Picture this: you’re driving down a winding road, navigating a treacherous mountain pass, every turn revealing a stunning new vista. But as you approach a particularly sharp bend, a thick fog envelops your vehicle, obscuring your vision and making it almost impossible to see ahead. Suddenly, you spot two faint lines painted on the road surface – they’re subtle and easy to miss, but they provide critical guidance to keep you safe. These lines are known as support and resistance, and they serve as the guiding lights for traders navigating the volatile world of urban forex.

Image: excellenceassured.com

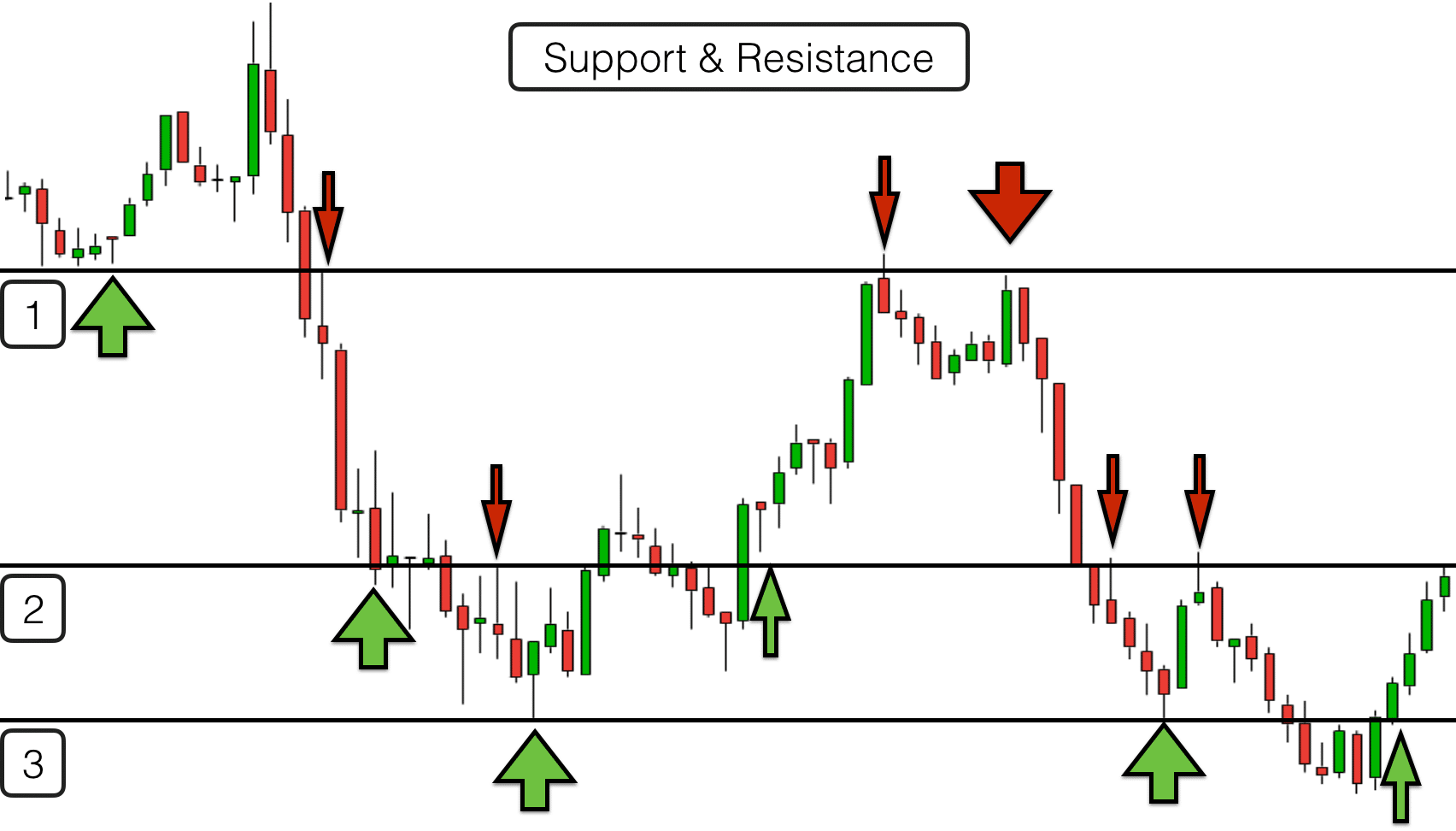

Like the lines on that mountain road, support and resistance levels in forex are not physically present, yet they profoundly influence the direction of price movements. These levels indicate areas where the price of a currency pair has repeatedly found it difficult to break through, either on the upside or downside. They act as invisible barriers, bouncing the price action off their surfaces like a ball against a wall.

Support levels form at points where the price has previously found buying interest, creating a floor beneath which it struggles to fall. Resistance levels, on the other hand, indicate price ceilings, marking areas where the selling pressure has historically been strong enough to prevent further price increases. When price approaches a support level, it often finds buyers willing to purchase at a perceived bargain, pushing the price back up. Conversely, when price nears a resistance level, it often encounters sellers eager to offload their holdings, driving the price back down.

Mastering the art of identifying and trading support and resistance levels is a cornerstone of successful forex trading. By understanding these hidden forces, traders can gain invaluable insights into market sentiment, anticipate future price movements, and make informed trading decisions.

Identifying Support and Resistance Levels

Identifying support and resistance levels is not an exact science, but it becomes easier with practice and requires some understanding of market analysis techniques. There are several common ways to identify potential support and resistance areas:

-

Horizontal Line Tool: One of the most straightforward methods is to draw horizontal lines at key price points where the price has repeatedly bounced.

-

Trendlines: Trendlines are lines connecting a series of price highs or lows, indicating the overall direction of the market. Support and resistance levels often form at points where these trendlines intersect with price.

-

Moving Averages: Moving averages are technical indicators that smooth out price fluctuations. They can act as dynamic support or resistance levels, especially important ones like the 200-day moving average.

-

Round Numbers: Psychological round numbers, such as whole numbers or 0.00 levels, often attract trading interest and can act as support or resistance.

-

Order Blocks: Order blocks are areas on the chart where there has been a significant accumulation or distribution of orders, creating potential support or resistance zones.

Trading with Support and Resistance

Once you’ve identified potential support and resistance levels, you can use them to inform your trading decisions:

-

Buy at Support: When the price approaches a support level, look for indications of buying interest, such as bullish candlesticks or positive divergence on technical indicators. This could be a potential entry point for a long trade.

-

Sell at Resistance: Conversely, when the price nears a resistance level, watch for signs of selling pressure, such as bearish candlesticks or negative divergence. This could be an opportunity to enter a short trade.

-

Breakouts: Breakouts occur when the price decisively breaks through a support or resistance level. A breakout to the upside suggests bullish momentum, while a breakout to the downside indicates bearish pressure. Breakouts often present trading opportunities.

-

Bounce Plays: Bounce plays involve trading the immediate reversal at a support or resistance level. Traders aim to enter a short-term trade in the direction of the bounce, taking profits on the subsequent retracement.

Cautions and Tips

While support and resistance levels are valuable tools, it’s important to use them with caution and consider them in the context of the overall market environment. They can be less effective in highly volatile markets or during periods of significant news or economic events.

Here are some additional tips for using support and resistance effectively:

-

Multiple Time Frames: Consider support and resistance levels across multiple time frames to get a broader perspective on market trends.

-

Confirmation: Always look for confirmation of a support or resistance level through other technical indicators or price action patterns before taking a trade.

-

Context: Understand the market context and the reasons for the formation of support or resistance levels. This helps you make more informed trading decisions.

-

Risk Management: Always manage your risk carefully by using proper position sizing and stop-loss orders.

Remember, support and resistance levels are not absolute guarantees of future price movements. They are simply guidelines that can help you identify potential trading opportunities and make informed decisions. By mastering the art of support and resistance, you can gain an edge in the dynamic and ever-evolving world of urban forex.

Image: justdancenintendosave.blogspot.com

Support And Resistance Indicators From Urban Forex