Introduction:

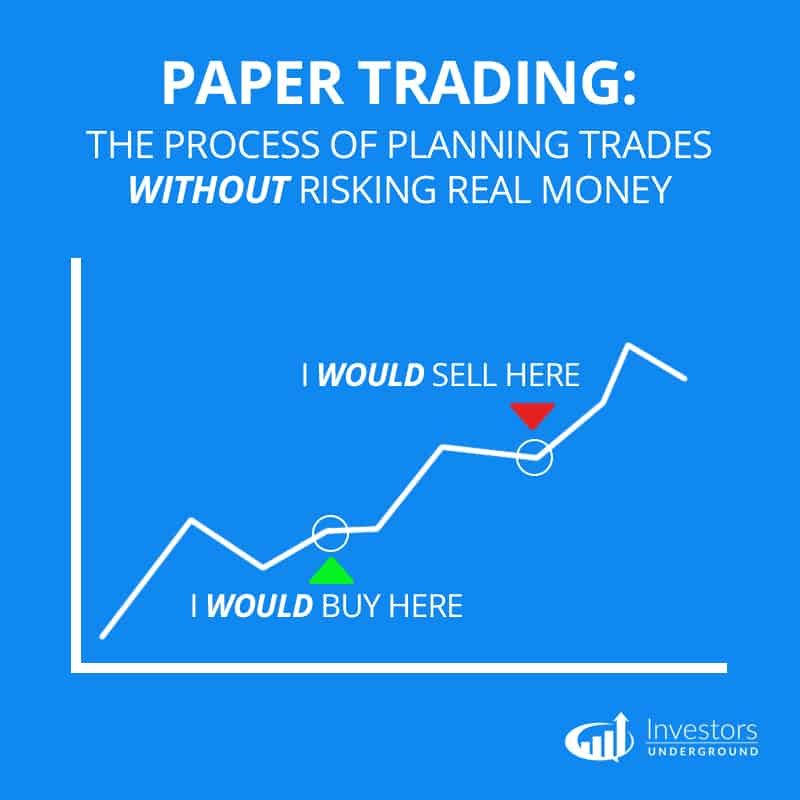

The foreign exchange market, or forex, is the world’s largest and most traded financial market, offering lucrative opportunities for traders around the globe. However, for beginners and even experienced traders, navigating the forex market can be daunting. Enter paper trading—a risk-free simulation environment where traders can test their strategies and gain market experience without putting real capital on the line.

Image: www.investorsunderground.com

In this comprehensive guide, we will explore the ins and outs of paper trading in forex in India, providing you with the knowledge and tips you need to get started and maximize your potential.

What is Paper Trading in Forex?

Paper trading involves practicing trading using virtual currency on a simulated trading platform that mimics the real-world forex market. These platforms allow traders to create demo accounts with virtual funds to trade various currency pairs without risking any real money.

Why Paper Trading is Essential for Forex Traders

Paper trading offers numerous benefits for both novice and seasoned traders:

- Zero Risk: Traders can experiment with different strategies, market conditions, and trading tools without endangering real funds.

- Learning Platform: It provides a safe environment to learn about the forex market, technical analysis, and trading methodologies.

- Strategy Testing: Traders can refine their strategies before deploying them in the live market, minimizing potential losses.

- Emotional Management Practice: Paper trading allows traders to manage their emotions and develop a disciplined approach.

Choosing a Paper Trading Platform

Selecting the right paper trading platform is crucial. Consider the following factors:

- Real-Time Data Feeds: The platform should provide access to live market data for realistic simulations.

- Extensive Market Instruments: Look for platforms that offer a range of currency pairs and financial instruments.

- Customizable Interface: A user-friendly interface with customizable charts, news feeds, and technical indicators is essential.

Technical and Fundamental Analysis Tools: These tools empower traders to analyze market trends and make informed trading decisions.

Image: corporatefinanceinstitute.com

Tips and Expert Advice for Paper Trading

Follow these tips to maximize your paper trading experience:

- Set Realistic Goals: Paper trading should mimic live trading as much as possible. Avoid setting unrealistic profit targets that can lead to overconfidence and poor decision-making.

- Keep a Trading Journal: Track your trades, strategies, and emotions to identify areas for improvement.

- Analyze Your Performance: Regularly review your trading results to evaluate your strengths and weaknesses.

- Connect with the Community: Engage with online forums and social media groups to connect with experienced traders, discuss strategies, and learn from others.

- Transition to Live Trading Gradually: Once you have gained confidence and achieved consistent results in paper trading, consider gradually transitioning to live trading with small amounts of capital.

FAQs on Paper Trading in Forex

Q: Is paper trading in forex legal in India?

A: Yes, paper trading forex is legal in India as it does not involve the exchange of real currency.

Q: Can I make money paper trading forex?

A: While you cannot make real money through paper trading, it allows you to develop skills and strategies that can potentially lead to success in live trading.

Q: How long should I paper trade before going live?

A: The recommended duration varies, but most experts suggest at least three to six months of consistent paper trading to gain sufficient experience and confidence.

Paper Trading In Forex In India

Conclusion

Paper trading in forex provides an invaluable opportunity for Indian traders to gain market knowledge, refine trading strategies, and manage risk effectively. By embracing the tips and insights presented in this guide, you can maximize your paper trading experience and pave the way for potential success in the live forex market.

Are you ready to embark on the paper trading journey and explore the alluring world of forex?