Introduction

In today’s interconnected global landscape, cross-border transactions have become crucial for businesses and individuals alike. SBI, the leading financial institution in India, recognizes this need and has introduced an exclusive offer for forex transactions that empowers customers to explore the world with ease and convenience.

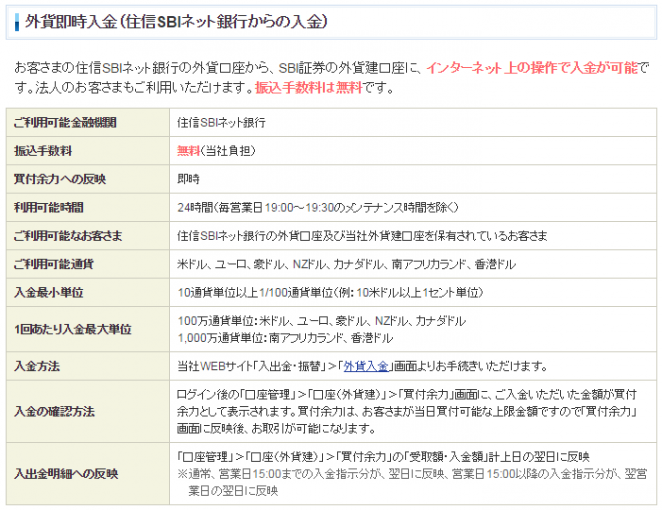

Image: www.hibineta.com

SBI’s forex transaction offer is designed to simplify the process of transferring funds overseas, addressing critical pain points such as high costs, complex procedures, and fluctuating exchange rates. With this offer, customers can now enjoy frictionless forex transactions, unlocking opportunities for global expansion, personal travel, and more.

Understanding SBI’s Forex Services

SBI offers a comprehensive suite of forex services tailored to meet the diverse needs of its customers. These services include:

- Foreign Currency Exchange: Convert various currencies at competitive rates for international payments, travel, investments, and more.

- Wire Transfers: Send funds to international bank accounts securely and efficiently with low transfer fees.

- Travel Cards: Load up multiple currencies onto a single prepaid card for convenient and secure spending abroad.

SBI’s forex services are backed by a robust global network of partner banks and financial institutions, ensuring swift and reliable transactions.

Benefits of SBI’s Forex Offer

SBI’s forex offer provides numerous benefits that make cross-border transactions seamless and cost-effective:

- Competitive Exchange Rates: SBI offers competitive exchange rates, helping customers save on conversion costs.

- Reduced Transfer Fees: Enjoy low transfer fees for both retail and corporate customers, minimizing transaction expenses.

- Online Convenience: Transact online with SBI’s user-friendly platform, conduct currency exchanges, and initiate wire transfers at your fingertips.

- Dedicated Forex Desk: Access personalized assistance from experienced forex professionals, ensuring smooth and timely transactions.

Whether you’re planning a business trip, studying abroad, or expanding your global horizons, SBI’s forex offer empowers you to navigate international financial transactions with confidence and ease.

Latest Trends in the Forex Market

The forex market is constantly evolving, driven by economic, political, and technological developments around the world. Here are some key trends shaping the industry:

- Rise of Digital Currency: The growth of cryptocurrencies and decentralized finance is transforming the traditional forex landscape, introducing new opportunities and challenges.

- Impact of Central Bank Policies: Monetary policy decisions by central banks significantly impact exchange rates and currency movements.

- Technological Advancements: AI, machine learning, and blockchain are revolutionizing the way forex transactions are processed and executed.

Staying updated on these trends is essential for individuals and businesses to adapt to the changing forex landscape and make informed decisions.

Image: www.goibibo.com

Expert Tips for Forex Transactions

To maximize the benefits of SBI’s forex offer, here are some expert tips to consider:

- Plan Your Transactions Carefully: Research exchange rates and market conditions to identify optimal times for making currency conversions.

- Understand Exchange Rate Structure: Familiarize yourself with the difference between spot rates and forward rates to make informed decisions.

- Consider Hedging Options: Protect your funds from currency fluctuations by using hedging strategies such as forward contracts or options.

By following these tips, you can navigate the forex market confidently, minimize transaction costs, and mitigate risks.

FAQs on SBI Forex Transactions

- Q: What documents are required to make a forex transaction with SBI?

A: Typically, you will need to provide your identity proof (passport or Aadhaar card), PAN card, and relevant supporting documents depending on the purpose of the transaction.

- Q: What is the maximum limit for forex transactions?

A: The maximum limit for forex transactions varies based on the purpose and regulations. Individuals may require RBI approval for certain high-value transactions.

- Q: Can I lock in an exchange rate with SBI?

A: Yes, SBI offers forward contracts that allow you to secure a future exchange rate for a specific transaction.

Sbi Offer For Forex Transaction

Conclusion

SBI’s forex offer provides a comprehensive solution for cross-border transactions, offering competitive rates, reduced fees, and convenient online banking. By taking advantage of this offer and following the expert tips provided, you can unlock global opportunities and make informed decisions in the forex market. Embark on your global journey with SBI today and experience the world with ease and confidence.

Are you ready to explore the benefits of SBI’s forex transaction offer? Visit their website or contact your nearest branch to learn more and start your financial journey towards global expansion.