Introduction

Image: bankbooklet.com

In today’s globalized world, the ability to seamlessly transfer funds across borders is paramount for businesses and individuals alike. For those in India, transferring forex balances into their HDFC account has become increasingly important as the country’s economy continues to grow and international trade flourishes. This article will delve into the intricacies of forex balance transfer to an HDFC account, guiding readers through the process, providing valuable tips, and exploring the advantages of utilizing this service.

Understanding Forex and HDFC Accounts

Foreign exchange (Forex) refers to the trading of currencies between different countries. When businesses or individuals engage in international transactions, they often need to exchange one currency for another. HDFC Bank, India’s largest private sector bank, offers a wide range of services, including forex accounts, which enable customers to hold and exchange various foreign currencies.

Benefits of Transferring Forex Balance to HDFC Account

Transferring forex balance to an HDFC account offers numerous benefits:

- Competitive Exchange Rates: HDFC Bank’s forex services provide competitive exchange rates, ensuring that you get the best value for your currency conversion.

- Swift Transaction Processing: HDFC’s online banking platform allows for quick and easy transfer of funds, reducing turnaround time and delays.

- Secure Transactions: HDFC is renowned for its robust security measures, ensuring the safety and confidentiality of your forex transactions.

- Variety of Currencies: HDFC accounts support a wide range of foreign currencies, catering to the diverse needs of businesses and individuals.

- Dedicated Support: HDFC’s dedicated forex support team is always on hand to assist with any queries or issues related to forex balance transfer.

Process of Transferring Forex Balance to HDFC Account

The process of transferring forex balance to an HDFC account is straightforward:

- Open an HDFC Forex Account: If you don’t already have one, open an HDFC forex account by visiting your nearest branch or applying online.

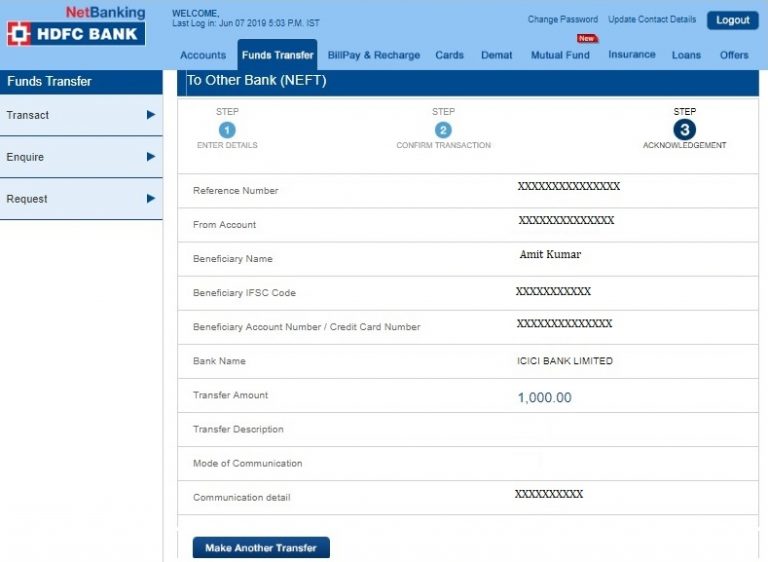

- Login to HDFC Online Banking: Once your account is set up, log in to HDFC’s online banking portal.

- Select “Forex Transfer”: Navigate to the “Forex Transfer” section and select the type of transfer you wish to make.

- Enter Details: Provide the required details, such as the sending currency, receiving currency, amount, and recipient account number.

- Review and Submit: Carefully review the transaction details before submitting the request for processing.

Tips for a Smooth Transfer

To ensure a smooth and successful forex balance transfer, consider these tips:

- Check Exchange Rates: Track the exchange rates to find the most favorable time to transfer your balance.

- Minimize Transfer Fees: Research and choose the transfer method with the lowest fees to maximize your funds.

- Verify Recipient Details: Double-check the recipient account number and currency to avoid any errors or delays.

- Document the Transaction: Keep a record of all transaction details, including the reference number and date, for future reference.

- Contact HDFC Support: If you encounter any issues during the transfer process, don’t hesitate to contact HDFC’s dedicated forex support团队 for assistance.

Conclusion

Transferring forex balance into an HDFC account is a convenient and secure way to manage international transactions. By utilizing HDFC’s competitive exchange rates, swift processing, and robust security measures, businesses and individuals can seamlessly move funds across borders to meet their global needs. Remember to follow the tips outlined in this article to ensure a smooth and seamless transfer process.

Image: www.paisabazaar.com

Transfer Forex Balance Into Hdfc Account