Introduction

Choosing the right ECN forex broker in Australia is crucial for maximizing your trading performance and minimizing risks. An ECN (Electronic Communication Network) broker connects traders directly to liquidity providers, offering unprecedented transparency, low spreads, and fast execution. However, navigating the numerous options available can be daunting. This comprehensive guide will equip you with the knowledge and insights to identify and select the best ECN forex broker for your trading needs.

Understanding ECN Forex Brokers

An ECN forex broker operates as an intermediary between traders and liquidity providers, such as banks and institutional investors. By bypassing traditional market makers, ECN brokers provide direct access to the interbank market, where the most competitive prices are found. This results in tighter spreads and faster order execution, allowing traders to take advantage of market opportunities swiftly and cost-efficiently.

Image: fxeareview.com

Benefits of Using an ECN Forex Broker

- Tighter Spreads: ECN brokers typically offer raw spreads that represent the difference between bid and ask prices in the interbank market. These spreads are usually lower than what retail forex brokers quote, reducing your trading costs.

- Fast Execution: Direct access to liquidity providers ensures lightning-fast order execution. ECN brokers use advanced algorithms to match buy and sell orders instantly, ensuring your trades are executed at the best available prices.

- Transparency: ECN brokers display live order book data, providing traders with real-time insights into market depth and liquidity. This transparency allows you to make informed trading decisions.

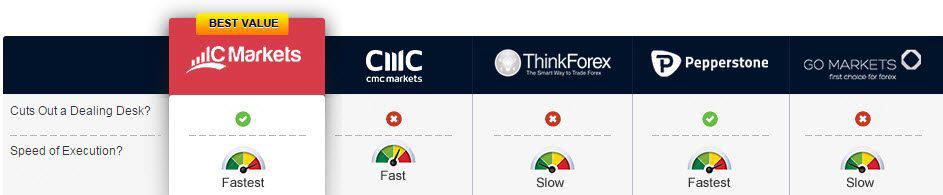

- No Dealing Desk Intervention: Unlike market makers, ECN brokers do not have a dealing desk with the potential to manipulate prices or interfere with trade execution. This ensures a neutral trading environment and eliminates conflicts of interest.

Key Considerations When Choosing an ECN Forex Broker

- Regulation: Ensure the broker is regulated by a reputable financial authority in Australia, such as the Australian Securities and Investments Commission (ASIC). This ensures the broker adheres to strict financial and compliance standards.

- Trading Platform: Choose a broker that offers a reliable and feature-rich trading platform. Look for platforms with advanced charting tools, technical indicators, and order management capabilities.

- Spreads and Commissions: Compare spreads and commissions charged by different brokers. While raw spreads are typically lower for ECN brokers, some may charge additional commissions or fees.

- Customer Support: Excellent customer support is essential in case of any inquiries, technical issues, or trading challenges. Look for brokers with responsive and knowledgeable support teams available 24/5 or 24/7.

- Account Types and Funding Options: Ensure the broker offers account types that suit your trading style and capital. Also, consider the availability of multiple funding options, such as bank transfers, credit cards, and e-wallets.

Top-Rated ECN Forex Brokers in Australia

- IC Markets: ASIC-regulated broker offering ultra-low spreads, lightning-fast execution, and an intuitive trading platform.

- Pepperstone: Another trusted ASIC-regulated broker with competitive spreads, advanced trading tools, and a user-friendly mobile app.

- FP Markets: An award-winning broker known for its exceptional ECN execution and comprehensive educational resources.

- Go Markets: ASIC-regulated broker with a wide range of account types, including ECN and Raw ECN accounts with variable spreads.

- FXTM: Globally recognized broker with a strong reputation and ECN account options offering narrow spreads and fast order processing.

Image: www.compareforexbrokers.com

Review Best Ecn Forex Broker Australia

Conclusion

Choosing the best ECN forex broker in Australia is a critical step in maximizing your trading success. By carefully considering the factors discussed in this guide and researching top-rated brokers, you can select a provider that meets your trading requirements and provides you with a competitive edge in the forex market. Remember, ECN brokers offer significant advantages, such as tighter spreads, fast execution, transparency, and no dealing desk intervention, but selecting the right one is crucial to optimize your trading experience.