips

To leverage the full potential of forex cards, here are invaluable insights from seasoned experts:

- Plan Your Currency Needs: Determine the currencies you’ll need and load them onto your forex card accordingly, minimizing potential losses due to currency fluctuations.

- Compare Exchange Rates: Don’t settle for the first forex provider you find. Compare exchange rates offered by different providers to secure the most favorable rates and maximize your savings.

- Consider Your Usage Patterns: Opt for a forex card that aligns with your travel frequency and spending habits. This ensures you choose a card with features that best suit your needs.

Image: finage.co.uk

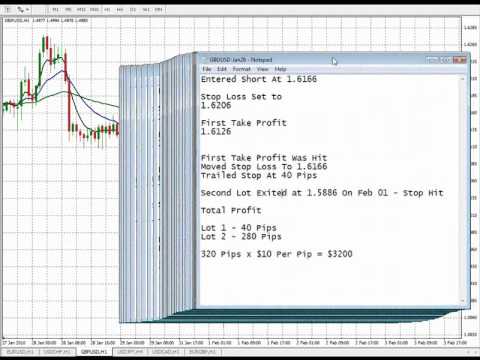

What Determines The Demand Of Forex Card

Conclusion: Embracing Forex Cards for Global Financial Freedom

Forex cards have revolutionized international currency management, offering a seamless and cost-effective solution for travelers. Understanding the key drivers of forex card demand provides valuable insights into how these cards empower global explorers. By embracing the benefits and following expert advice, travelers can unlock the true potential of forex cards, unlocking financial freedom and enhancing the convenience of their international ventures.