Ascending to Forex Trading Success: Embracing the Order Level Indicator

In the fast-paced world of forex trading, success hinges on precision, timing, and the ability to anticipate market movements. The order level indicator emerges as an indispensable tool, empowering traders with a comprehensive view of supply and demand dynamics. This transformative indicator unveils crucial insights into the market’s underlying forces, allowing traders to make informed decisions that maximize profit potential. Its intuitive nature and versatility make it an essential companion for both seasoned traders and those embarking on their forex journey.

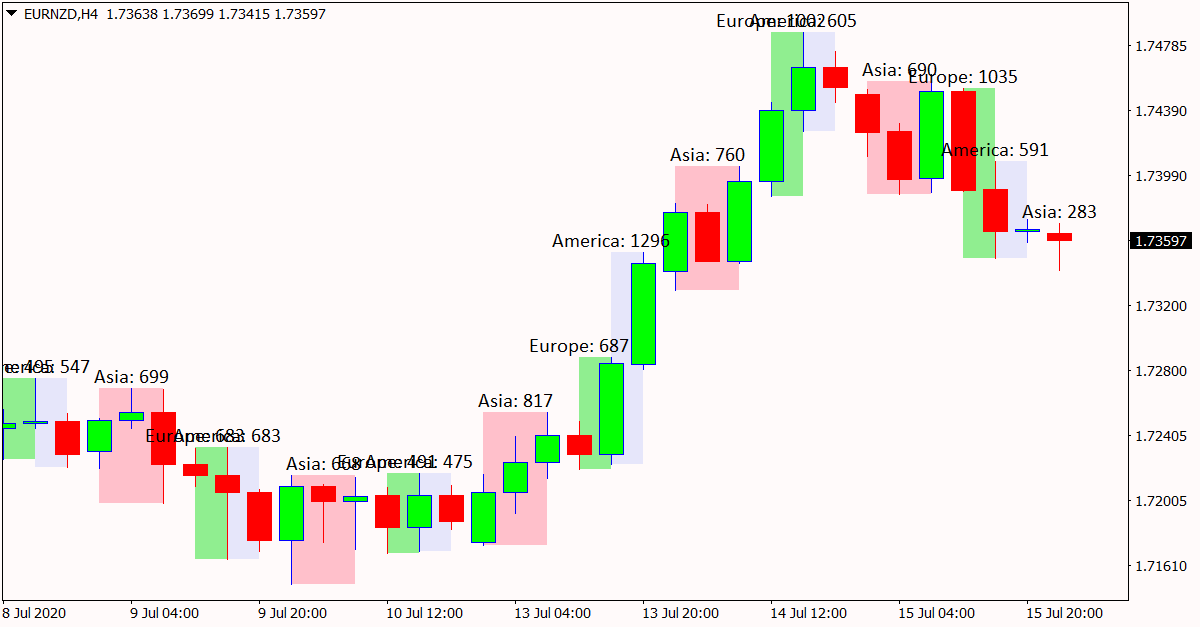

Image: steprety.weebly.com

Understanding the Order Level Indicator: A Comprehensive Guide

The order level indicator is a technical analysis tool that plots horizontal lines on a price chart to reflect areas of significant support and resistance. These levels represent price points where a large number of buy or sell orders have been placed, creating a temporary imbalance between supply and demand.

Support Levels: These levels mark price points where demand exceeds supply, indicating a potential buying opportunity. When the price falls to a support level, it encounters strong buying pressure, which tends to halt its decline and push it back upwards.

Resistance Levels: Conversely, resistance levels represent price points where supply outstrips demand, indicating a potential selling opportunity. When the price rises to a resistance level, it meets significant selling pressure, which can cause it to reverse and move downwards.

Applications of the Order Level Indicator: Harnessing Its Power

The order level indicator serves as a versatile tool, offering a wide range of applications that can enhance trading strategies:

Identifying Trading Opportunities: By identifying areas of significant support and resistance, traders can pinpoint potential entry and exit points for trades. Support levels can indicate potential buying opportunities, while resistance levels may signal potential selling opportunities.

Confirming Market Trends: The order level indicator can validate established market trends. If the price consistently breaks above resistance levels or below support levels, it suggests a strong trend in that direction.

Managing Risk: The indicator aids in risk management by identifying potential stop-loss and take-profit levels. Placing stop-loss orders below support levels and take-profit orders above resistance levels can help limit potential losses and maximize profits.

Enhancing Other Indicators: The order level indicator seamlessly complements other technical analysis tools, such as moving averages and oscillators. By combining these indicators, traders can gain a more comprehensive understanding of market conditions.

Embracing Expert Insights: Tapping into Wisdom

Seasoned forex traders highly regard the order level indicator for its simplicity and effectiveness. Here are some valuable insights from experts in the field:

John Bollinger, Creator of the Bollinger Bands: “The order level indicator is a powerful tool that can help identify support and resistance levels, which are crucial for trading success.”

Steve Nison, Renowned Technical Analyst: “The order level indicator provides valuable information about the balance of power between buyers and sellers. When it’s combined with other indicators, it can offer a powerful edge in trading.”

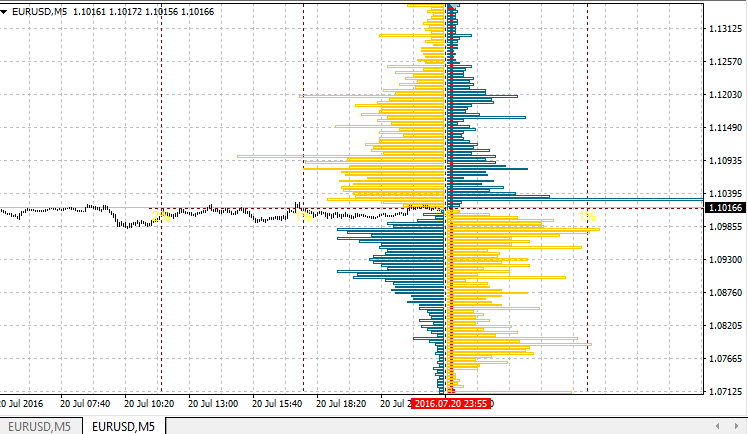

Image: www.forexmt4indicators.com

Practical Tips for Utilizing the Order Level Indicator: Maximizing its Potential

To harness the full potential of the order level indicator, consider these tactics:

Focus on High-Volume Areas: Concentrate on areas where significant trading volume accompanies support and resistance levels. These areas represent strong supply and demand imbalances, increasing the likelihood of price reversals.

Combine with Price Action: Marry the order level indicator with price action to enhance its effectiveness. Look for candlesticks that respect support and resistance levels, as they often offer valuable insights into potential market moves.

Avoid False Signals: Recognize that not all support and resistance levels will hold. Practice patience and wait for confirmation from other indicators before executing trades.

Set Realistic Expectations: The order level indicator is not a crystal ball. It provides valuable information, but it should not be used as the sole basis for trading decisions.

Order Lebel In Chart Indicator Forex

Conclusion: Empowering Traders with the Order Level Indicator

The order level indicator stands as a cornerstone of the trading toolkit, offering forex traders a profound understanding of market dynamics. Its versatility, simplicity, and ability to identify potential trading opportunities make it a must-have tool for both novice and seasoned traders alike. By embracing the insights and practical tips outlined in this article, traders can elevate their forex trading strategies, enhance their decision-making, and ultimately achieve their financial aspirations. As the market continues to evolve, the order level indicator will remain a constant companion, empowering traders to navigate the intricacies of forex trading and reap the rewards it offers.