Image: www.forex.academy

Introduction:

In today’s globalized world, the need to transfer money across borders has become more prevalent than ever before. For Indians living abroad or having business interests in India, sending money back home can sometimes be daunting. But with the advent of HDFC Forex Cards, the process has become incredibly convenient and hassle-free. This comprehensive guide will illuminate the intricacies of transferring money to India using an HDFC Forex Card, empowering you with the knowledge to make informed decisions.

Unveiling the HDFC Forex Card:

An HDFC Forex Card is a prepaid card that allows you to store multiple currencies, including Indian Rupees (INR). It functions much like a regular debit or credit card, providing an easy and secure way to make purchases or withdraw cash anywhere globally.

Benefits of Using HDFC Forex Cards for Money Transfers to India:

-

Competitive Exchange Rates: HDFC offers competitive exchange rates for currency conversion, ensuring that you get the most out of your transfer.

-

Swift and Effortless: Money transfers using HDFC Forex Cards are lightning-fast and require minimal documentation compared to traditional bank transfers.

-

No Hidden Fees: HDFC’s transparent fee structure eliminates any hidden charges, providing complete clarity on the transfer costs.

-

Wide Acceptance: HDFC Forex Cards are widely accepted in India, enabling you to transfer money to any bank account or withdraw cash from ATMs across the country.

Eligibility and Application Process:

To be eligible for an HDFC Forex Card, you must be an Indian resident with a valid PAN number. The application process is straightforward and can be completed online or at any HDFC branch. Simply submit the necessary documentation, including proof of identity and address, and your card will be issued within a specified timeframe.

Transferring Money to India Using HDFC Forex Card:

-

Step 1: Load Your Card: Fund your HDFC Forex Card by transferring INR or foreign currency from your bank account or using a wire transfer.

-

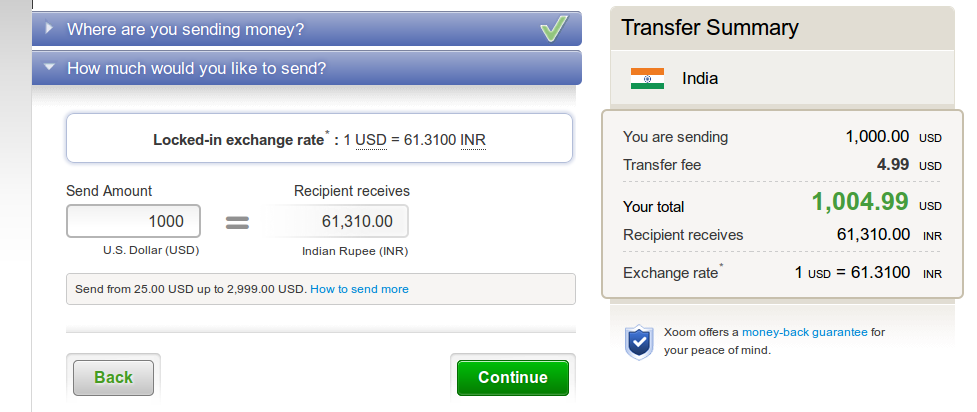

Step 2: Select Currency and Amount: On the HDFC Forex Card website or mobile app, choose INR as the recipient currency and enter the desired amount.

-

Step 3: Provide Beneficiary Details: Enter the beneficiary’s bank account number, name, and contact details.

-

Step 4: Confirm and Send: Review the transfer details carefully, including the exchange rate and applicable charges. Once satisfied, confirm the transfer to initiate the process.

Conclusion:

HDFC Forex Cards revolutionize the way you transfer money to India. Their competitive exchange rates, swiftness, lack of hidden fees, and wide acceptance make them an ideal choice for individuals and businesses alike. By equipping yourself with the knowledge provided in this guide, you can harness the power of HDFC Forex Cards to seamlessly send money back home with peace of mind. Embrace the convenience and simplicity they offer to enhance your financial transactions with India.

Image: akowedananipa.web.fc2.com

Transfer Money To India From Hdfc Forex Card