Navigating Forex with Precision: Mastering Exit Rules

Embrace the vast landscape of forex trading, adventurers! As we plunge into the depths of this dynamic market, a crucial aspect that shapes our success lies in knowing when to depart the trade. Allow me to guide you through the fascinating realm of exit rules, equipping you with the knowledge and expertise to conquer Forex’s unpredictable waters.

Image: paxforex.org

The Art of Abandoning Positions

Exiting a trade with finesse is a profound art, requiring impeccable judgment, technical prowess, and emotional resilience. The forex market offers a plethora of strategies to facilitate this delicate maneuver, ensuring that every trader finds a strategy that resonates with their risk tolerance and trading style.

Unveiling Common Exit Strategies

A cauldron of exit strategies awaits our exploration:

-

Trailing Stops: Dynamic shields that shadow your position, automatically adjusting to protect profits while minimizing losses.

-

Target Price: Embark on a quest for predefined price levels that trigger automatic exits, locking in profits or mitigating potential downturns.

-

Time-Based Exits: Establish time horizons that govern your trades, enforcing discipline and preventing emotional overstaying.

-

Break-Even Stops: Protective barriers that safeguard your initial investment, ensuring that you don’t venture into negative territory.

-

Volatility-Based Exits: Harness the power of volatility; exit during periods of low volatility to lock in profits or during high volatility to protect against potential losses.

The Essence of Execution

The art of exiting trades doesn’t end with choosing the perfect strategy; impeccable execution is the linchpin of success. Here are a few tips:

-

Swift Execution: Seize every opportunity by placing exit orders promptly, leaving no room for market fluctuations to disrupt your plans.

-

Partial Exits: Break your exits into smaller chunks, allowing you to take profits gradually while leaving a portion of your position open for potential growth.

-

Trade Management: Exercise meticulous trade management skills; regularly review your exits and adjust them dynamically as market conditions evolve.

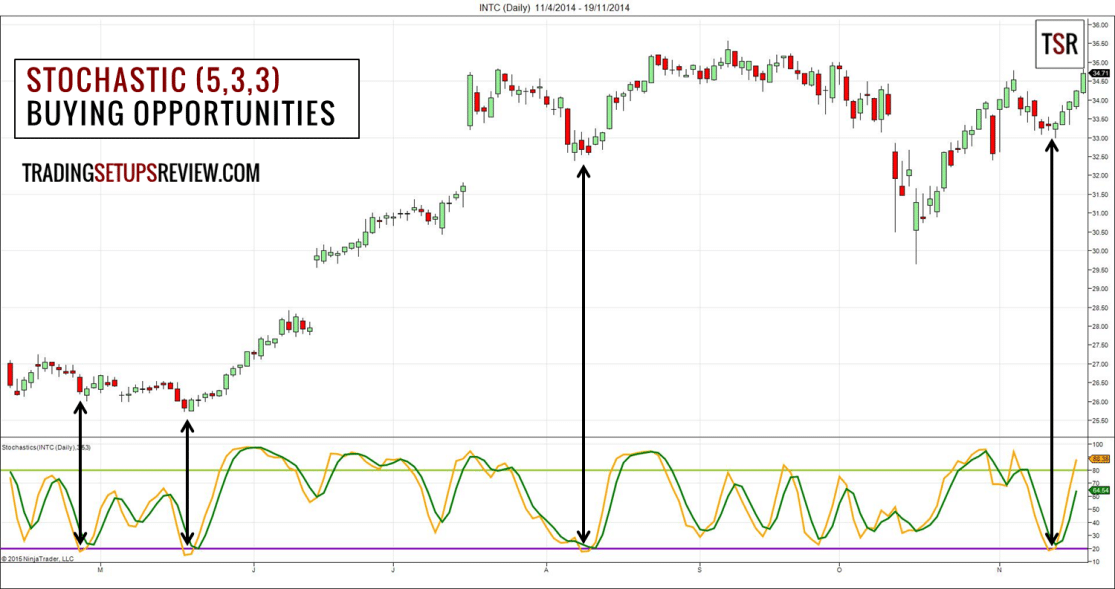

Image: forexrobotexpert.com

Igniting Your Forex Proficiency

With a comprehensive understanding of exit strategies and expert advice tucked firmly under your belt, embark on your Forex adventure with newfound confidence. Remember, the path to mastery is paved with continuous learning and an unwavering commitment to refining your skills.

Frequently Asked Questions

Q: How do I choose the best exit strategy?

A: Embark on a journey of self-discovery, assessing your risk appetite, trading style, and market conditions to identify the strategy that seamlessly aligns with your objectives.

Q: Can I use multiple exit strategies simultaneously?

A: Absolutely! Diversify your exit arsenal by combining strategies to create a robust trading plan that enhances your resilience and adapts to varying market conditions.

Q: How often should I review my exit rules?

A: Your exit rules should be subject to constant scrutiny, adapting to evolving market dynamics and your growing experience as a trader. Regular reviews ensure that your strategies remain aligned with your goals and the ever-changing forex landscape.

Various Exit Rules In Forex Trading

https://youtube.com/watch?v=-LrueUFxxpM

Conclusion

With a keen grasp of exit strategies and a resolute mindset, you now possess the tools to navigate the forex labyrinth with precision. Remember, the true measure of a trader lies not only in their ability to enter trades but also in their mastery of the art of exiting. Embrace the power of exit rules, and may your forex endeavors yield abundant triumphs! Are you ready to embark on your own forex journey and unlock the boundless potential of precise exits? Let the markets tremble before your command!