The foreign exchange (forex) market, the largest financial market globally, presents traders with unparalleled opportunities for profit. However, navigating its complexities requires a systematic approach. Embracing the following seven time-tested tips will empower you to enhance your trading acumen and consistently turn a profit in the dynamic forex market.

Image: likoswb.weebly.com

1. Cultivate a Comprehensive Understanding of the Forex Market

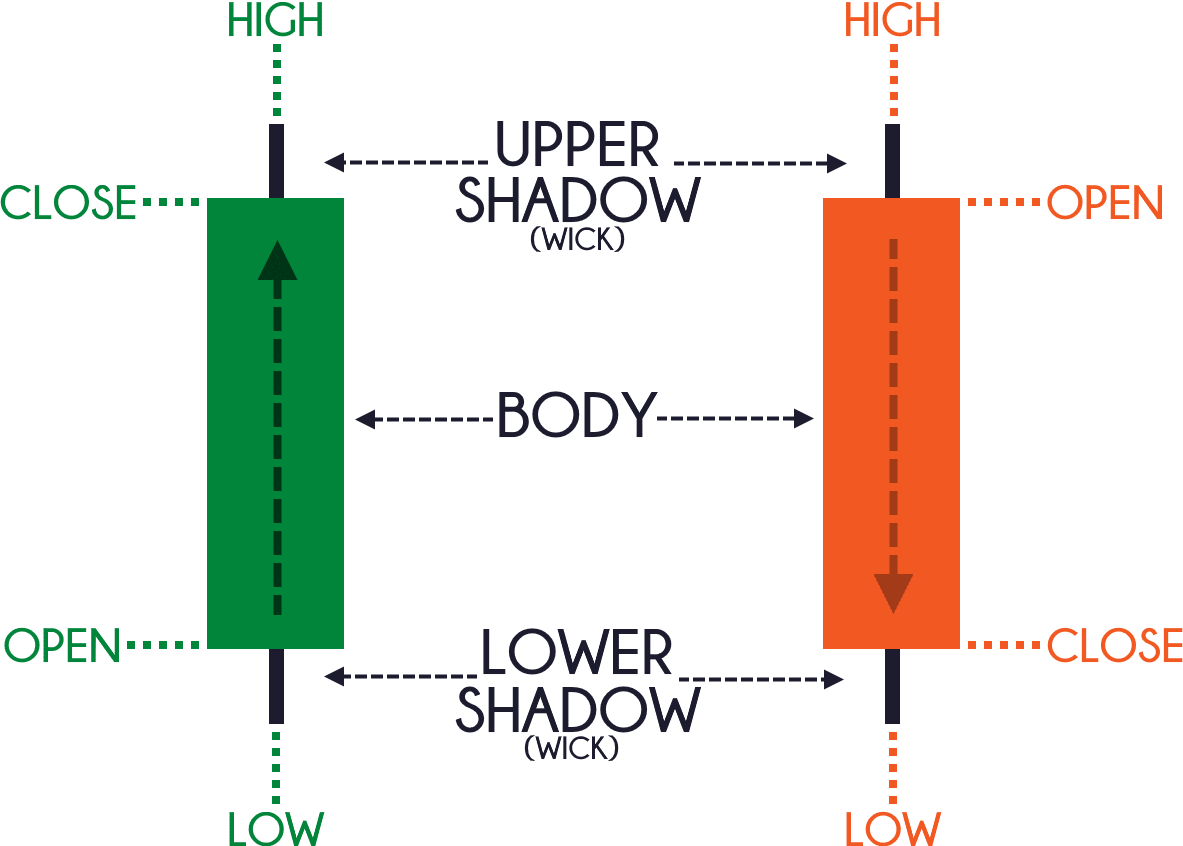

Thorough knowledge of the forex market’s fundamentals is paramount for successful trading. Dedicate time to understanding currency pairs, exchange rates, and the factors that influence them, such as economic indicators, political events, and global news. Delve into technical analysis techniques, chart patterns, and trading strategies to gain an edge in predicting market movements.

2. Establish a Disciplined Trading Strategy

Discipline is the cornerstone of successful forex trading. Define your trading strategy meticulously, outlining your entry and exit points, risk management parameters, and profit targets. Stick to your strategy diligently, avoiding emotional decision-making and impulsive trades. Remember, trading is not a get-rich-quick scheme; it demands patience, perseverance, and unwavering commitment to your trading plan.

3. Risk Management: A Prudent Approach

Risk management is not an option in forex trading; it is an absolute necessity. Determine the maximum amount you’re willing to lose on each trade and adhere to it strictly. Utilize stop-loss orders diligently to limit potential losses should the market move against you. Proper money management techniques will safeguard your capital and prevent catastrophic losses.

Image: www.dailybreizh.fr

4. Technical and Fundamental Analysis: A Symbiotic Relationship

Technical analysis, the study of historical price data, and fundamental analysis, which examines economic and political factors, are two pillars of forex trading. Employ technical analysis to identify trading opportunities based on chart patterns, indicators, and support/resistance levels. Simultaneously, stay informed about macroeconomic data releases, political events, and global news to complement your technical analysis and make well-rounded trading decisions.

5. The Power of Leverage: A Calculated Risk

Leverage, a double-edged sword, amplifies both potential profits and losses. Exercise caution when using leverage and trade only with what you can afford to lose. Remember, higher leverage increases the risk of substantial losses if the market moves against you. Use leverage judiciously and consider your risk appetite before employing it in your trading strategy.

6. Continuous Learning and Adaptability

The forex market is an ever-evolving landscape, and successful traders continuously expand their knowledge and adapt to changing market dynamics. Attend industry webinars, engage in online forums, read books, and follow market news to stay abreast of the latest trading techniques, strategies, and economic developments. Embrace flexibility and adjust your trading approach as the market evolves to remain profitable in the long run.

Tips Fr A Good Forex Trader

7. The Psychology of Trading: A Battle Within

Trading psychology, often overlooked, plays a fundamental role in trading success. Cultivate emotional discipline to avoid impulsive trades driven by fear or greed. Embrace patience and persistence, understanding that profit accumulation is a gradual process that cannot be rushed. Develop a positive mindset, learn from your mistakes, and maintain a healthy trading psychology to enhance your overall trading performance.