Have you ever dreamt of making a fortune by simply predicting the direction of currency movements? The allure of Forex trading lies in its potential, the ability to profit from global economic shifts. But beneath the glittering surface of potential riches lurks a hidden ocean of risk. The Forex market, a sprawling global marketplace, is renowned for its high volatility and fast-paced action. It’s a place where fortunes can be made and lost in the blink of an eye, leaving many traders stranded on the shores of their aspirations.

Image: derivbinary.com

Understanding the risks inherent in Forex trading is paramount to navigating this treacherous yet potentially rewarding terrain. This article delves deep into the complexities of Forex risk, equipping you with the knowledge necessary to make informed decisions and protect your hard-earned capital. From the insidious nature of leverage to the unpredictable forces of geopolitical events, we’ll unravel the intricacies of forex trading risk and guide you toward a more informed and potentially successful trading journey.

Delving into Forex Risk: Unveiling the Underlying Currents

Forecasting the future of currency exchange rates is an ambitious undertaking. It’s a dance with several factors, often unpredictable and interconnected. These factors, often operating in tandem, contribute to the inherent risk that defines Forex trading.

1. Market Volatility – The Ever-Shifting Sands

The Forex market is renowned for its volatility, a factor driven by the constant ebb and flow of global events. Economic indicators, political pronouncements, natural disasters, and even social media trends can trigger dramatic swings in currency values. While volatility can create opportunities for profit, it also magnifies potential losses.

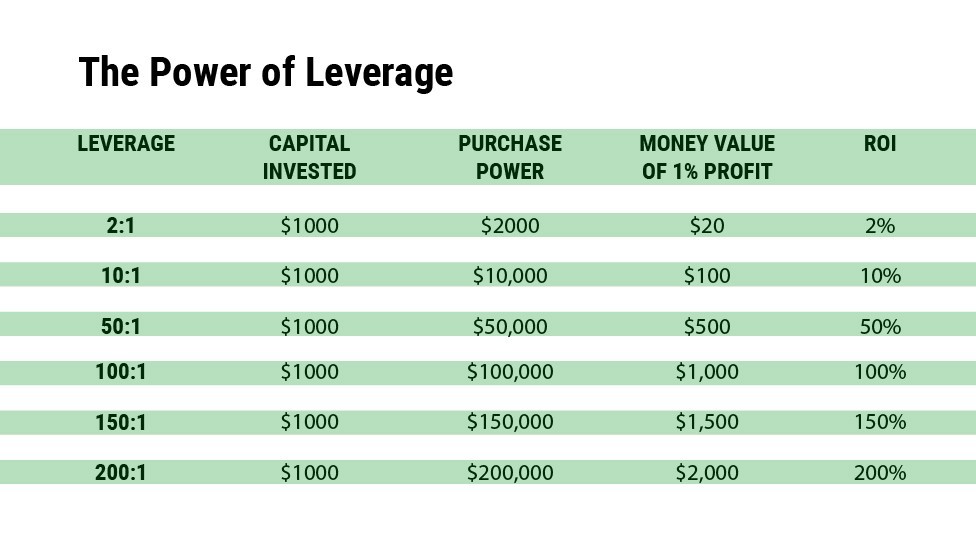

2. Leverage – A Double-Edged Sword

Leverage is a powerful tool in Forex trading, allowing traders to control a larger position with a smaller initial investment. While leverage can amplify profits, it can also amplify losses exponentially. A slight adverse movement in the market can quickly erode your capital if you’re heavily leveraged.

Image: howtotrade.com

The Leverage Trap: A Real-World Example

Imagine a trader with $1,000 in their account using a 1:100 leverage. They can control $100,000 worth of currency. If the currency value drops by 1%, they lose $1,000 (1% of $100,000). The same 1% drop with no leverage would only result in a loss of $10. This demonstrates how leverage can significantly impact both profits and losses.

3. Liquidity – The Illusion of Abundance

Forex markets boast incredible liquidity, suggesting that traders can easily enter and exit positions without impacting the price. However, liquidity isn’t always constant. During high-impact news events or periods of market uncertainty, liquidity can decrease, leading to wider spreads, price gaps, and potentially significant losses.

4. Geopolitical Risk – The Unpredictable Storm

Global events, from political tensions to trade wars, can send shockwaves through the Forex market. The impact of these events, often unexpected, can create substantial market volatility and unpredictable price shifts, making it challenging to navigate the turbulent waters.

5. Counterparty Risk – Trusting the Unknown

In Forex trading, you’re dealing with brokers and financial institutions. While reputable brokers are essential, counterparty risk still exists. If your broker experiences financial difficulties or fails to honor their obligations, you could lose your investment.

6. Psychological Factors – The Invisible Hand

Trading involves emotions, and managing these emotions plays a critical role in success. Fear, greed, and overconfidence can cloud judgment, leading to impulsive decisions that can jeopardize your trading strategy and potentially result in significant losses.

Mitigating Forex Risk: Building a Strong Foundation

While Forex trading risks are inherent, adopting a disciplined approach and employing risk management strategies can significantly improve your chances of success.

1. Risk Management Techniques: Protecting Your Financial Fortress

Risk management encompasses various strategies aimed at limiting potential losses. Some prominent methods include:

a. Stop-Loss Orders: Setting Boundaries

Stop-loss orders automatically close your trading position when a specific price level is reached, limiting potential losses. They are a vital tool for controlling risk, preventing further losses if the market moves against your position.

b. Position Sizing: Determing the Optimal Investment

Position sizing determines the amount of capital you allocate to each trade. Based on your risk tolerance and account size, you can define a percentage of your capital to risk on each trade. This can help you avoid overexposure to a single trade, mitigating the impact of potential losses.

c. Diversification: Spreading the Risk

Don’t put all your eggs in one basket. Diversify your portfolio across multiple currency pairs, reducing the likelihood that a single unfavorable market movement will significantly impact your overall performance.

2. Continuous Learning: Elevating your Trading Expertise

The Forex market is constantly evolving. Keeping abreast of market trends, economic news, and geopolitical events is crucial for informed decision-making. This can involve:

a. Fundamental Analysis: Understanding the Big Picture

Fundamental Analysis aims to understand the underlying factors that influence currency values. This involves examining economic data, interest rates, inflation, and government policies. By understanding these macroeconomic forces, traders can make more informed decisions about potential market trends.

b. Technical Analysis: Reading the Market Charts

Technical Analysis focuses on identifying patterns and trends in price charts to predict future price movements. This involves using various indicators and charting tools to analyze price historical data and identify potential trading opportunities.

The Foremost Principle: Understanding Your Risk Tolerance

Your risk tolerance is a crucial factor in your Forex trading journey. It reflects your willingness to accept potential losses to achieve higher potential profits. Before embarking on Forex trading, it’s essential to have a clear understanding of your risk appetite.

a. Risk-Averse: The Cautious Approach

Risk-averse traders prioritize protecting their capital. They tend to use smaller position sizes, stop-loss orders, and conservative strategies. Their goal is to minimize losses and sustain long-term profitability.

b. Risk-Seeking: Embrace the Volatility

Risk-seeking traders are comfortable with higher risk to pursue greater potential rewards. They may use larger position sizes and employ more aggressive trading strategies, potentially leading to bigger gains but also larger losses.

Forex Trading Risk

The Bottom Line: Foresight in Trading

Forex trading offers both lucrative opportunities and inherent risks. Choosing to embark on this journey demands careful planning, a disciplined approach, and an unwavering commitment to self-education. By understanding the complexities of Forex risk, employing effective risk management strategies, and tailoring your approach to your risk tolerance, you can navigate the often unpredictable waters of the Forex market with enhanced awareness and a greater chance of success.