Introduction: Navigating the Evolving Landscape of Forex

In the ever-dynamic realm of forex trading, where fortunes are won and lost in lightning-fast intervals, embracing the latest trends is paramount for traders seeking success. Forex, short for foreign exchange, is the world’s largest financial market, rife with opportunities for savvy investors. The advent of sophisticated technologies and innovative trading strategies has transformed the forex landscape, presenting traders with a treasure trove of tools and techniques to maximize their returns. From nimble trading bots to data-driven analytics, the latest trends in forex empower traders to navigate market volatility and seize profitable opportunities with greater precision and efficiency.

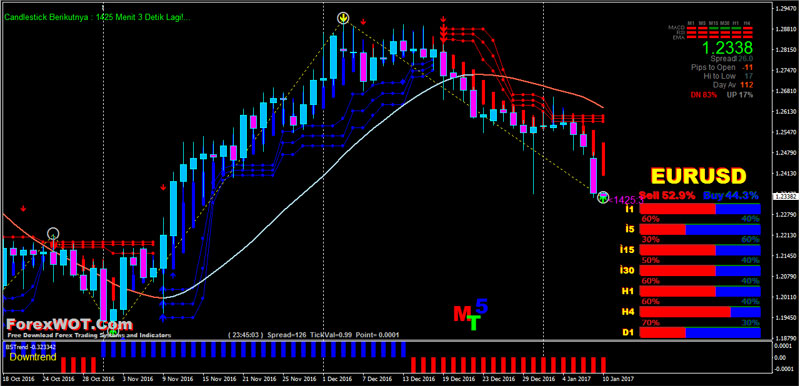

Image: forexwot.com

Exploring the Technological Arsenal: AI-Powered Bots and Algorithmic Trading

The influence of artificial intelligence (AI) and machine learning in forex trading has been nothing short of revolutionary. Automated trading bots, powered by sophisticated algorithms, meticulously analyze vast amounts of data and execute trades autonomously based on pre-defined parameters. These bots monitor market fluctuations in real-time, leveraging complex mathematical models to identify profitable trading opportunities with lightning-fast execution speeds that far surpass human capabilities. By seamlessly adapting to dynamic market conditions, these AI-driven bots offer traders a significant edge, allowing them to capitalize on market movements around the clock.

Big Data Analytics: Harnessing Market Insights for Informed Decisions

Data has become the lifeblood of modern finance, and forex trading is no exception. Big data analytics empowers traders with unparalleled insights into market behavior. Advanced analytical tools scour through vast repositories of historical data, identifying patterns, correlations, and trends that may elude the naked eye. By leveraging these data-driven insights, traders can make informed decisions, proactively anticipate market movements, and develop tailored strategies that resonate with the unique dynamics of the forex market.

The Rise of Mobile Trading: Convenience at Your Fingertips

Mobility has become a ubiquitous aspect of modern life, and forex trading has embraced this trend wholeheartedly. Mobile trading platforms, accessible through smartphones and tablets, liberate traders from the constraints of traditional desktop setups. These platforms empower traders to monitor market fluctuations, execute trades, and manage their portfolios seamlessly on the go. With mobile trading, traders can seize trading opportunities and respond to market events in real-time, regardless of their location.

Image: s3.amazonaws.com

Social Trading: Tapping into the Collective Wisdom

In the interconnected world of forex trading, social trading platforms have emerged as vibrant online communities. These platforms enable traders to connect, share ideas, and learn from the experiences of their peers. Social trading platforms offer a unique opportunity to access real-time market insights, emulate the strategies of successful traders, and expand knowledge through interactive forums and discussions. By tapping into the collective wisdom of the trading community, traders can refine their skills, identify profitable trading opportunities, and minimize risk.

Blockchain Revolution: Enhancing Transparency and Security

The advent of blockchain technology has introduced a paradigm shift in forex trading, enhancing transparency and security. Blockchain-based trading platforms offer traders a secure and immutable ledger that records all transactions transparently. This eliminates counterparty risk, minimizes the potential for fraud, and fosters trust within the trading ecosystem. By leveraging the transformative power of blockchain, forex traders can execute trades with greater confidence, knowing that their transactions are secure and verifiable.

Adapting to Market Volatility: The Art of Risk Management

Embracing the latest trends in forex trading goes hand in hand with managing risk effectively. In an environment characterized by inherent volatility, implementing robust risk management strategies is critical. Effective risk management involves setting appropriate leverage levels, implementing stop-loss orders, and diversifying trading portfolios to mitigate potential losses. By proactively managing risk, traders can safeguard their capital and navigate market turbulence with greater resilience.

Embracing the Learning Curve: Continuous Education for Success

The forex market is a complex and ever-evolving landscape, necessitating a commitment to continuous learning. Successful traders recognize the importance of expanding their knowledge and honing their skills. Forex education encompasses a broad spectrum of resources, including online courses, webinars, trading books, and mentorship programs. By investing in their education, traders can enhance their understanding of market dynamics, refine their strategies, and adapt to the ever-changing terrain of forex trading.

Seeking Professional Guidance: The Value of Forex Mentorship

Navigating the intricacies of forex trading can be daunting, especially for novice traders. Seeking guidance from experienced traders can provide invaluable support and accelerate the learning curve. Forex mentorship programs offer personalized coaching, customized trading strategies, and tailored risk management advice. By partnering with a skilled mentor, traders gain access to real-world insights, practical guidance, and emotional support, equipping them to make informed trading decisions and maximize their potential in the forex market.

The Latest Trend Ins Forex Trading

Conclusion: Embracing the Future of Forex Trading

The forex market presents a boundless realm of opportunities for traders who embrace innovation and adapt to the evolving landscape. The latest trends in forex trading offer an arsenal of cutting-edge tools, data-driven insights, and globally interconnected platforms, empowering traders to navigate market volatility with greater precision and efficiency. By harnessing the collective wisdom of the trading