In the pulsating realm of trading, technical analysis stands as a beacon of guidance, illuminating the ebb and flow of markets. Amidst this analytical arsenal, support and resistance levels emerge as indispensable tools, providing traders with a glimpse into the underlying forces shaping price action. This comprehensive guide will unveil the secrets of support and resistance, empowering you to amplify your trading prowess across both stock and forex markets.

Image: homecare24.id

Deciphering Support and Resistance: The Pillars of Market Dynamics

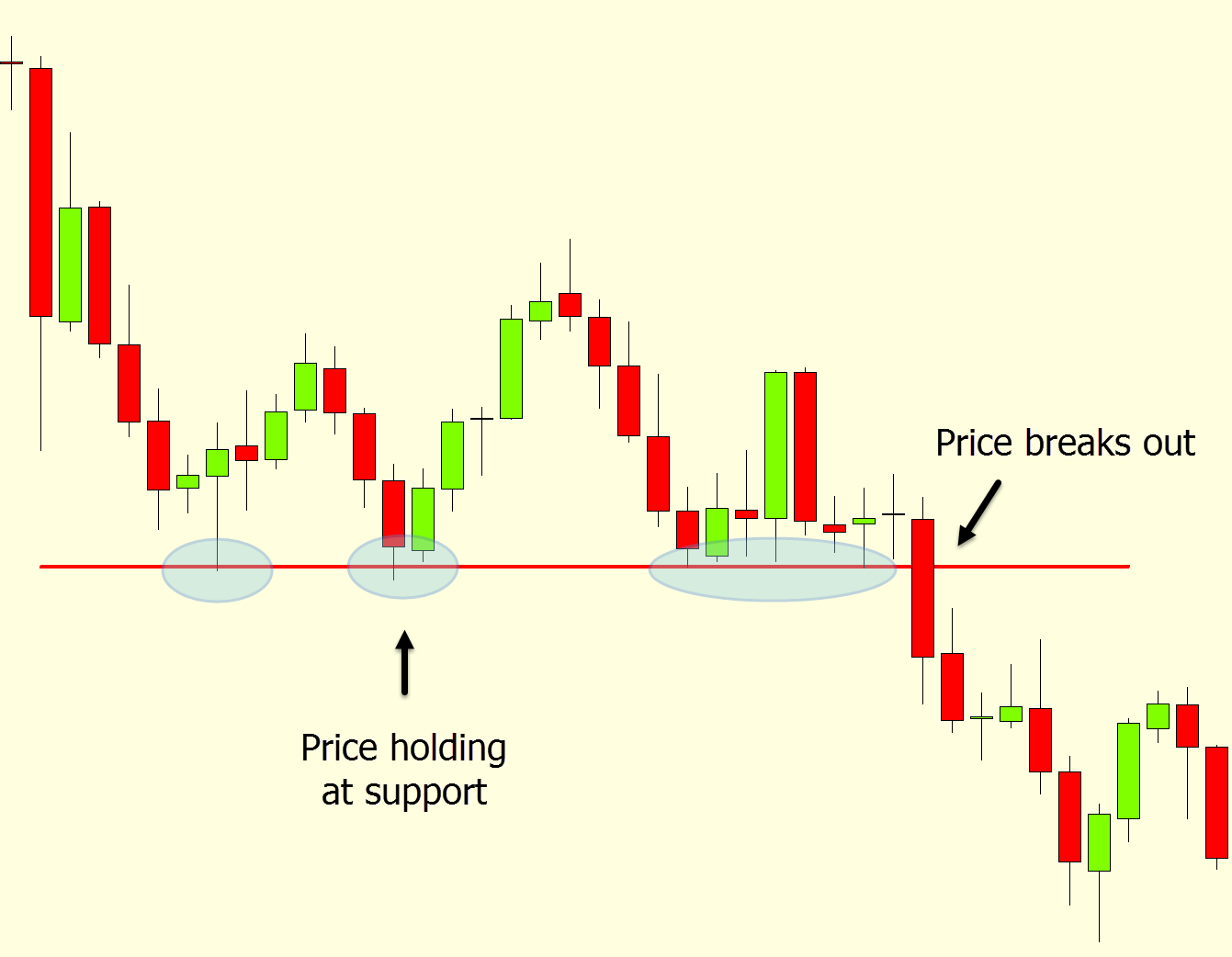

Support refers to price levels at which a downtrend is anticipated to halt or reverse. Here, buyers perceiving value step in, bolstering demand and propelling prices upward. In contrast, resistance signifies price levels where an uptrend is likely to encounter obstacles or stall. At these junctures, selling pressure intensifies, countering buyers’ influence and potentially triggering a price retracement.

Understanding support and resistance levels unveils the market’s underlying structure, enabling traders to identify potential trading opportunities. By discerning areas where the price is likely to pause, reverse, or advance, traders can astutely position their entries, exits, and stop-loss orders, optimizing their profit-taking potential while minimizing risks.

Identifying Support and Resistance Levels: A Practical Approach

Determining support and resistance levels entails diligent observation of price action. Commonly, these levels manifest as horizontal lines on a price chart, connecting points where the price has previously stalled, reversed, or encountered significant buying or selling pressure. Pinpoint these levels by analyzing historical price data, employing technical indicators (e.g., moving averages, Bollinger Bands), or scrutinizing price candlestick patterns.

Once support and resistance zones are established, traders can employ this knowledge to formulate robust trading strategies. For instance, buying near support levels or selling close to resistance levels can potentially yield profitable opportunities. Additionally, these levels serve as critical reference points for setting stop-loss orders, minimizing losses in adverse market conditions.

Unveiling the Dynamics of Support and Resistance: The Interplay of Psychological Factors

The significance of support and resistance extends beyond technical analysis; they also bear strong psychological undertones. Market participants tend to perceive these levels as areas of psychological significance, triggering buying or selling behavior accordingly. This self-fulfilling prophecy further reinforces the efficacy of support and resistance zones, creating a dynamic feedback loop in price action.

Traders can exploit this psychological aspect by anticipating the market’s response at or near support and resistance levels. Identifying imbalances between supply and demand through volume analysis or order flow monitoring can provide invaluable insights into the market’s potential direction, empowering traders to make informed trading decisions.

Image: learnpriceaction.com

Navigating Fluid Conditions: Adapting to Market Dynamics

While support and resistance levels offer invaluable insights into market dynamics, their efficacy is not absolute. Markets are inherently fluid, subject to external events and evolving economic conditions. As such, traders must adapt their strategies accordingly, recognizing that support and resistance zones can shift or even dissipate amidst volatile market scenarios.

Continuously monitoring market dynamics, incorporating real-time news updates, and adapting trading strategies to suit prevailing market conditions are essential for successful trading. Rigorous risk management practices, including stop-loss orders and position sizing, should always be part of a trader’s arsenal to mitigate potential losses.

Tips and Expert Advice for Mastering Support and Resistance

1.Consolidate Knowledge through Practice: Hone your skills by studying historical price charts, practicing on demo trading platforms, and seeking educational resources to deepen your understanding of support and resistance.

2.Seek Confirmation from Multiple Indicators: Reinforce your analysis by corroborating support and resistance levels with other technical indicators, such as moving averages, Bollinger Bands, or Fibonacci retracements, to enhance the reliability of your predictions.

3.Respect Market Volatility: Be mindful of market volatility when identifying support and resistance levels. Wider price ranges necessitate wider stop-loss orders, while narrower ranges may allow for tighter risk management.

Frequently Asked Questions: Demystifying Support and Resistance

Q: Can support and resistance levels change over time?

A: Yes, support and resistance levels can change due to market conditions, news events, and shifts in supply and demand.

Q: How do I identify strong support and resistance levels?

A: Look for areas where price has consistently reversed or stalled, or where multiple technical indicators (e.g., moving averages, Fibonacci retracements) align.

Q: Can support and resistance levels be broken?

A: Yes, support and resistance levels can be broken, often accompanied by high trading volume, indicating a significant shift in market sentiment.

Support And Resistance For Stocks And Forex Trading Strategy

Conclusion: Embracing the Power of Support and Resistance

In the dynamic arenas of stock and forex trading, support and resistance levels emerge as indispensable tools, illuminating the intricacies of price movements and providing a solid foundation for strategic decision-making. By thoroughly understanding these concepts, traders can unlock their full potential in the markets, gaining a competitive edge and maximizing their profit-making opportunities. Are you intrigued by the captivating world of support and resistance? Embrace the knowledge and elevate your trading acumen to unprecedented heights.