Introduction

The foreign exchange market, often known as Forex, is the largest financial market in the world, with daily trading volumes that dwarf those of the stock, bond, and commodities markets combined. This vast and dynamic space, where currencies from all over the globe are bought, sold, and traded against each other, offers countless opportunities for traders to capitalize on price movements and generate profits. Among the plethora of trading strategies available for Forex traders, support and resistance is a cornerstone technique that has stood the test of time and continues to be a staple in the arsenals of successful traders worldwide.

Image: www.dolphintrader.com

The Concept of Support and Resistance

In the world of Forex trading, support and resistance levels are horizontal lines on a price chart that indicate levels at which the price of a currency pair has repeatedly encountered difficulty moving past. Support represents the price level at which buyers step in and start actively purchasing the currency pair, driving the price higher, while resistance represents the price level at which sellers become dominant, forcing the price lower. These levels are crucial for traders, as they provide valuable insights into market sentiment and potential trading opportunities.

Historical Significance and Applicability

The concept of support and resistance has been a core principle in technical analysis since its inception, and its validity has been confirmed through decades of trading practice across various markets, including Forex. Professional traders and analysts rely on support and resistance levels to gauge market sentiment, identify potential trading opportunities, and make informed trading decisions. This strategy’s time-tested effectiveness and universal application are testaments to its strength and reliability.

Trading Strategies Using Support and Resistance

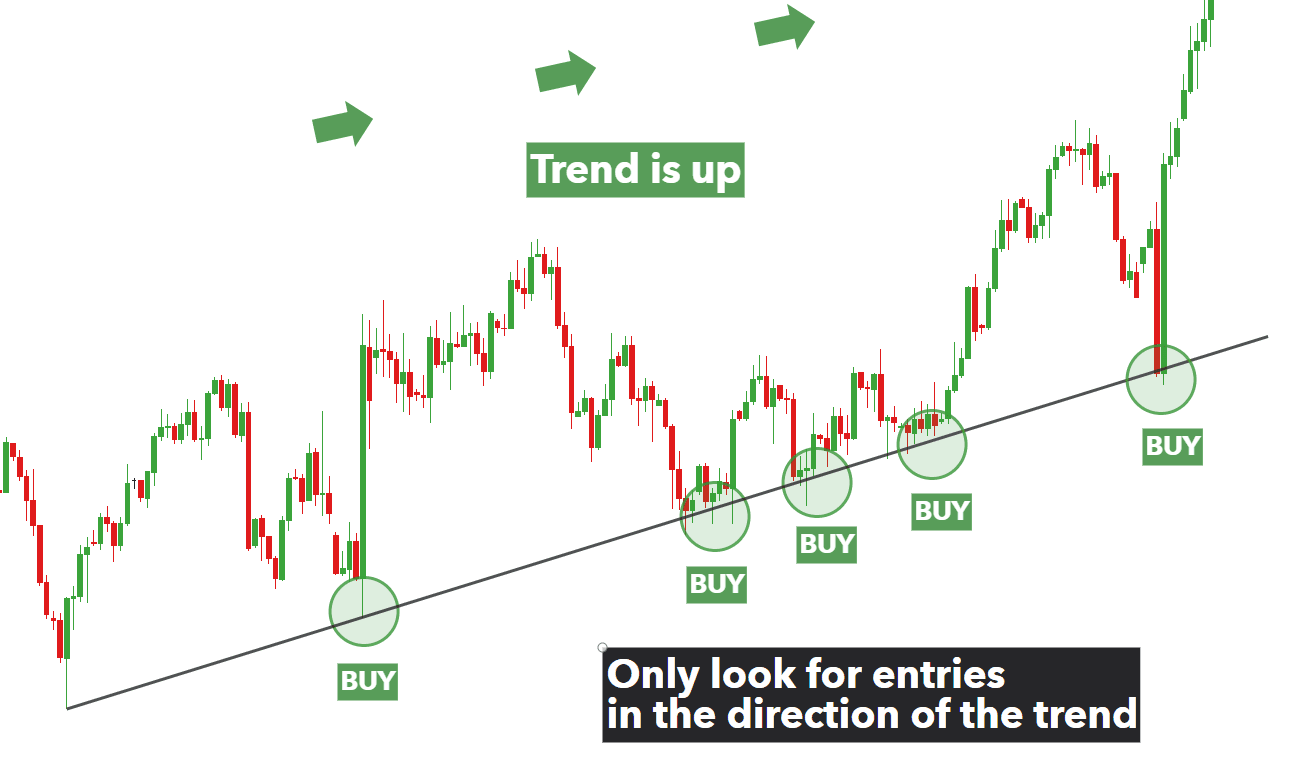

There are several effective trading strategies that incorporate support and resistance levels. Here are two of the most popular approaches:

-

Breakout Trading: This strategy involves trading in the direction of a breakout from a support or resistance level. When the price breaks above a resistance level, it signifies a bullish breakout and signals a potential buying opportunity. Conversely, a breakdown below a support level indicates a bearish breakout and presents an opportunity for short selling.

-

Retracement Trading: This approach involves trading against the breakout direction but within the support or resistance zone. When the price retraces back to a support or resistance level after a breakout, it creates an opportunity for counter-trend trading. Traders can look to buy around support levels after a bullish breakout or sell around resistance levels after a bearish breakout.

Image: changelly.com

Benefits and Advantages

The use of support and resistance in Forex trading offers numerous benefits to traders, including:

-

Clear and Objective Analysis: Support and resistance levels provide objective and quantifiable points of reference on a price chart, making them easy to identify and utilize in trading decisions.

-

Enhanced Entry and Exit Points: By recognizing support and resistance levels, traders can identify potential trade entry and exit points, optimizing their risk-to-reward ratios and increasing their chances of profitable trades.

-

Market Sentiment Analysis: Support and resistance levels provide valuable insights into market sentiment, whether it’s bullish or bearish, by highlighting areas of price rejection or acceptance.

Examples of Support and Resistance in Forex

Consider the daily price chart of the EUR/USD currency pair below:

[Image of EUR/USD currency pair price chart showing support and resistance levels]

The chart clearly illustrates multiple instances of support and resistance levels. The support level at around 1.0500 has held strong on multiple occasions, preventing the price from falling further. The resistance level at approximately 1.1000 has acted as a barrier to upward movement, causing the price to reverse direction several times. These levels have provided valuable trading opportunities for traders who understand and utilize the support and resistance strategy.

Support Resistance Forex Factory Strategy

Conclusion

The support and resistance strategy is a time-honored and effective technique for Forex trading. By incorporating support and resistance levels into their trading plans, traders can enhance their understanding of market sentiment, identify potential trading opportunities, and improve their chances of profitability. Whether you are a seasoned trader or new to Forex, mastering the support and resistance concept will empower you to navigate the complexities of the Forex market with confidence and precision.