Introduction

The foreign exchange (forex) market, a quintessential component of the global financial ecosystem, serves as a vital platform for facilitating international trade and investment. The Indian forex market, a microcosm of this global phenomenon, has witnessed substantial growth and development in recent years, spurred by India’s burgeoning economy and increasing globalization. Banks, the lifeblood of this dynamic market, play a pivotal role in its seamless functioning and overall efficiency. This article delves into the multifaceted role of banks in the Indian forex market, shedding light on their indispensable contributions.

Image: www.youtube.com

The Pivotal Role of Banks in Currency Exchange

At the heart of the forex market lies currency exchange, an indispensable process that enables businesses and individuals to conduct international transactions. Banks serve as facilitators of currency exchange, providing a reliable and secure platform for converting one currency into another. Their extensive network of branches and partnerships with foreign banks ensures efficient and timely currency conversions, ensuring that international trade and investment can proceed smoothly.

Providing Derivatives for Hedging

Fluctuations in foreign exchange rates can pose significant risks for businesses and investors alike. To mitigate these risks, banks offer a range of derivatives, such as forwards, futures, and options, which allow market participants to hedge against exchange rate volatility. These instruments provide flexibility and enable businesses and investors to lock in exchange rates, thereby protecting their financial positions.

Extending Credit to Importers and Exporters

International trade often requires importers and exporters to extend credit to their counterparts. Banks play a crucial role in this process by providing trade financing, which enables buyers and sellers to bridge the gap between the time of shipment and the receipt of payment. This financial support ensures the smooth flow of goods and services across borders, fostering economic growth.

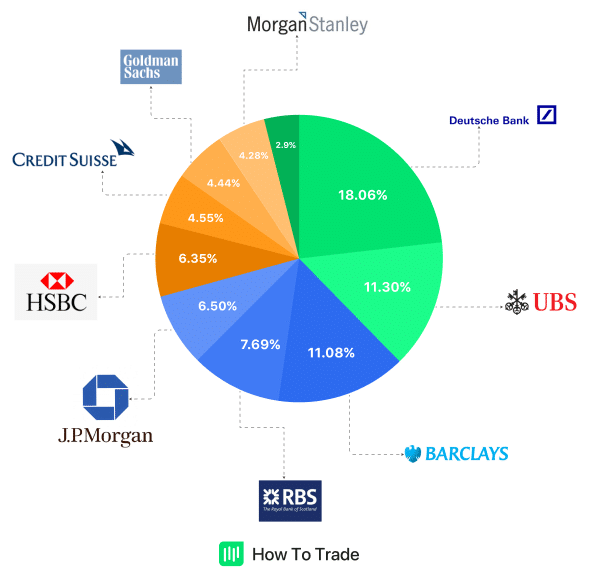

Image: howtotrade.com

Facilitation of Cross-Border Investments

Globalization has fueled cross-border investments, leading to increased demand for foreign exchange transactions. Banks act as intermediaries in these transactions, facilitating the inflow and outflow of capital. They provide advisory services, execute foreign exchange orders, and ensure compliance with regulatory requirements, enabling seamless cross-border investments.

Role in International Remittances

Banks play a vital role in international remittances, enabling individuals and businesses to transfer funds across borders. Their vast network of branches and partnerships with banks worldwide ensures efficient and reliable remittance services, facilitating cross-border payments for various purposes, such as family support, educational expenses, and business transactions.

Evolution of Banks’ Role in the Indian Forex Market

The Indian forex market has undergone significant transformations over the years, and banks have continuously adapted to meet the evolving needs of the market. Technology has played a pivotal role in this evolution, with the introduction of electronic trading platforms, real-time market information, and automated risk management systems. These advancements have enhanced the efficiency, transparency, and accessibility of the forex market, while also creating opportunities for banks to offer innovative financial solutions.

Role Of Banks In Indian Forex Market

Conclusion

Banks remain the cornerstone of the Indian forex market, playing a multifaceted role that encompasses currency exchange, hedging, trade financing, cross-border investments, and international remittances. Their extensive network, financial expertise, and technological capabilities enable them to facilitate efficient and secure foreign exchange transactions, fostering international trade, investment, and economic growth. As the market continues to evolve, banks will undoubtedly continue to adapt and innovate, ensuring the seamless functioning of the Indian forex market.