Introduction

Understanding foreign exchange (Forex) rates is crucial for individuals, businesses, and financial institutions involved in international transactions. As one of the leading banks in India, HDFC Bank plays a significant role in facilitating Forex transactions for its customers. This article delves into the intricacies of Forex rates and provides an in-depth analysis of today’s HDFC Forex rates, helping you make informed decisions regarding your foreign exchange needs.

Image: forexgoldsystem.blogspot.com

Forex rates fluctuate constantly due to factors such as economic conditions, political events, and market demand and supply. Staying updated with the latest Forex rates is essential to minimize transaction costs and maximize profits. HDFC Bank offers competitive Forex rates and provides its customers with real-time updates on exchange rates, ensuring they stay ahead of the currency market.

Understanding Forex Rates

Forex rates represent the value of one currency relative to another. They determine how much of one currency is required to purchase a unit of another currency. Exchange rates are quoted in pairs, and the first currency is known as the base currency, while the second currency is known as the quote currency.

For example, if the USD/INR exchange rate is 80.12, it means that 1 US Dollar (USD) is equal to 80.12 Indian Rupees (INR). In simpler terms, you need 80.12 INR to buy 1 USD. Forex rates are constantly changing, and the variations can impact the cost of imports and exports, as well as the value of investments and assets denominated in foreign currencies.

HDFC Forex Rates

HDFC Bank offers a wide range of Forex products and services to cater to the diverse needs of its customers. These products include Forex trading, currency exchange, and travel cards. HDFC’s Forex rates are competitive and are updated regularly to reflect the latest market conditions.

HDFC Bank customers can access real-time Forex rates through the bank’s online banking portal, mobile banking app, and Forex dealers. The bank also provides forward contracts, which allow customers to lock in exchange rates for future transactions, protecting them from exchange rate fluctuations.

Factors Influencing Forex Rates

- Economic Conditions: Economic growth, inflation, and interest rates play a significant role in determining Forex rates. A strong economy with high growth and low inflation tends to attract foreign investment, leading to an appreciation of its currency.

- Political Events: Political stability and uncertainty can impact Forex rates. Major political events, such as elections, coups, or wars, can cause rapid fluctuations in exchange rates.

- Market Demand and Supply: The Forex market is a global marketplace where currencies are traded 24/7. Demand and supply for different currencies are constantly changing, influencing their respective exchange rates.

- Central Bank Intervention: Central banks can intervene in the Forex market to influence the value of their currencies. They can buy or sell foreign currencies to stabilize exchange rates or meet specific economic goals.

Image: economictimes.indiatimes.com

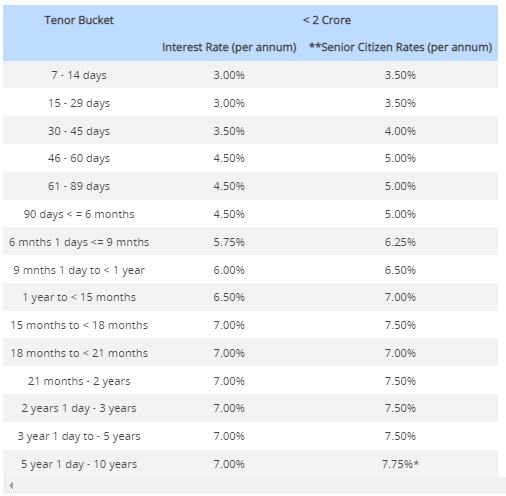

Live Forex Rates from HDFC Bank

Today’s Forex rates from HDFC Bank are as follows:

| Currency | Buy Rate | Sell Rate |

|---|---|---|

| USD | 80.12 | 80.35 |

| EUR | 87.29 | 87.52 |

| GBP | 97.45 | 97.71 |

| JPY | 0.73 | 0.75 |

Note: Rates are subject to change. Please refer to HDFC Bank’s online banking portal or mobile app for the latest rates.

Tips for Using HDFC Forex Services

- Compare Rates: Always compare Forex rates from different banks and financial institutions to ensure you’re getting the best deal.

- Use Forward Contracts: If you have a future foreign currency transaction, consider using forward contracts to lock in the exchange rate and protect yourself from adverse fluctuations.

- Stay Informed: Monitor the latest Forex market news and trends to make informed decisions regarding your foreign exchange transactions.

- Consult a Forex Expert: If you’re unsure about Forex rates or the best course of action, consider consulting a Forex expert or financial advisor.

Todays Forex Rate Of Hdfc

Conclusion

Understanding and utilizing Forex rates effectively is crucial for managing international financial transactions. HDFC Bank provides competitive Forex rates and comprehensive Forex services, making it a reliable partner for your foreign exchange needs. By staying informed about Forex market dynamics and following the tips outlined above, you can optimize your Forex transactions and minimize risks.

We encourage you to explore HDFC Bank’s Forex offerings and consult with the bank’s experts to find the best Forex solutions tailored to your specific requirements.