What is a Forex Card?

Forex cards, also known as currency cards, are prepaid cards that allow you to store and spend multiple currencies on international travels. They are specifically designed to provide a convenient and cost-efficient way to manage your finances abroad. Unlike traditional credit or debit cards, forex cards are not linked to your bank account and instead hold the foreign currency of your choice.

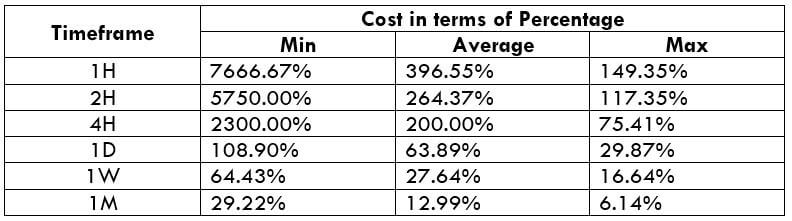

Image: www.forex.academy

USD to INR forex cards offer you the flexibility to preload US dollars and withdraw Indian rupees as per your requirement. This eliminates the need to exchange cash physically, saving you time, effort, and potential conversion losses.

Benefits of Using a USD to INR Forex Card

- Competitive Exchange Rates: Forex cards generally offer more competitive exchange rates compared to traditional banks or currency exchange bureaus.

- Lower Transaction Fees: Transactions made with forex cards often incur lower fees than credit or debit cards, reducing your overall expenses.

- Cashless Convenience: Forex cards allow you to withdraw local currency from ATMs abroad without carrying large amounts of cash, ensuring security and peace of mind.

- Wide Acceptance: Forex cards are accepted at ATMs, POS terminals, and online merchants worldwide, providing maximum flexibility.

- Multi-Currency Support: Forex cards allow you to load and store multiple currencies, enabling you to manage your finances efficiently while traveling to different countries.

How to Obtain a USD to INR Forex Card

Obtaining a USD to INR forex card is a simple process that involves the following steps:

- Choose a Forex Provider: Research and select a reputable forex provider that offers competitive exchange rates and low fees.

- Apply Online or In-Person: Complete the application form either online or by visiting the provider’s branch in person.

- Provide Documentation: Submit necessary documents such as your passport, proof of identity, and proof of address.

- Load Funds: Once your application is approved, load US dollars onto the forex card in the desired amount.

- Activate the Card: Contact your forex provider to activate your card before using it abroad.

Tips for Using a USD to INR Forex Card

- Monitor Exchange Rates: Keep an eye on market fluctuations and load your forex card when exchange rates are favorable.

- Withdraw Large Amounts: To minimize transaction fees, consider withdrawing larger amounts of INR at a time from ATMs.

- Check for ATM Fees: Be aware of any ATM fees charged by both the forex provider and the ATM operator.

- Use for Online Purchases: Take advantage of the card’s multi-currency support for online shopping and maximize savings.

- Inform Your Bank: Notify your bank about your forex card usage abroad to prevent any potential issues with your regular transactions.

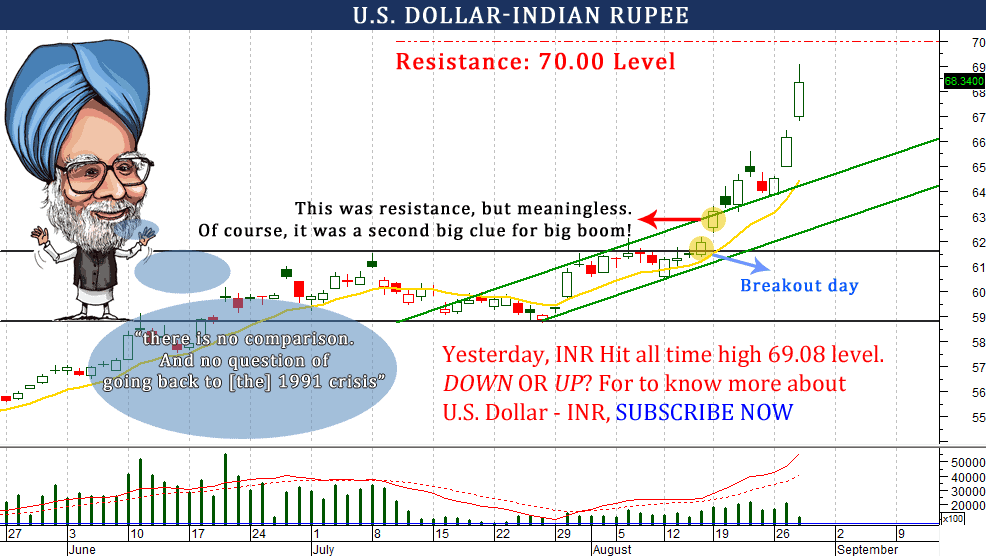

Image: moneymunch.com

Usd To Inr Forex Card

Conclusion

USD to INR forex cards provide a convenient, cost-effective, and secure way to manage your finances while traveling to India. By offering competitive exchange rates, lower fees, and multi-currency support, these cards empower you to make the most of your international experiences. Embrace the cashless convenience and financial flexibility of forex cards for your next trip to India.

Are you interested in learning more about USD to INR forex cards and how they can benefit your travels? Let us know in the comments section, and we’ll be happy to provide additional information.