Delving into the Nuances of India’s Currency Trading Landscape

The foreign exchange (forex) market in India, a pivotal component of the global financial ecosystem, presents a dynamic and multifaceted terrain. Comprehending the defining characteristics of this market empowers traders and investors alike to navigate its complexities and capitalize on its opportunities. Embark on this comprehensive journey to decipher the salient features that shape the Indian forex market and delineate its distinctive attributes.

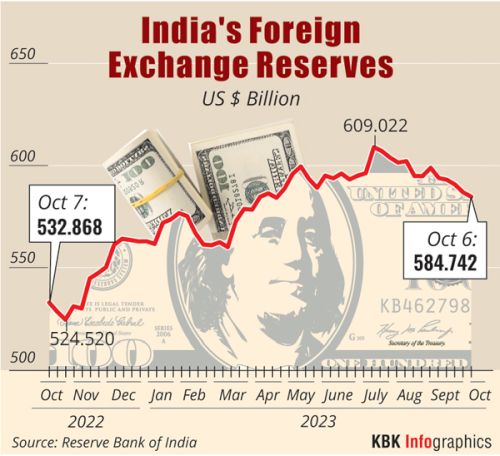

Image: news.rediff.com

1. Regulation and Oversight: A Framework for Measured Growth

The Reserve Bank of India (RBI), the country’s central bank, assumes the mantle of regulatory authority for India’s forex market. This oversight ensures adherence to strict regulations, safeguarding the integrity and stability of the market. Importers and exporters are obligated to conduct their forex transactions exclusively through authorized dealers (ADs), designated financial institutions licensed by the RBI. This regulatory framework fosters transparency, bolsters investor confidence, and prevents illicit activities.

2. Market Structure: A Thriving Hub of Financial Activity

The Indian forex market operates as a two-tier system, comprising interbank and retail segments. The interbank market serves as the primary platform for large-scale forex transactions between banks and other financial institutions. The retail segment, accessible to individuals and small businesses, allows for smaller-scale forex transactions conducted through authorized dealers. This dual structure caters to the diverse needs of market participants, facilitating efficient price discovery and ensuring ample liquidity.

3. Market Hours: A Rhythmic Pulse of Trading Activity

Forex trading in India adheres to specific market hours, dictated by the global nature of the market. Trading commences at 9:00 AM Indian Standard Time (IST) and concludes at 5:00 PM IST, coinciding with the operational hours of major global financial centers. This alignment enables Indian market participants to interact seamlessly with their international counterparts, ensuring continuous price updates and uninterrupted trading opportunities.

Image: tradersunion.com

4. Currency Pairs: A Kaleidoscope of Exchange Rates

The Indian forex market facilitates the trading of a multitude of currency pairs, each representing the exchange rate between two different currencies. The most actively traded currency pair in India is USD/INR, followed by EUR/INR and GBP/INR. These currency pairs reflect India’s significant trade ties with the United States, Europe, and the United Kingdom, respectively. Traders can take advantage of the fluctuations in these exchange rates to generate profits or hedge against currency risk.

5. Spot Trading: Capturing the Present Moment

Spot trading, a prevalent practice in the Indian forex market, involves the immediate buying or selling of currencies at the prevailing market rate. This form of trading is ideal for short-term price movements and speculative trading strategies. Spot transactions are typically settled within two business days, providing traders with prompt access to their funds.

6. Forward Contracts: Navigating Future Currency Needs

Forward contracts offer a valuable tool for managing currency risk and locking in future exchange rates. These contracts oblige parties to buy or sell a specified amount of currency at a predetermined rate on a future date. Forward contracts provide a degree of certainty and protection against unforeseen fluctuations in exchange rates, making them attractive for businesses engaged in international trade and investors with long-term currency exposure.

7. Currency Derivatives: Expanding Trading Horizons

The Indian forex market offers a diverse array of currency derivatives, sophisticated financial instruments that derive their value from the underlying currency. Options and futures contracts are popular derivative instruments that enable traders to speculate on future price movements, hedge against risk, or generate income through premiums. These derivatives enhance the flexibility and strategic possibilities available to market participants.

8. Regulatory Compliance: Preserving Market Integrity

To ensure the orderly functioning and transparency of the Indian forex market, the RBI has implemented stringent regulations. These regulations encompass measures to prevent market manipulation, insider trading, and other unethical practices. The RBI’s oversight helps maintain a level playing field, protects investors from unscrupulous activities, and fosters confidence in the market.

9. Technological Advancements: Empowering Traders

In recent years, the Indian forex market has witnessed a surge in technological advancements. The advent of online trading platforms and mobile applications has democratized access to the market, enabling traders of all levels to participate conveniently and efficiently. These platforms provide real-time market data, advanced charting tools, and automated trading capabilities, enhancing the trading experience and empowering traders with cutting-edge resources.

What Are The Features Of Forex Market Of India

Conclusion

The Indian forex market stands as a vibrant and dynamic marketplace, offering a wealth of opportunities for traders and investors alike. Its robust regulatory framework, diverse market structure, and flexible trading instruments provide a fertile ground for both speculative and risk management strategies. Embracing the salient features of this market empowers participants to navigate its intricacies, make informed decisions, and harness its potential for financial success. As the Indian economy continues to grow and international trade flourishes, the forex market is poised to play an increasingly pivotal role in facilitating global commerce and shaping India’s financial landscape.