In the dynamic realm of currency trading, Forex signals serve as guiding lights, promising traders a path to lucrative opportunities. However, amidst the allure of potential profits, lies a labyrinth of misconceptions and complexities. This article aims to unravel the mysteries surrounding Forex signals, empowering you with the knowledge and insights to make informed decisions and navigate the trading landscape with confidence.

Image: garrynutri.weebly.com

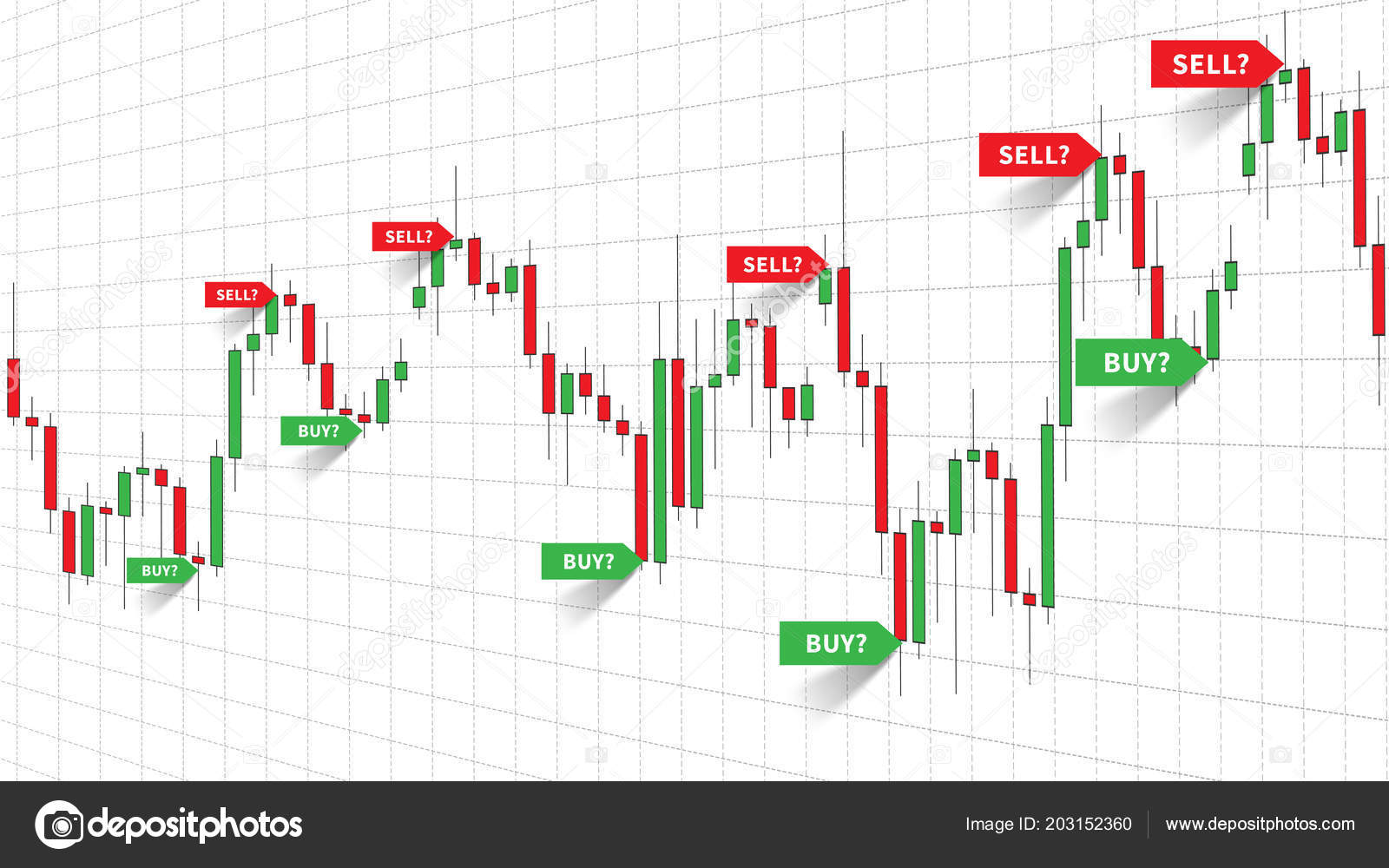

What Are Forex Signals?

Forex signals are recommendations issued by experts or service providers, advising traders on specific currency pairs to buy, sell, or hold at a given time. These signals are typically based on technical analysis, fundamental analysis, or a combination of both. The goal is to provide traders with an external perspective, helping them make more informed trading decisions.

Types of Forex Signals

The world of Forex signals is diverse, with different providers offering various types. Here’s a breakdown of the most common categories:

- Automated Signals: These signals are generated by automated trading algorithms using predetermined parameters.

- Manual Signals: These signals are provided by human analysts who study market charts and make trading decisions based on their expertise.

- Free Signals: Some providers offer free signals as a marketing or lead-generation strategy.

- Paid Signals: Paid signals come with a subscription fee, offering more comprehensive analysis and features.

- Customizable Signals: Advanced signal providers allow users to customize signals based on their risk tolerance and trading preferences.

Benefits of Using Forex Signals

Forex signals offer a myriad of advantages to traders of all levels of experience:

- Independent Perspective: Signals provide an external viewpoint, helping traders avoid emotional biases or tunnel vision.

- Time Saver: Analyzing markets and identifying trading opportunities can be time-consuming. Signals streamline the process, saving valuable time.

- Automated Trading: Automated signals enable traders to execute trades automatically, freeing up time for other tasks.

- Enhanced Confidence: Signals boost trader confidence, especially for beginners who may lack market experience.

- Learning Tool: Signals can provide insights into market analysis and trading strategies, serving as a learning tool for aspiring traders.

Image: candlestickstrading.blogspot.com

Cautions and Considerations

While Forex signals hold great potential, it’s essential to approach them with caution and awareness:

- Not a Guarantee of Profit: Signals are not a magic bullet; they do not guarantee profits. Success in Forex trading involves a combination of skill, knowledge, and discipline.

- Multiple Factors at Play: Signals should not be used in isolation. Other market factors, such as news or economic events, can impact trading outcomes.

- Reliability Matters: Signal providers vary in terms of reliability, accuracy, and trading strategies. Research and due diligence are crucial before opting for any service.

- Risk Assessment: As with any investment or trading strategy, it’s important to assess your risk tolerance and invest only what you can afford to lose.

- Emotion Management: Trading with signals can evoke emotions, but it’s essential to stay disciplined and avoid emotional decision-making.

Tips for Finding a Reliable Signal Provider

Finding a trustworthy Forex signal provider is key to success:

- Background Check: Research the provider’s history, track record, and reputation. Read reviews, testimonials, and feedback from other traders.

- Transparency: Look for providers who are transparent about their trading strategies, risk management policies, and commission structures.

- Customization: Opt for providers who offer customizable signals to align with your trading style and risk appetite.

- Performance Metrics: Evaluate the provider’s performance metrics, such as win rate, risk-to-reward ratio, and profitability.

- Trial Period: Many providers offer free trials or demo accounts, allowing you to test the signals before committing to a subscription.

Things To Know About Forex Signals

Conclusion

Forex signals can be a valuable tool in the Forex trader’s arsenal, providing guidance, time savings, and confidence. However, it’s crucial to approach them with caution, conduct thorough research, and understand the limitations. By embracing the information presented in this article, you can navigate the complexities of Forex signals, unlock their potential, and harness them to enhance your trading journey. Remember, the path to success in currency trading lies in a combination of knowledge, experience, and the prudent use of tools to navigate the evolving market landscape.