Unveiling the Gateway to Success

As you embark on your journey to become a seasoned Foreign Exchange Officer at Union Bank of India, a thorough understanding of the previous question paper holds immense significance. Like a beacon guiding your path, it illuminates the intricacies of the exam, empowering you with the knowledge and skills necessary to excel. Within this comprehensive guide, we delve into the depths of the paper, unraveling its complexities and providing you with an arsenal of expert insights and actionable tips to maximize your chances of success.

Image: www.slideshare.net

Exploring the Blueprint of the Exam

The SO Forex Officer exam conducted by Union Bank of India consists of two phases: the Preliminary Examination and the Main Examination. The Preliminary Examination is an objective test designed to assess your general knowledge, quantitative aptitude, and English language skills. The Main Examination, on the other hand, is a subjective test that evaluates your knowledge of economics, financial management, banking, and foreign exchange management.

Phase I: Preliminary Examination

- General Knowledge: Current events, history, geography, economics, and banking.

- Quantitative Aptitude: Numerical ability, data interpretation, and analytical reasoning.

- English Language: Comprehension, vocabulary, grammar, and usage.

Phase II: Main Examination

- Economics: Economic principles, monetary and fiscal policy, and international trade.

- Financial Management: Financial analysis, capital budgeting, and investment management.

- Banking: Banking operations, credit analysis, and risk management.

- Foreign Exchange Management: Foreign exchange markets, exchange rate determination, and international banking.

Image: www.chegg.com

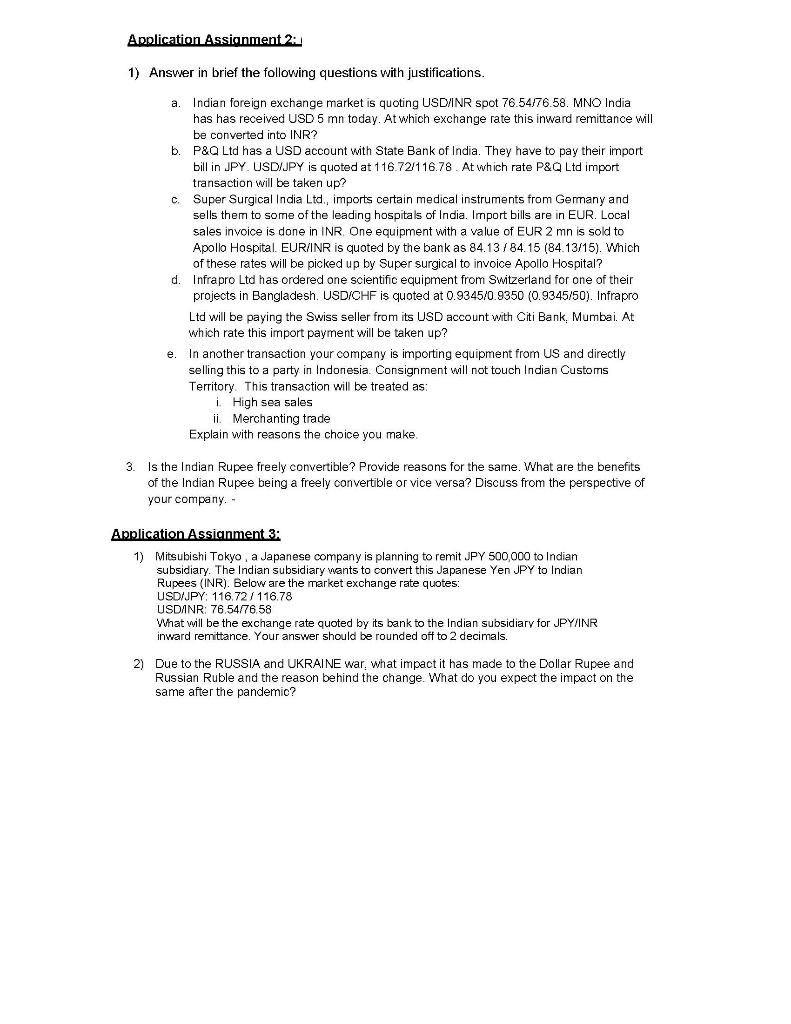

Deciphering the Previous Question Paper

Analyzing the previous question paper is crucial to gaining valuable insights into the exam’s format, difficulty level, and recurring topics. Here’s how to approach the paper effectively:

- Identify Patterns and Trends: Analyze the frequency and difficulty of questions in each section.

- Comprehension and Knowledge: Assess your understanding of the concepts covered in the paper.

- Time Management: Practice solving the paper within the stipulated time to enhance your speed and efficiency.

- Identify Weaknesses: Determine areas where you require additional focus and improvement.

Expert Insights: Mastering the Paper

To conquer the SO Forex Officer exam, harness the wisdom of experienced professionals. Here are some invaluable tips to maximize your potential:

- Build a Solid Foundation: Strengthen your knowledge of the core concepts in economics, finance, and banking.

- Practice Regularly: Engage in consistent practice with previous question papers and mock tests.

- Stay Updated: Keep abreast of current events and industry trends related to foreign exchange management.

- Seek Guidance: Consult with mentors or join study groups for support and expert insights.

Navigating the Exam with Confidence

As you approach exam day, embrace the following strategies to maximize your performance:

- Time Management: Allocate time wisely to each section, prioritizing the questions you are most confident in.

- Guessing Wisely: For uncertain questions, make educated guesses to avoid leaving them blank.

- Review Carefully: Before finalizing your answers, take time to review your work thoroughly.

- Maintain Composure: Stay calm and focused throughout the exam, regardless of the challenges you encounter.

Union Bank Of India So Forex Officer Previous Question Paper

Conclusion: A Path to Success

Mastering the SO Forex Officer previous question paper is the key to unlocking the door of opportunity that leads to a rewarding career at Union Bank of India. By diligently following the guidelines outlined in this comprehensive guide, you can acquire the knowledge, skills, and confidence necessary to conquer the exam. Remember, success is not a destination but a journey filled with dedication, perseverance, and a relentless pursuit of excellence. Embrace this challenge with determination and emerge as a seasoned Foreign Exchange Officer, ready to navigate the complexities of the financial world.