Introduction:

Image: windsorwhock2002.blogspot.com

In today’s globalized and interconnected world, foreign exchange plays a crucial role in international travel, business transactions, and personal finance. Amidst the plethora of forex card providers, SBI and Axis Bank stand tall as reputable contenders, offering competitive cards for seamless cross-border financial operations. In this in-depth analysis, we’ll delve into the depths of these two titans, comparing and contrasting their offerings to equip you with the knowledge to make an informed decision when choosing your forex card.

The Contenders: A Brief Overview

State Bank of India (SBI) Forex Card:

SBI, India’s leading public sector bank, offers a comprehensive range of financial services, including the SBI Forex Card. Designed for travelers, shoppers, and business professionals, this card provides hassle-free access to foreign currencies in over 200 countries and territories worldwide.

Axis Bank Forex Card:

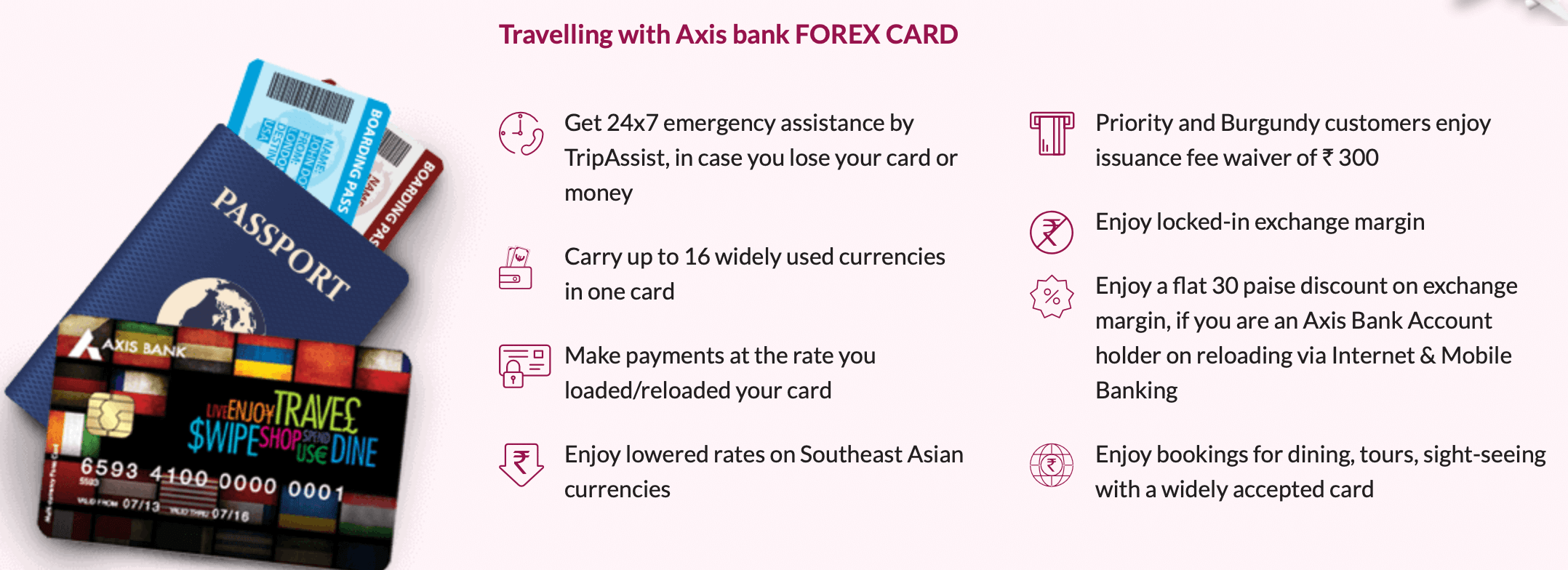

Axis Bank, one of India’s largest private sector banks, joins the fray with its Axis Forex Card. Like SBI’s offering, it empowers travelers and businesspersons with the ability to handle their foreign exchange needs effortlessly across 40+ million merchant outlets and ATMs globally.

Deep Dive: Dissecting the Features and Functions

1. Currency Coverage and Conversion Rates:

- SBI Forex Card: Supports over 20 foreign currencies and offers competitive conversion rates, updated in real-time.

- Axis Forex Card: Expands its coverage to 10 international currencies, ensuring flexibility in global transactions. Conversion rates are competitive and transparent.

2. Card Types and Fees:

- SBI Forex Card: Offers both physical and virtual cards. Physical cards carry a one-time issuance fee.

- Axis Forex Card: Provides physical cards with a pre-defined limit. Issuance fee varies depending on the card variant.

3. Convenience and Accessibility:

- SBI Forex Card: Easily accessible through SBI’s vast network of branches and online banking platform.

- Axis Forex Card: Available at designated Axis Bank branches and authorized forex dealers.

4. Security Measures:

- SBI Forex Card: Features advanced security features like chip-and-PIN protection and EMV compliance.

- Axis Forex Card: Embraces multi-layered security measures, including SMS alerts, ATM withdrawal limits, and zero liability protection.

5. Additional Features:

- SBI Forex Card: Exclusive tie-ups with global merchants, offering discounts and promotions.

- Axis Forex Card: Complimentary travel insurance and personalized customer service.

Expert Insights: Navigating the Forex Maze

- Financial Expert, Ms. Rohini Gandhi: “Choosing the right forex card is essential to avoid hidden fees and unfavorable exchange rates. Compare card offerings and read reviews before selecting one.”

- Travel Enthusiast, Mr. Amit Malhotra: “Look for cards that offer competitive conversion rates and convenience in accessing local currencies at your destination.”

Conclusion:

Navigating the complex world of foreign exchange cards can be daunting, but this comprehensive analysis of SBI Forex Card vs. Axis Forex Card unravels the intricacies of these offerings. Whether you’re embarking on a business trip, planning an adventure abroad, or simply managing your finances globally, understanding the features and nuances of these cards is paramount. Armed with this knowledge, you can make an informed choice that suits your specific needs, ensuring your cross-border financial transactions are seamless, secure, and cost-effective.

Image: bankkaro.com

Sbi Forex Card Vs Axis Forex Card