In the globalized world we live in, transferring funds between different currencies has become a commonplace necessity. Whether you’re a frequent traveler, an international businessperson, or simply need to send money abroad, understanding the intricacies of currency exchange is crucial. In this article, we’ll explore the advantages, methods, and processes involved in transferring money from online sources directly to your forex card.

Image: www.forex.academy

The term “forex card” refers to a prepaid card that’s specifically designed to store and manage multiple currencies simultaneously. Unlike traditional credit or debit cards, forex cards allow cardholders to load currencies directly onto their cards, eliminating the need for potentially expensive currency exchange fees and the hassle of carrying multiple currencies in cash.

Why Forex Cards Matter

The benefits of utilizing forex cards are substantial. Primarily, they offer significantly lower transaction fees and foreign exchange rates compared to banks and currency exchange bureaus. Forex cards also provide greater flexibility and control over your finances, allowing you to easily switch between different currencies as needed. Furthermore, they ensure security by minimizing the risk of carrying large amounts of cash in unfamiliar environments.

Methods of Funding Your Forex Card

Online transfers have emerged as the most convenient and efficient method of funding your forex card. Several reputable financial institutions and online platforms offer this service, enabling you to seamlessly transfer funds from your online bank account directly to your forex card.

The process of online funding typically involves the following steps:

- Sign into your online banking portal.

- Select the “Transfer” or “Pay” option.

- Enter the recipient’s details, including your forex card number and the desired currency.

- Input the amount you wish to transfer.

- Verify the transaction details and confirm the transfer.

Once the transfer is initiated, the funds should reflect in your forex card balance within a matter of minutes or hours, depending on the transfer method chosen and the processing time of your financial institution.

Key Considerations

Before transferring funds to your forex card, there are a few key considerations to keep in mind:

- Transfer fees: Every financial institution and online platform may have its own set of transaction and transfer fees associated with forex card funding. Make sure to compare and choose the option that best suits your needs and budget.

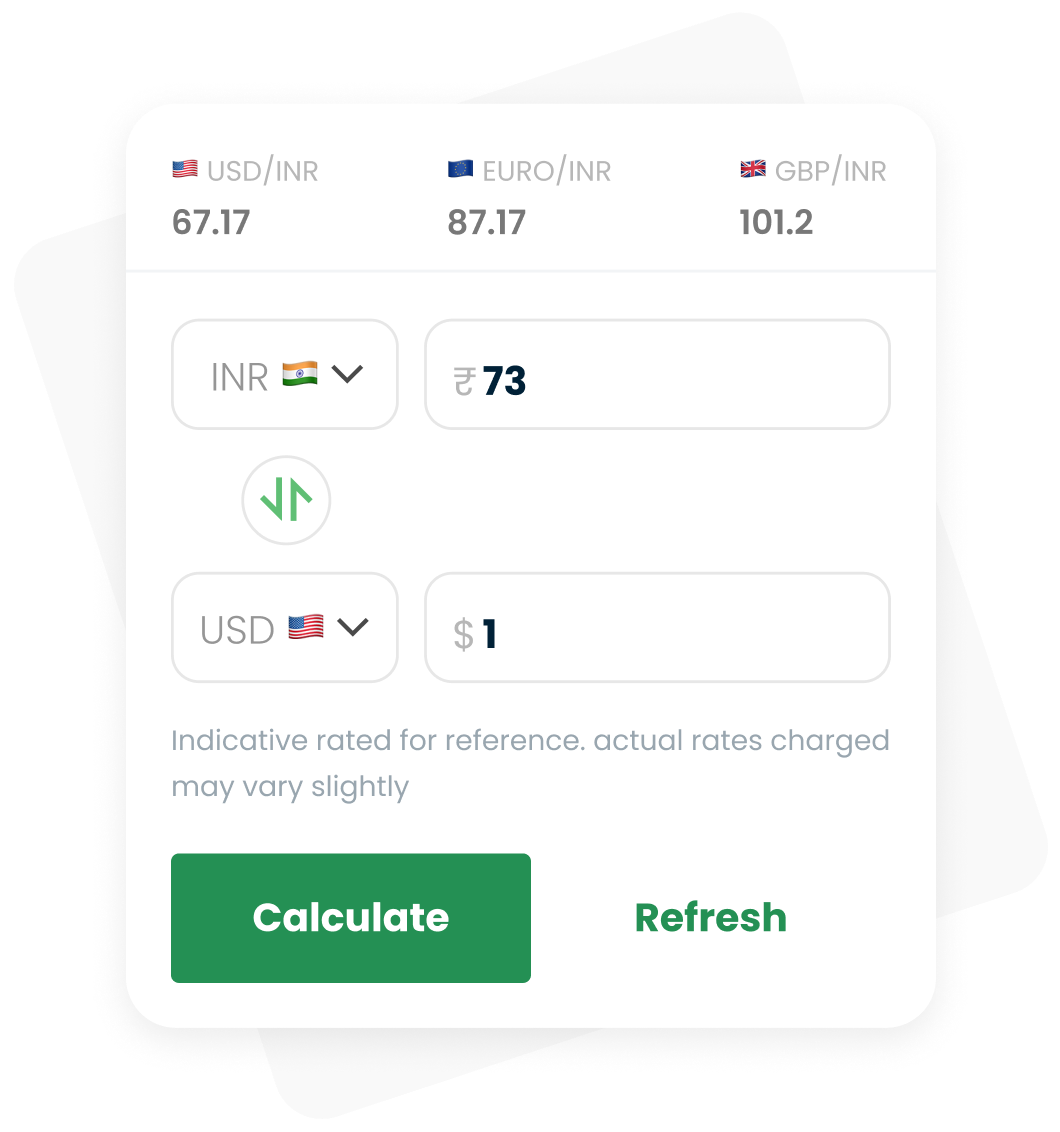

- Currency exchange rate: The exchange rate will determine the actual amount of funds credited to your forex card. It’s essential to check the prevailing exchange rates and compare them across different platforms before initiating a transfer.

- Transfer limits: Some platforms may impose transfer limits on forex card funding. These limits may vary based on your account type and the specific financial institution.

Image: www.tripmoney.com

Transferring Money From Online To Forex Card

Conclusion

Transferring money from online to your forex card has revolutionized global currency management, providing numerous advantages and simplified processes. Whether you’re a frequent traveler or need to conduct international business transactions, forex cards offer a secure, convenient, and cost-effective solution. By understanding the methods and considerations involved in online funding, you can seamlessly transfer funds to your forex card and enjoy the benefits of managing multiple currencies at your fingertips.