Traveling abroad can be a fantastic experience, but managing foreign currency can often be a hassle. Standard Chartered’s Multi-Currency Forex Card offers a convenient and cost-effective solution, allowing you to spend in multiple currencies without worrying about exchange rate fluctuations and hefty transaction fees.

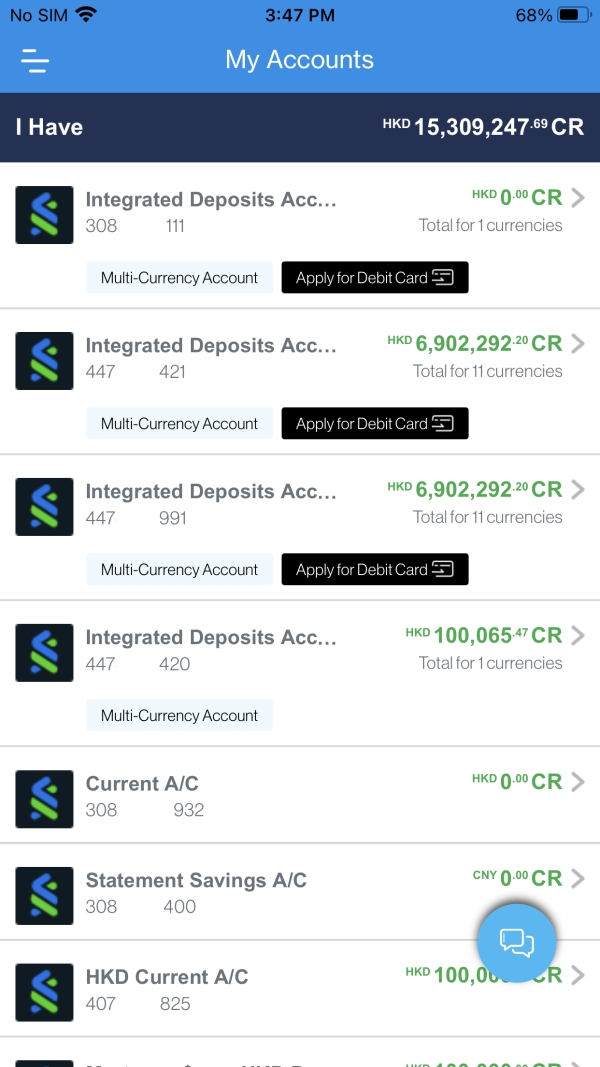

Image: www.sc.com

In this comprehensive guide, we’ll explore the ins and outs of the Standard Chartered Multi-Currency Forex Card and provide expert tips to maximize your savings.

Unlock the Benefits of Multi-Currency Magic

Zero Transaction Fees, Maximum Savings

Unlike traditional methods of currency exchange, the Standard Chartered Multi-Currency Forex Card eliminates hefty transaction fees. Whether you’re making a purchase or withdrawing cash, you’ll avoid the additional charges that can eat into your budget.

Competitive Exchange Rates, Real-Time Savings

The card offers competitive exchange rates that are constantly updated in real-time. This means you can lock in favorable rates on every transaction, ensuring you get the most value for your money.

Image: www.forex.academy

Global Acceptance, Seamless Transactions

Enjoy the convenience of global acceptance at millions of merchants worldwide with Visa or Mastercard. The card allows you to seamlessly conduct transactions in over 150 currencies, making it the perfect companion for international travelers.

A Closer Look at Transaction Fees

While the Standard Chartered Multi-Currency Forex Card offers significant savings on transaction fees, it’s essential to understand the specific charges that may apply:

- Annual Membership Fee: A nominal annual fee may be charged for card membership.

- Currency Conversion: A small spread above the wholesale exchange rate is applied to account for currency exchange costs.

- Cash Withdrawals: A standard cash withdrawal fee may be charged by ATMs.

- Non-Standard Transactions: Fees may apply for transactions outside of regular business hours or involving certain types of accounts.

Optimizing Your Card Usage for Savings

To maximize the benefits of the Standard Chartered Multi-Currency Forex Card, follow these expert tips:

Plan Your Purchases Strategically

Monitor the exchange rates and make purchases in countries where rates are favorable. Avoid transactions during peak travel periods when rates tend to be less advantageous.

Utilize the Multi-Currency Advantage

Load multiple currencies onto your card and switch between them as needed. This allows you to take advantage of currency fluctuations and save on transaction fees. However, avoid topping up the card with small amounts to minimize currency conversion charges.

Manage Your Card Effectively

Keep track of your card expenses and check your account statement regularly to avoid surprises. Report any unauthorized transactions promptly to protect against fraudulent activity.

Frequently Asked Questions

Q: What is the Standard Chartered Multi-Currency Forex Card?

A: It’s a prepaid card that allows you to store multiple currencies and spend abroad with competitive exchange rates and zero transaction fees.

Q: Are there any fees involved?

A: Yes, there may be an annual membership fee, currency conversion spread, cash withdrawal fee, and non-standard transaction fees.

Q: Can I use the card to make online purchases?

A: Yes, the card can be used for online transactions wherever Visa or Mastercard is accepted.

Q: What currencies can I load onto the card?

A: The card supports major currencies such as USD, GBP, EUR, AUD, and SGD, among others.

Standard Chartered Multi Currency Forex Card Transaction Fee

Conclusion

If you’re planning international travel or regularly make foreign currency transactions, the Standard Chartered Multi-Currency Forex Card is an invaluable tool. By eliminating transaction fees, offering competitive exchange rates, and providing global acceptance, it empowers you to save money and enjoy the world without financial worries.

Are you ready to unlock the benefits of multi-currency magic? Apply for the Standard Chartered Multi-Currency Forex Card today and start saving on your international expenses!