The Forex Market: A World of Opportunity

Imagine you’re sitting at your computer, sipping your morning coffee, and with just a few clicks, you can potentially profit from global currency fluctuations. This isn’t a daydream, it’s the reality of forex trading, a dynamic and exciting market open to anyone with an internet connection. I was first introduced to forex trading by a friend, who, to my surprise, was making a decent side income by simply analyzing currency trends. Intrigued, I dove into the world of forex, and soon discovered that it wasn’t just about luck, but about understanding the market and making informed decisions.

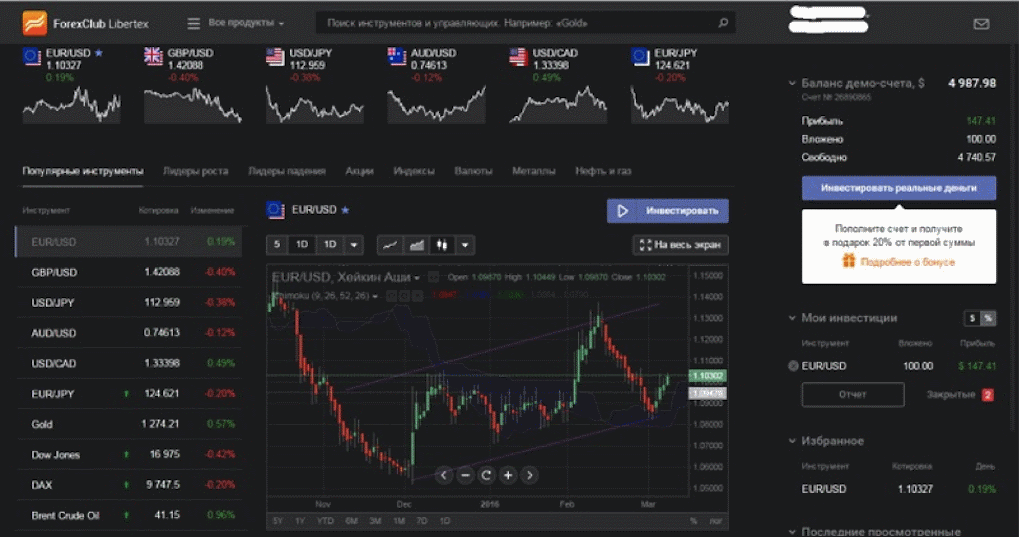

Image: howtotradeonforex.github.io

But as I started researching, I realized that choosing the right forex trading website was crucial. There are countless platforms out there, each with its own features, fees, and functionalities. Choosing the wrong platform could mean missing out on opportunities, facing high trading costs, or even encountering security risks. So, how do you navigate this complex landscape and find the perfect forex trading platform for your needs?

A Comprehensive Guide to Forex Trading Websites

What is a Forex Trading Website?

A forex trading website is an online platform that allows individuals to buy and sell currencies. It acts as an intermediary between traders and the global forex market, offering a secure environment to execute trades. Think of it as an online broker, connecting you to the world’s largest financial market, which trades over $6.6 trillion daily.

History and Evolution of Forex Trading Platforms

The history of forex trading websites is intertwined with the evolution of the internet itself. Initially, forex trading was primarily conducted through telephone and telex, a cumbersome process. The advent of the internet revolutionized the industry, allowing for faster execution, lower costs, and greater accessibility. Today, forex trading has become accessible to individuals all over the world, thanks to the user-friendly platforms developed by leading brokers.

Image: www.forex-ratings.com

Key Features of Forex Trading Websites

A good forex trading website offers a range of features designed to enhance your trading experience. These include:

- Trading Platforms: These are the interfaces through which you place and manage your trades. Look for platforms that are intuitive, user-friendly, and offer advanced features like charting tools and technical indicators.

- Currency Pairs: A reputable forex trading website will offer a wide range of currency pairs, allowing you to diversify your trading portfolio and take advantage of various market conditions.

- Account Types: Different account types cater to various trader levels, from beginners to experienced professionals. Choose an account that aligns with your trading style, experience, and investment goals.

- Educational Resources: A good forex trading website will provide educational resources like articles, tutorials, webinars, and demo accounts to help you learn the ropes of forex trading.

- Customer Support: Having reliable customer support is vital, especially when dealing with a complex financial market. Ensure quick response times, multiple contact channels, and knowledgeable representatives.

- Security Measures: Ensure the trading platform boasts advanced security measures like two-factor authentication, encryption, and regulatory compliance to safeguard your funds and personal information.

Choosing the Right Forex Trading Website

Selecting the ideal forex trading website requires careful consideration of your individual needs and risk tolerance. Here are some key factors to evaluate:

- Reputation and Regulation: Choose a reputable broker regulated by legitimate financial authorities. Look for platforms with a proven track record and positive user reviews.

- Fees and Spreads: Trading costs can significantly impact your profitability. Compare fees, commissions, and spreads (the difference between the buy and sell prices) offered by different brokers.

- Trading Platforms and Tools: Ensure the trading platform is user-friendly, offers advanced charting tools, and provides access to technical indicators. Consider platforms that are compatible with your preferred devices and operating systems.

- Account Types and Minimum Deposit: Choose an account type that aligns with your trading experience and investment goals. Consider the minimum deposit requirements and decide what works best for your budget.

- Educational Resources and Customer Support: Look for platforms that offer comprehensive educational resources and responsive customer support. These resources can be invaluable for building your trading knowledge and navigating any issues you might encounter.

Latest Trends in Forex Trading Websites

The world of forex trading is constantly evolving, driven by technological advancements and changing investor needs. Some of the latest trends include:

- Artificial Intelligence (AI): AI-powered trading tools are becoming increasingly popular, offering automated trading strategies and personalized insights based on complex market data analysis.

- Mobile Trading: More and more traders are opting for mobile trading apps, allowing them to access the market anytime, anywhere from their smartphones or tablets.

- Social Trading: Social trading platforms let you connect with other traders, share strategies, and learn from their experience. This collaborative approach can benefit both seasoned and novice traders.

- Cryptocurrency Trading: Many forex trading websites now offer access to cryptocurrency trading, expanding their reach into this rapidly evolving market.

Tips and Expert Advice for Forex Trading

While forex trading can be exciting and potentially lucrative, it’s important to approach it with a cautious and analytical mindset. Here are some tips to help you succeed:

- Start with a Demo Account: Don’t jump into live trading without understanding the ropes. Practice using a demo account to familiarize yourself with the platform, trading tools, and market dynamics.

- Develop a Trading Plan: Every successful trader has a plan. Define your trading goals, risk tolerance, and strategies. This plan will guide your decisions and help you remain disciplined, especially during volatile market conditions.

- Manage Your Risk: Never risk more than you can afford to lose. Utilize stop-loss orders to limit potential losses on individual trades. Always strive to maintain a healthy risk-reward ratio.

- Stay Informed and Learn Continuously: The forex market is constantly evolving, so staying updated on global economic news, political events, and market trends is essential. Continuously learning and refining your trading strategies will help you adapt to changing market dynamics.

- Be Patient and Disciplined: Forex trading requires patience and discipline. Avoid chasing quick profits or getting caught up in emotional decisions. Stick to your plan and let your strategies play out over time.

Remember, trading success is a journey, not a destination. Be patient, learn constantly, and don’t be afraid to adapt your strategies along the way.

Frequently Asked Questions (FAQs)

What are the risks associated with forex trading?

Forex trading involves inherent risks, including:

- Market Volatility: Currency exchange rates can fluctuate significantly, leading to potential losses on your trades.

- Leverage: Forex trading often utilizes leverage, which can magnify your potential profits but also your potential losses.

- Liquidity Risk: In certain market conditions, it may be difficult to exit a trade at your desired price due to insufficient liquidity.

- Economic and Political Events: Unexpected economic or political events can significantly impact currency markets, leading to sudden and drastic price movements.

How do I choose the right trading account type?

The appropriate account type depends on your trading experience, investment goals, and risk tolerance.

- Micro Accounts: Suit beginners with smaller investment capital and lower trading volumes.

- Standard Accounts: Offer a standard trading experience with competitive spreads and trading conditions.

- Premium/VIP Accounts: Designed for experienced traders with higher trading volumes, offering tighter spreads and personalized support.

What are the benefits of using a forex trading website?

Utilizing a forex trading website offers several advantages:

- Accessibility and Convenience: Trade currencies from the comfort of your home or anywhere with an internet connection.

- Variety of Trading Tools: Access advanced charting tools, technical indicators, and real-time market data.

- Educational Resources: Learn about forex trading and refine your strategies through articles, tutorials, and webinars.

- Security: Secure platforms with encryption and regulatory compliance to protect your funds and information.

Forex Trading Website

Conclusion

Choosing the right forex trading website is a crucial first step in navigating this dynamic and exciting market. By carefully considering your needs, risk tolerance, and exploring reputable platforms with user-friendly interfaces, advanced features, and robust security measures, you can find the perfect platform to embark on your forex trading journey. Remember, continue learning, stay disciplined, and always focus on managing your risk.

Are you interested in learning more about forex trading websites and how to choose the one that’s right for you? Share your thoughts and questions in the comments below!