Introduction

Are you ready to unlock the secrets of profitable forex trading? Buckle up as we delve into the Trendlant Forex Trading Strategy for MT4, a powerful tool that can empower you to navigate the dynamic forex markets with confidence. This beginner-friendly guide will unravel the intricacies of this strategy, providing you with a comprehensive understanding of its components, mechanics, and techniques. Prepare yourself to elevate your trading endeavors to new heights as we embark on a journey into the realm of forex mastery.

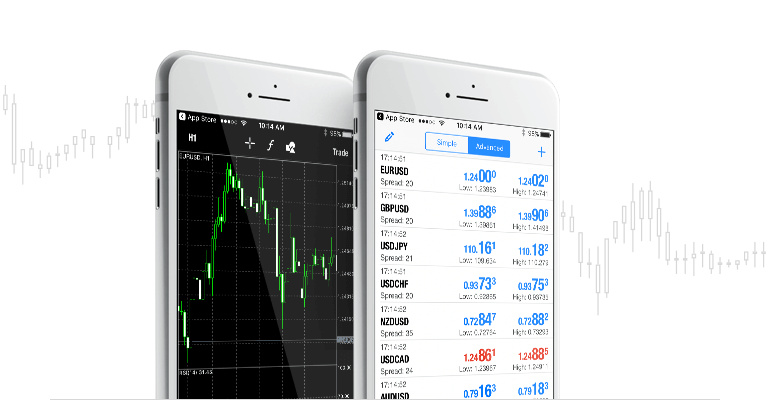

Image: www.forex.com

Introducing Trendlant: A Tailwind for Forex Trading

Trendlant is a highly effective technical analysis tool designed exclusively for the MetaTrader 4 (MT4) platform. It harnesses the power of multiple indicators to provide traders with valuable insights into market trends, support and resistance levels, and potential trading opportunities. By analyzing price action, momentum, and volatility, Trendlant arms traders with the intelligence they need to make informed decisions that can lead to successful trades.

At the heart of Trendlant lies a combination of key indicators, including the Moving Average, Bollinger Bands, Relative Strength Index (RSI), and Stochastic Oscillator. These indicators work synergistically to identify trend reversals, overbought and oversold conditions, and potential breakouts. Trendlant’s user-friendly interface makes it easy for traders of all skill levels to interpret the data, even for those new to the forex market.

Understanding the Trendlant Forex Trading Strategy

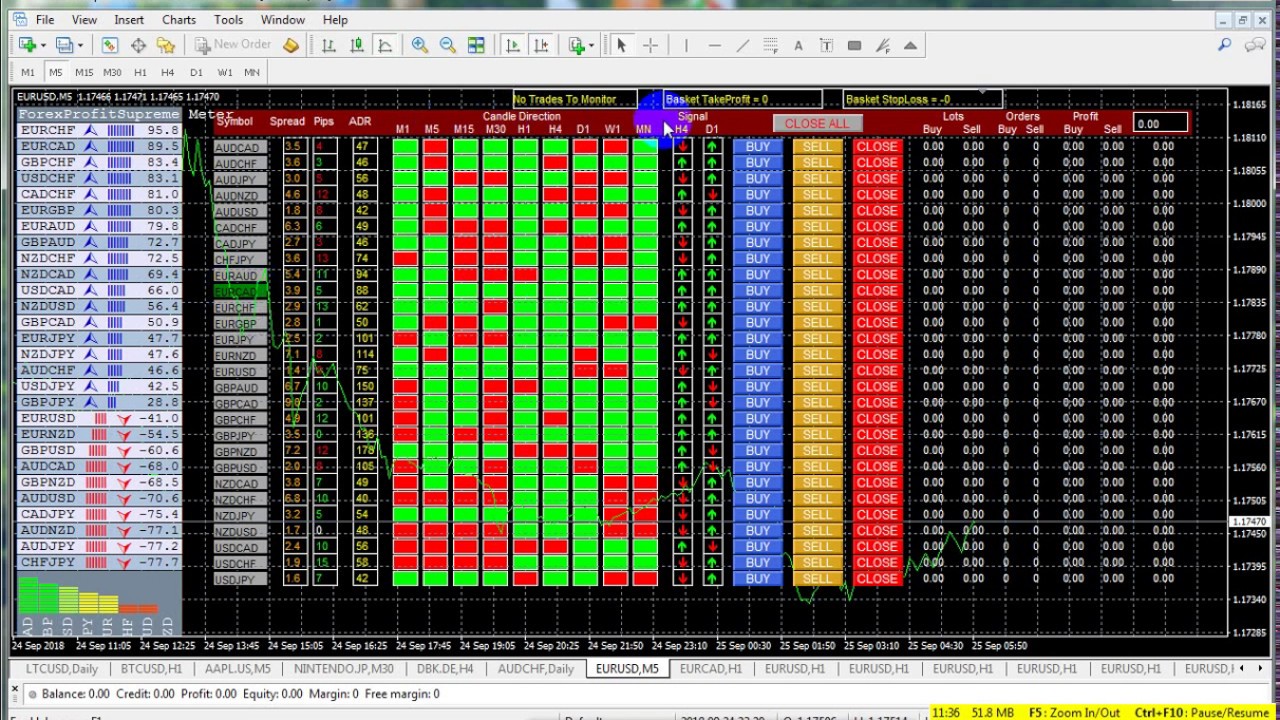

The Trendlant Forex Trading Strategy utilizes Trendlant’s indicators to establish a comprehensive trading plan that capitalizes on prevailing market trends. The strategy is grounded in the principle of trend following, which involves aligning your trades with the dominant trend to increase your probability of success. Here’s how it works:

1. **Identify the Trend:** Determine the direction of the trend using the Moving Average and Bollinger Bands. An uptrend is characterized by consecutive higher highs and higher lows, while a downtrend exhibits lower highs and lower lows.

2. **Gauge Market Momentum:** Measure market momentum using the RSI. An RSI value above 70 indicates overbought conditions, while a value below 30 suggests oversold conditions.

3. **Locate Potential Trading Opportunities:** Utilize the Stochastic Oscillator to identify oversold or overbought levels that may present potential trading opportunities. Look for buy signals when the Stochastic Oscillator is below 20 and sell signals when it is above 80.

4. **Manage Risk and Reward:** Set stop-loss and take-profit levels to control your risk and maximize your potential reward. Place your stop-loss below support levels in an uptrend and above resistance levels in a downtrend. Position your take-profit at appropriate levels based on the prevailing trend.

Tips and Expert Advice for Forex Mastery

To enhance your forex trading experience with the Trendlant strategy, consider these valuable tips and expert advice:

– **Trade with the Trend:** Align your trades with the dominant market trend. Avoid trading against the trend, as it can increase your risk of losses.

– **Use Multiple Indicators:** Trendlant combines several indicators to provide a more comprehensive view of market conditions. Don’t rely solely on a single indicator; use them in conjunction for a holistic analysis.

– **Manage Your Risk:** Risk management is paramount in forex trading. Always define your risk tolerance and trade within your limits.

– **Practice Discipline:** Trading requires patience and discipline. Stick to your trading plan and avoid emotional decision-making.

– **Continuously Educate Yourself:** Stay up-to-date on market trends and trading strategies by reading books, attending webinars, and studying market analysis.

Image: mungfali.com

Frequently Asked Questions about Trendlant

Q: Is the Trendlant strategy suitable for beginners?

A: Yes, the Trendlant Forex Trading Strategy is designed to be accessible to traders of all skill levels, including beginners. Its user-friendly interface makes it easy to understand and apply.

Q: Which currency pairs are best for Trendlant trading?

A: Trendlant is suitable for trading all major currency pairs, such as EUR/USD, GBP/USD, and USD/JPY. Choose currency pairs that exhibit clear trends and volatility for optimal results.

Q: Can Trendlant be used with other trading strategies?

A: Yes, Trendlant can be combined with other technical analysis strategies to enhance your trading approach. However, it’s advisable to fully understand and master Trendlant before combining it with other strategies.

Trendlant Forex Trading Strategy For Mt4

https://youtube.com/watch?v=8LJWPI3LCao

Conclusion

Unlock the transformative power of the Trendlant Forex Trading Strategy and witness your forex trading endeavors soar to new heights. By embracing the insights and techniques outlined in this guide, you are well-equipped to navigate the dynamic forex markets with confidence and reap the rewards of informed decision-making. Remember, the journey to forex mastery is an ongoing pursuit. Stay committed to learning, adapting, and refining your strategies over time. Are you ready to embark on this exciting adventure and conquer the world of forex trading?