In today’s dynamic globalized economy, organizations’ financial well-being hinges significantly on their ability to manage treasury and forex operations effectively. Treasury management involves overseeing an organization’s financial resources, including cash flow, investments, and debt, while forex management focuses on managing currency exposures and risks. Mastering these disciplines empowers businesses to optimize financial performance, navigate market volatility, and unlock long-term growth.

Image: www.pinterest.com

Embracing the Cornerstone of Financial Stability

Treasury management serves as the foundation for financial stability and soundness within an organization. By centralizing control over financial resources and cash flow, treasury professionals ensure efficient utilization of funds. They forecast future cash needs, manage liquidity, and explore investment opportunities to maximize returns while minimizing risks. Effective treasury management also involves managing debt effectively, ensuring that an organization’s borrowing aligns with its strategic objectives and minimizes interest expenses.

Navigating the Labyrinth of Foreign Exchange

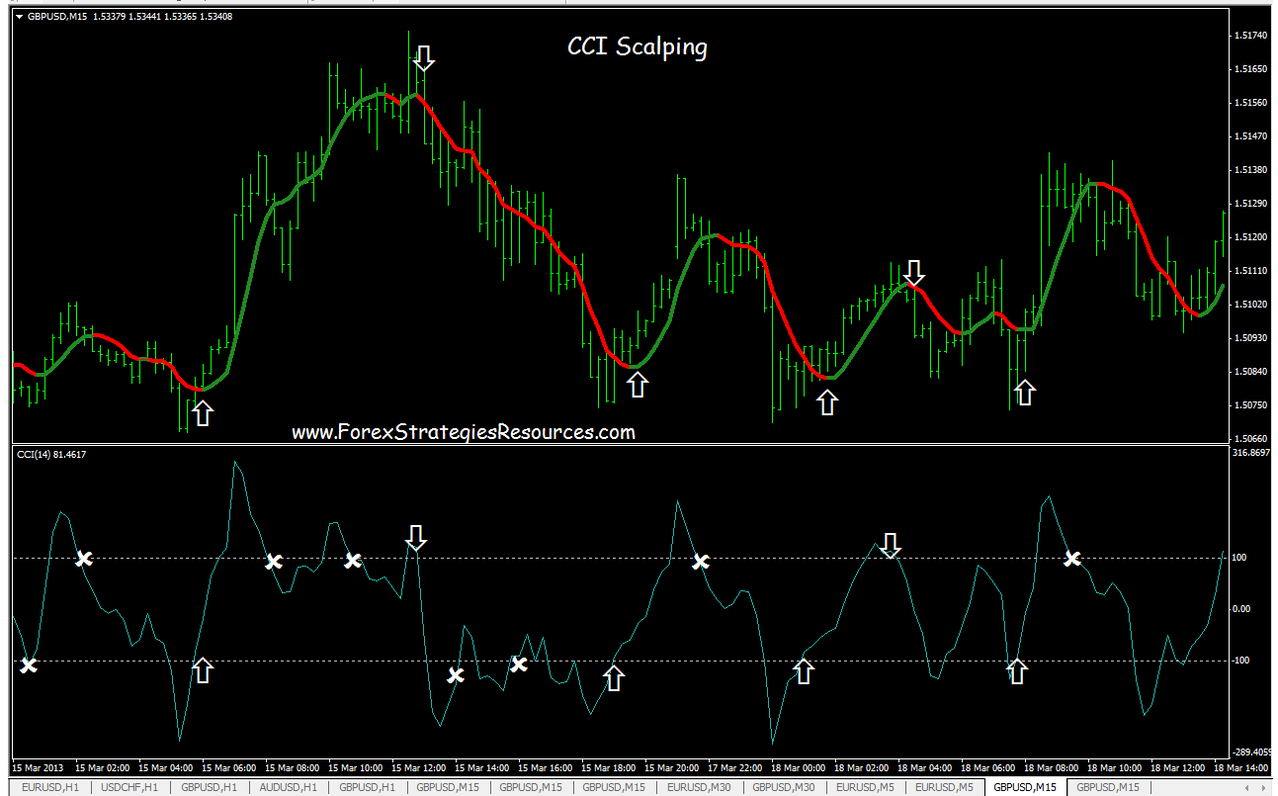

In the interconnected global marketplace, organizations often engage in business transactions involving multiple currencies. Managing these exposures is crucial to safeguard financial performance against currency fluctuations. Forex management involves mitigating risks associated with foreign exchange rate movements, such as exchange rate volatility and transaction costs. Skilled forex managers utilize hedging strategies, forward contracts, and other instruments to minimize the impact of currency fluctuations on profitability and cash flow.

Real-World Applications: A Tapestry of Success

The principles of treasury and forex management translate into tangible benefits for businesses across industries. For instance, a manufacturing company with global operations can leverage treasury management to optimize cash flow across multiple subsidiaries, reducing interest expenses and maximizing returns. A retail chain importing goods from overseas can effectively utilize forex management strategies to mitigate exchange rate risks, ensuring stable margins and predictable financial outcomes.

Image: www.forexstrategiesresources.com

Embracing Innovation and the Future of Treasury and Forex Management

The advent of technology is transforming the treasury and forex management landscape, introducing innovative tools and platforms. FinTech solutions facilitate automated cash flow management, real-time reporting, and sophisticated risk management techniques. Businesses can now harness artificial intelligence (AI) to analyze market trends, predict currency movements, and make informed decisions. Embracing these advancements empowers organizations to streamline operations, reduce costs, and respond swiftly to changing market conditions.

Reasury And Forex Management Meaning

https://youtube.com/watch?v=EH5RMs38mAQ

Conclusion: Empowering Financial Excellence

In the ever-evolving global economy, mastering treasury and forex management is no longer a choice but a necessity for organizations that aspire to succeed. These disciplines provide the foundation for financial stability, risk mitigation, and value creation. By embracing the principles and leveraging transformative technologies, businesses can unlock their full potential and achieve sustained growth in the face of market uncertainties and global challenges.