Introduction

Navigating the world of foreign exchange transactions can be a baffling experience. If you plan to embark on this adventure, understanding the associated service charges is crucial. In this article, we’ll delve into the intricacies of SBI forex charges in 2015, empowering you with the knowledge to make informed decisions.

Image: www.sappscarpetcare.com

SBI (State Bank of India) is renowned as India’s largest public sector bank, catering to a vast customer base for international currency exchange needs. Recognizing the importance of transparency, SBI publishes its forex-related charges to keep customers well-informed. Comprehending these charges will enable you to budget effectively and avoid unexpected expenses.

Types of SBI Forex Charges

SBI levies specific charges for various forex-related services to cover administrative and operational costs. Here’s a breakdown:

1. Wire Transfer Charges:

- Within India: INR 250

- Outside India: INR 500

2. Demand Draft Charges:

- Within India: INR 100

- Outside India: INR 250

3. Traveler’s Cheque Issuance Charges:

- In India: INR 50 per cheque

- Outside India: INR 100 per cheque

4. Currency Exchange Commission:

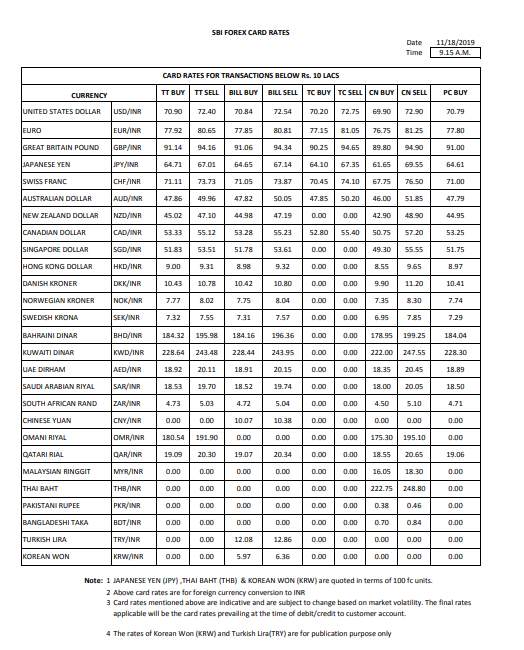

This varies depending on the currency and the amount being exchanged. SBI provides live currency rates on its website for reference.

Additional Charges to Consider

Apart from the standard charges listed above, there may be additional expenses to take into account:

- Correspondent Bank Charges: If the beneficiary bank is not a direct correspondent of SBI, additional charges may apply.

- Swift Charges: Sending payments via the SWIFT network may incur a fee.

- Beneficiary Bank Charges: The beneficiary bank may impose a charge for receiving the funds.

Tips for Minimizing Forex Charges

To save on forex-related expenses, consider these tips:

- Negotiate with SBI: For large transactions, you may be able to negotiate lower charges with your SBI branch.

- Utilize Online Platforms: SBI offers online forex services with competitive rates and lower transaction fees.

- Compare Rates: Research and compare exchange rates offered by different banks before finalizing a transaction.

Image: howtotradeonforex.github.io

FAQs on SBI Forex Charges

Here are some frequently asked questions and answers regarding SBI forex charges:

Q: Can I avoid currency exchange commission charges?

No, the currency exchange commission is a standard charge levied by SBI for converting one currency to another.

Q: Is it possible to get a refund on forex charges?

Typically, forex charges are non-refundable once the transaction is processed.

Sbi Forex Related Charges 2015

Conclusion

Understanding SBI forex charges empowers you to plan and execute your international currency exchange transactions efficiently. By carefully considering the charges involved, you can manage your expenses and optimize your overall experience. If you have any further questions or require additional information, we encourage you to engage with us through the comments section. Thank you for your attention!