Introduction

In the fast-paced world of forex trading, time is money. This is especially true on platforms like Olymp Trade, where traders engage in short-term trades that can yield significant profits or losses in a matter of minutes. Understanding and managing the time limit is therefore crucial for achieving consistent success in Olymp Trade forex. This article provides a comprehensive guide to time limits, exploring its significance, ramifications, and strategies for effective management.

Image: trade-in.forex

Understanding the Time Limit

The time limit in Olymp Trade forex refers to the duration for which a trader has to complete a trade. This varies depending on the type of asset being traded but typically ranges from 1 minute to 24 hours. Once the time limit expires, the trade is automatically closed, and the trader either gains or loses based on the price movement.

Importance of the Time Limit

The time limit plays a pivotal role in Olymp Trade forex for several reasons:

-

Risk Management: It forces traders to carefully consider the risks involved in each trade and make informed decisions accordingly. Traders cannot hold on to losing positions indefinitely, as the time limit ensures eventual closure, limiting potential losses.

-

Discipline: The time limit instills a sense of discipline and urgency, preventing traders from getting caught up in indecision or emotional trading. It encourages them to execute trades on time, avoiding costly delays.

-

Trading Objectives: Different time limits suit different trading objectives. Scalpers may prefer short time limits to maximize profit opportunities in volatile markets, while swing traders may opt for longer limits to capitalize on longer-term price trends.

Strategies for Managing the Time Limit

-

Choose the Right Time Limit: Select a time limit that aligns with your trading style, risk tolerance, and the asset being traded. Consider the volatility and liquidity of the market before making a decision.

-

Set Realistic Profit Targets: Establish realistic profit targets based on the time limit chosen. Avoid setting overly ambitious goals or holding on to positions for too long, aiming instead for consistent, achievable profits.

-

Use Pending Orders: Place pending orders at specific price levels to automate trades, ensuring that they are executed even if you are not actively monitoring the market. This can help you capitalize on market opportunities outside of the time limits.

-

Manage Emotions: Time limits can trigger emotions like fear and greed, leading to impulsive decisions. Maintain emotional control, stick to your trading plan, and avoid making hasty trades when the time limit is approaching.

-

Take Breaks: Step away from the trading platform regularly to clear your mind and return with a fresh perspective. This can prevent burnout and help you make more rational decisions within the time limits.

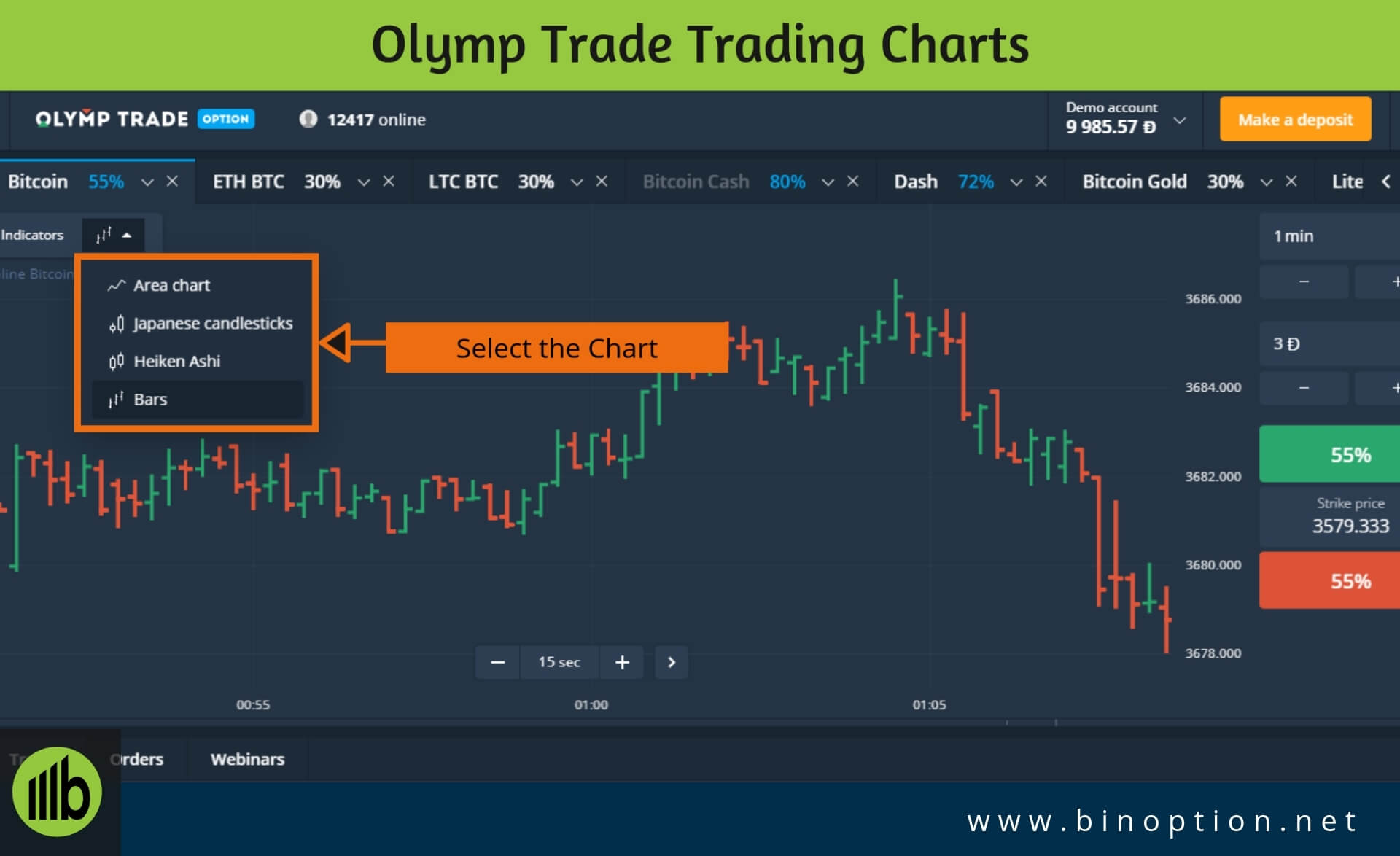

Image: morestmat.blogspot.com

Time Limit In Olymp Trade Forex

Conclusion

The time limit in Olymp Trade forex is a crucial factor that every trader must understand and manage effectively. By choosing the right time limit, setting realistic profit targets, utilizing pending orders, controlling emotions, and taking breaks, traders can optimize their trading strategy and improve their chances of success in the demanding world of Olymp Trade forex. Remember, time is of the essence in trading, and by mastering the art of time management, you can unlock the full potential of this exciting platform.