The vibrant streets of Thailand beckon travelers with a symphony of sights, sounds, and flavors. Amidst this captivating land’s allure, a crucial decision looms on the horizon: forex card or cash? Navigating the complexities of foreign exchange can seem daunting, but understanding the distinctions between these two methods empowers you to maximize your financial freedom and enhance your Thai adventure. Brace yourself for an in-depth exploration as we unveil the secrets of Thailand forex card vs. cash.

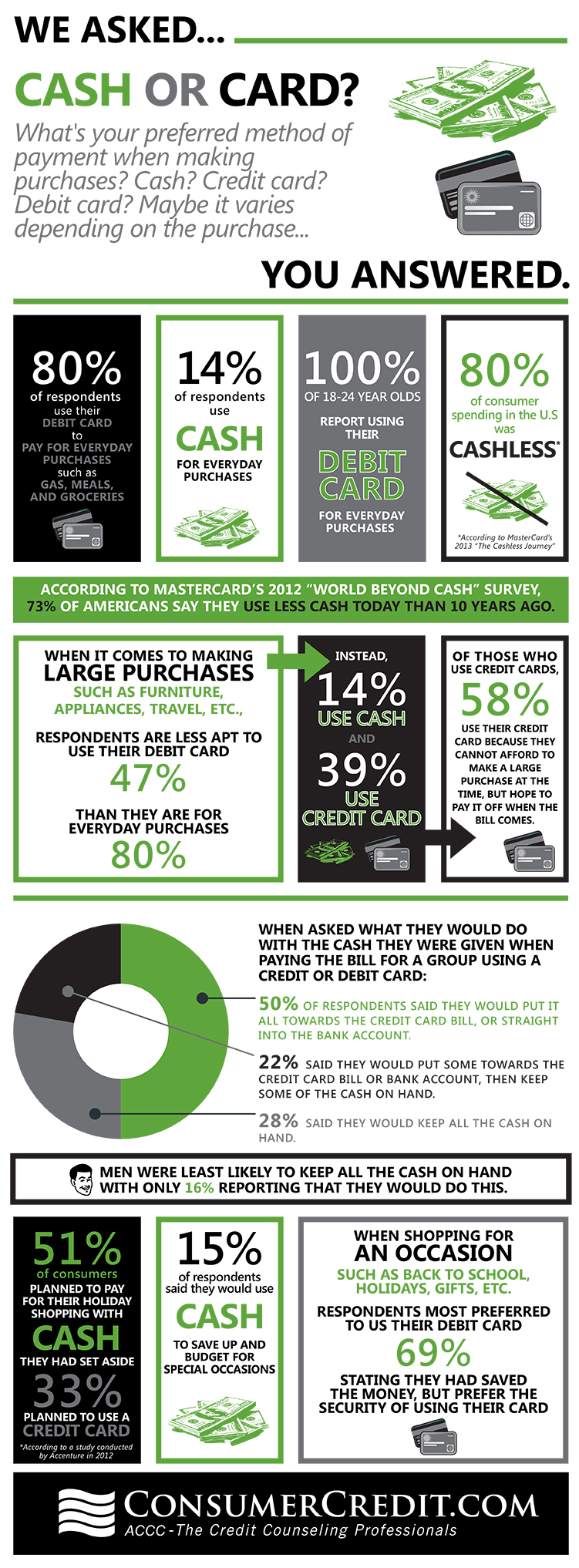

Image: www.consumercredit.com

Forex Card: A Fusion of Convenience and Security

A Thailand forex card is an electronic equivalent of cash, seamlessly bridging the gap between your home currency and Thai Baht. Its preloaded nature eliminates the need for cash exchanges, freeing you from cumbersome lines and unpredictable rates. With a forex card, you can effortlessly make purchases, withdraw cash from ATMs, and settle bills with the convenience of a credit or debit card. Moreover, the accompanying mobile application provides real-time exchange rate updates and transaction details, ensuring transparency and peace of mind.

Cash: The Tangible Touch of Tradition

Cash remains a steadfast companion for many travelers, offering a tangible connection to their finances. Thailand’s widespread acceptance of cash grants you access to a vast network of street vendors, local markets, and small businesses that may not accept card payments. The ability to physically count and manage your spending can provide a sense of control and security, especially for those unaccustomed to electronic transactions.

Key Considerations: Security and Fees

Before choosing between a forex card and cash, carefully weigh the following considerations:

Security: Forex cards offer enhanced security compared to cash, as they can be remotely frozen or canceled in case of loss or theft, minimizing financial risk.

Fees: Forex cards typically incur lower transaction fees compared to cash exchanges, but may come with an initial issuance fee and a small currency conversion spread.

Image: scalpingforexquees.blogspot.com

Local Currency Dynamics: Unveiling the Exchange Rate Maze

Thailand’s currency, the Thai Baht (THB), fluctuates in value against other currencies over time. Understanding these fluctuations can help you make informed decisions regarding currency exchange. It’s wise to monitor exchange rate trends before your trip to identify the most favorable time to exchange your currency.

Expert Insights: Unraveling the Nuances

Seasoned travelers and financial experts offer valuable insights on navigating the forex card vs. cash landscape in Thailand:

-

Carry a combination of cash and a forex card to cater to different scenarios.

-

Notify your bank of your travel plans to avoid any card issues.

-

Keep track of your expenses diligently, regardless of your chosen method.

-

Stay vigilant against currency scams and street vendors offering unfavorable exchange rates.

Thailand Forex Card Vs Cash

Conclusion: Embracing the Power of Informed Choice

Whether you embrace the convenience of a forex card or prefer the familiarity of cash, an informed decision empowers you to manage your finances skillfully in Thailand. Forex cards offer a secure and seamless experience, while cash retains its appeal for those seeking tangible control and wider local acceptance. By delving into the intricacies of Thailand forex card vs. cash, you unlock the secrets to financial flexibility and embark on a Thai adventure brimming with vibrant experiences. So, pack your wanderlust, embrace the power of choice, and let Thailand’s allure captivate your heart as you navigate the landscape of foreign exchange with newfound confidence.