In the dynamic realm of financial markets, where fortunes can be made and lost in a matter of moments, mastering the art of research methodology is paramount to achieving sustained success in Forex trading. Forex, the world’s largest and most liquid financial market, presents an unparalleled opportunity for traders to capitalize on global economic trends. However, navigating its complexities requires a sound understanding of the research methods that underpin profitable trading strategies.

Image: www.forexpeacearmy.com

Unraveling the Essentials of Forex Research

At the heart of successful Forex trading lies a rigorous research methodology that empowers traders to make informed decisions based on reliable market analysis. This involves meticulously gathering and interpreting data from multiple sources, ranging from economic indicators to geopolitical events. By delving into technical analysis, fundamental analysis, and sentiment analysis, traders can gain a comprehensive understanding of the factors driving market movements.

Technical Analysis: A Numbers Game

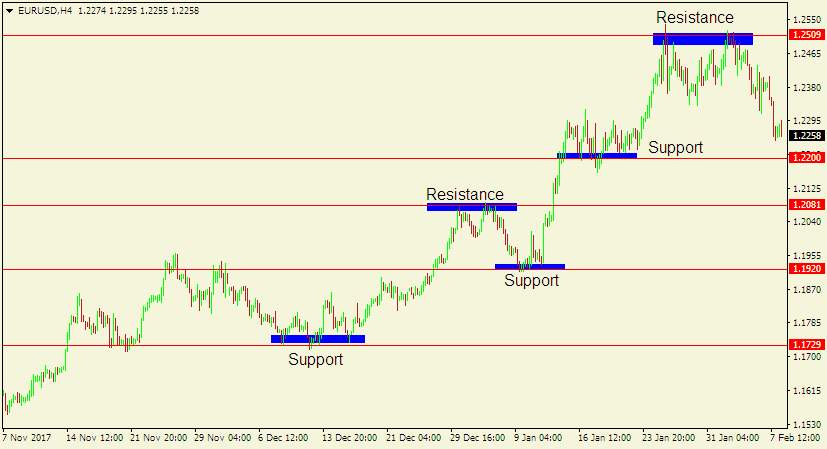

Technical analysis involves studying historical price data to identify patterns, trends, and support and resistance levels. By analyzing charts and utilizing technical indicators, traders can discern potential entry and exit points, aiming to maximize profits and minimize losses. Moving averages, Fibonacci retracements, and candlestick patterns are just a few of the many tools employed in technical analysis to illuminate market behavior.

Fundamental Analysis: Understanding the Bigger Picture

Fundamental analysis, on the other hand, focuses on macroeconomic factors that influence currency values. This includes examining economic data such as GDP, inflation, and interest rates, as well as political events, natural disasters, and central bank policies. By assessing the underlying health of an economy, traders can better gauge the direction of its currency and make informed trading decisions.

Image: www.tradersdna.com

Sentiment Analysis: Gauging Market Perception

Sentiment analysis plays a crucial role in understanding the collective emotions and expectations of market participants. By analyzing social media sentiment, news articles, and other forms of public discourse, traders can gauge the overall mood of the market and identify potential shifts in market sentiment. This information can provide valuable insights into the direction of upcoming price movements.

Harnessing the Power of Expertise

Once traders have mastered these fundamental research methods, delving into the insights of industry experts can further enhance their trading strategies. Seasoned traders, analysts, and economists provide invaluable perspectives on market trends, potential opportunities, and risk management techniques. By studying their insights and incorporating them into their research process, traders can gain a competitive edge in the volatile world of Forex trading.

The Art of Risk Management: Minimizing Losses and Preserving Capital

In Forex trading, as in any financial endeavor, risk management is paramount. A comprehensive research methodology should include robust strategies for identifying, assessing, and managing risks. This involves establishing clear risk tolerance levels, utilizing stop-loss orders to limit potential losses, and diversifying trading strategies to mitigate overall risk exposure.

Research Methodology For Forex Trading

Embracing the Journey of Knowledge and Empowerment

Mastering the intricacies of Forex research methodology is an ongoing journey of knowledge acquisition and practical application. By continuously honing their research skills, traders can build a solid foundation for successful trading. Embrace the learning process, stay abreast of the latest market developments, and refine your research techniques to maximize your potential in the Forex market.

Call to Action:

Unlock the full potential of your Forex trading endeavors by delving into the comprehensive research methodologies outlined in this article. Equip yourself with the knowledge and insights necessary to navigate the complexities of the market, make informed decisions, and achieve your financial goals. Start your journey today!