In today’s dynamic financial landscape, Forex trading has emerged as a lucrative venture, attracting traders worldwide. The United Kingdom, renowned for its well-established financial regulatory framework, provides an inviting environment for aspiring Forex traders looking to establish their businesses. This article serves as an in-depth guide, demystifying the intricacies of setting up a Forex trading company in the UK.

Image: www.forthline.com

Setting up a Forex trading company in the UK requires careful planning and execution. With its robust regulatory bodies and favorable business climate, the UK has become a preferred destination for companies engaged in Forex and other financial activities. This guide will delve into the essential considerations, legal requirements, and practical steps involved in establishing your Forex trading company in the UK, empowering you with the knowledge to navigate the process efficiently and effectively.

Legal Considerations: Choosing the Right Entity

The first step in setting up a Forex trading company in the UK involves selecting the appropriate legal structure for your business. The most common options include:

-

Sole proprietorship: This structure provides a simple and cost-effective way to establish a Forex trading business, with minimal regulatory requirements. However, it places unlimited personal liability on the business owner for all debts and obligations incurred by the business.

-

Limited liability partnership (LLP): An LLP offers more liability protection than a sole proprietorship while allowing flexibility in management and profit distribution. LLPs are subject to lower administrative burdens compared to limited companies.

-

Limited company: This is the most common legal structure for Forex trading companies in the UK, providing substantial liability protection to company directors and shareholders. Limited companies offer greater flexibility in raising capital and are more recognizable in the eyes of investors and regulators.

Regulatory Requirements: Navigating the Financial Conduct Authority

All Forex trading companies operating in the UK must obtain authorization from the Financial Conduct Authority (FCA), the regulatory body for the financial services industry in the UK. The FCA’s regulatory framework includes:

-

Registering as a financial services firm: Companies involved in Forex trading as a regulated activity must register with the FCA and obtain the appropriate permissions to conduct business.

-

Anti-money laundering (AML) and counter-terrorism financing (CTF): Forex trading companies must implement robust AML and CTF policies and procedures to prevent money laundering and terrorism financing.

-

Capital adequacy: Forex trading companies must maintain sufficient capital to cover their operational risks and potential losses. The FCA sets minimum capital requirements based on the size and nature of their trading activities.

Practical Steps: Establishing Your Company

Once you have chosen the appropriate legal structure and obtained regulatory approval, you need to take practical steps to establish your Forex trading company in the UK. These steps include:

-

Registering your company: This involves choosing a company name, registering with Companies House, and obtaining a unique company identification number.

-

Opening a business bank account: A business bank account is essential for handling financial transactions related to your Forex trading activities.

-

Hiring staff: If necessary, you will need to recruit and employ staff to support your Forex trading operations.

-

Obtaining professional services: Forex trading companies may need to engage professional services such as accounting, legal, and IT support to ensure smooth operations.

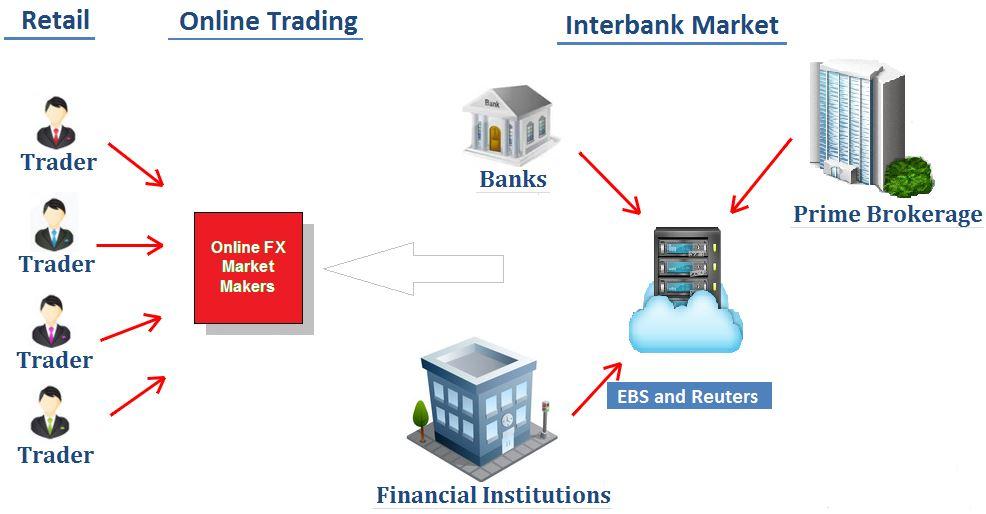

Image: forex-plans.blogspot.com

Business Considerations: Key Factors for Success

In addition to the legal and regulatory aspects, several business considerations are essential for setting up a successful Forex trading company in the UK:

-

Market research: Conduct thorough market research to understand the UK Forex trading landscape, identify potential opportunities, and assess your competitive advantage.

-

Business plan: Develop a comprehensive business plan that outlines your company’s objectives, strategies, and financial projections. A well-defined business plan is crucial for attracting investors and securing funding.

-

Trading platforms: Select reliable and robust Forex trading platforms that meet your trading requirements and provide access to a wide range of currency pairs.

-

Risk management: Implement robust risk management strategies to mitigate potential losses and protect your company’s capital.

-

Marketing and branding: Develop an effective marketing and branding strategy to promote your Forex trading company, attract clients, and establish a strong reputation.

Setting Company In Uk For Trading Forex

Conclusion

Setting up a Forex trading company in the UK can be a rewarding endeavor for those who have carefully considered the legal, regulatory, and practical aspects involved. By conducting thorough research, choosing the right legal structure, and complying with FCA regulations, you can lay a solid foundation for your Forex trading business in the UK. Remember to develop a comprehensive business plan, implement robust risk management strategies, and invest in marketing and branding to maximize your chances of success. As you embark on this venture, we wish you all the best in building a thriving and profitable Forex trading company in the UK.