Within the bustling metropolis of the financial world, forex trading reigns supreme. It’s a realm where fortunes are made and lost, and the key to unlocking its vast potential lies in understanding the art of support and resistance. Just as skyscrapers soar against the urban skyline, support and resistance levels provide crucial markers, guiding traders to make informed decisions and navigate the turbulent forex waters.

Image: kanienkeha.net

In this comprehensive guide, we will delve into the depths of support and resistance, unraveling its significance, unraveling its intricacies, and equipping you with actionable strategies that will transform your forex trading into a thriving enterprise.

Support and Resistance: The Cornerstones of Success

In the ever-changing forex market, support and resistance levels act as invisible boundaries, defining the battleground where bulls and bears clash. Support occurs when the price of a currency pair finds a floor, preventing it from falling further. Resistance, on the other hand, marks the ceiling, where the price encounters resistance and is unable to break through.

Understanding these levels is paramount for success in forex trading. They provide valuable insights into the market’s direction, revealing areas where traders can capitalize on price movements. It’s akin to identifying the crossroads in a bustling city, where traffic patterns converge and the flow of commerce unfolds before your very eyes.

Unlocking the Urban Forex Blueprint

1. Identify Historical Support and Resistance Levels:

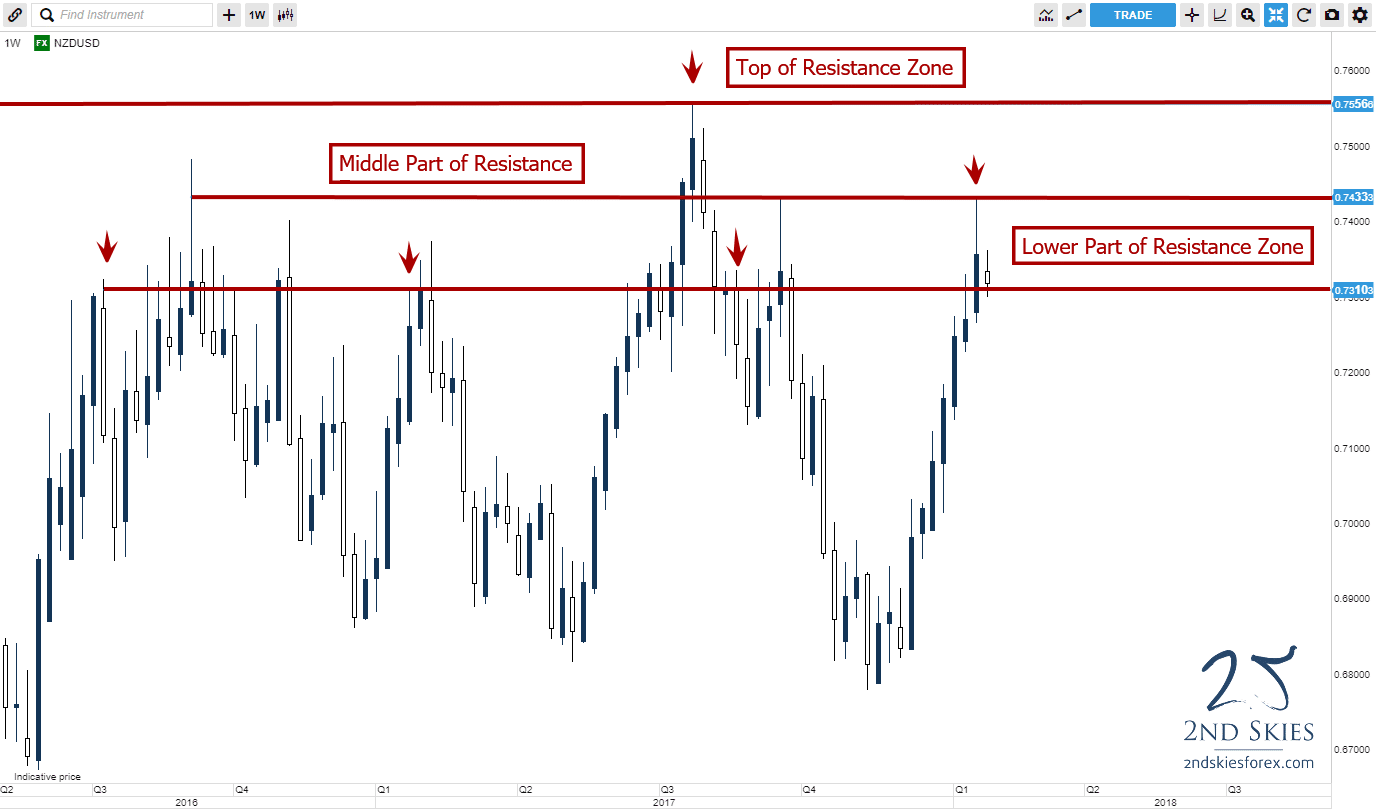

Just as historical landmarks shape a city’s identity, historical support and resistance levels play a pivotal role in the forex market. The repetitive nature of market behavior means that areas where prices have repeatedly found support or resistance in the past are likely to continue doing so in the future.

2. Dynamic Support and Resistance Hunting:

The forex market is not static; it’s a constantly evolving entity that responds to real-time events and economic data. As a result, support and resistance levels are dynamic and can shift over time. Traders who stay tuned to market sentiment and technical indicators can uncover these dynamic levels and gain a competitive edge.

3. Breakouts and False Breakouts:

Sometimes, support and resistance levels give way beneath the relentless pressure of buyers or sellers, leading to breakouts. These breakouts can signal potential trend reversals or significant price movements. However, it’s crucial to distinguish between true breakouts and false breakouts, where the price momentarily penetrates a level but falls back within its former range.

4. Advanced Trading Strategies:

Armed with a deep understanding of support and resistance, traders can unlock advanced trading strategies. These include:

- Trend Trading: Identifying the prevailing market trend and trading in line with it, leveraging support and resistance as confirmation signals.

- Counter-Trend Trading: Capitalizing on short-lived price movements that challenge support or resistance levels, offering high-risk, high-reward opportunities.

- Range Trading: Exploiting the fluctuation of prices within a defined support and resistance range, earning consistent profits through targeted entries and exits.

Expert Insights: Trading Wisdom from the Masters

“The key to successful trading is not about predicting when a price will rise or fall, but rather identifying where the price is likely to struggle,” says renowned forex trader George Soros. “Support and resistance are the battlegrounds where these struggles play out.”

Similarly, hedge fund manager Paul Tudor Jones emphasizes the importance of context, saying, “Support and resistance levels are like street signs in the financial landscape. They tell you where you are and where you’re going if you follow the trend.”

Image: s3.eu-central-1.amazonaws.com

Urban Forex Support And Resistance Strategy

Actionable Tips for Forex Warriors

- Integrate Support and Resistance into Your Trading Plan: Success begins with a well-defined trading plan that explicitly incorporates support and resistance levels into your decision-making process.

- Use a Variety of Support and Resistance Tools: Explore different tools like horizontal lines, moving averages, and Fibonacci levels to identify support and resistance levels more accurately.

- Confirm Levels with Technical Indicators: Validate support and resistance levels by combining them with technical indicators like moving averages, stochastic oscillators, and relative strength indexes.

- Manage Risk Effectively: Always use stop-loss and take-profit orders to manage risk and protect your hard-earned capital.

- Seek Guidance from Seasoned Traders: Surround yourself with seasoned traders and mentors who can share their insights and valuable trading lessons.

Conclusion:

Mastering support and resistance is the key to unlocking urban forex success. By understanding these fundamental concepts, employing advanced trading strategies, and seeking guidance from experts, you can transform the forex market into your own personal financial metropolis. Remember, trading carries inherent risks, so always trade responsibly and within your risk tolerance. May your forex journey be filled with profitable trades and unwavering determination.