Introduction

Have you ever wondered why certain companies choose not to disclose their foreign exchange (forex) gains or losses in their financial statements? While this practice is relatively common, it can often lead to confusion and misunderstandings among investors and analysts. In this article, we will explore the reasons behind non-disclosure of forex gain/loss, its implications, and the potential consequences for companies and investors.

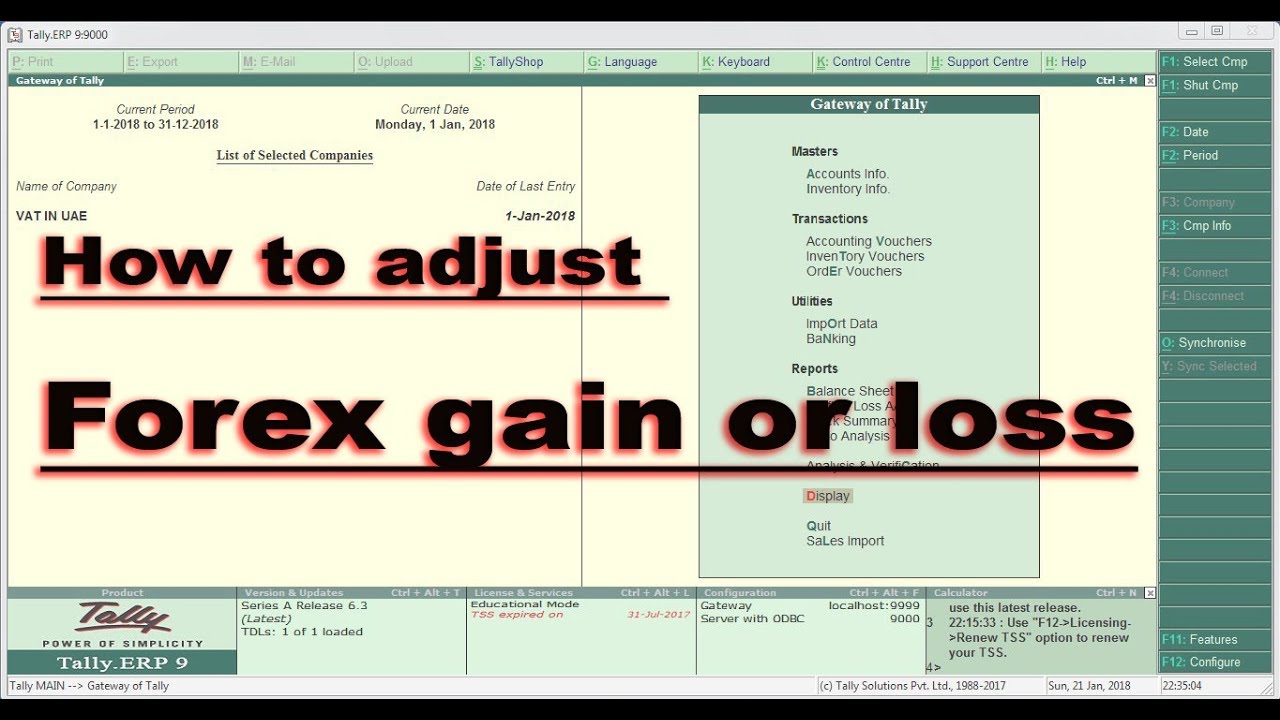

Image: forexfibonacciscalperstrategy.blogspot.com

Why Companies Conceal Forex Gain/Loss?

There are several reasons why companies may opt not to disclose forex gain/loss in their financial books. Some of these reasons include:

- Materiality: Forex gains or losses are considered immaterial if they do not have a significant impact on the company’s overall financial performance. In such cases, companies may choose not to disclose this information to avoid cluttering their financial statements with insignificant details.

- Strategic Considerations: Companies may decide not to disclose forex gain/loss to maintain a competitive advantage. By keeping this information confidential, they can prevent competitors from gaining insights into their foreign exchange exposure and strategies.

- Financial Instability: Companies with volatile forex exposures may choose to conceal this information to avoid triggering market panic or investor concern. This can be especially important for companies that operate in multiple currencies and are subject to significant exchange rate fluctuations.

Implications of Forex Gain/Loss

The non-disclosure of forex gain/loss can have several implications for companies and investors alike:

Company Perspective:

-

Financial Statement Transparency: The absence of forex gain/loss information in financial statements can reduce the transparency of a company’s financial performance, making it harder for investors to assess its true profitability.

-

Risk Management: Non-disclosure can make it difficult for companies to manage their foreign exchange risk effectively, as they may not have a complete understanding of their forex exposure.

Investor Perspective:

-

Investment Decisions: Lack of forex gain/loss information can hinder investors’ ability to make informed investment decisions. Without this information, it becomes harder to assess the impact of exchange rate fluctuations on a company’s earnings and cash flows.

-

Share Price Volatility: Non-disclosure of forex gain/loss can contribute to share price volatility, as investors may react negatively to unexpected or undisclosed foreign currency effects.

Consequences of Forex Gain/Loss Misrepresentation

In some cases, companies may deliberately misrepresent their forex gain/loss information to mislead investors and boost their financial performance. Such misrepresentations can have serious consequences, including:

-

Securities Fraud: Misrepresentation of forex gain/loss can constitute securities fraud, which is a violation of securities laws. This can lead to legal liabilities and fines for the company and its management.

-

Loss of Investor Confidence: Misrepresenting forex gain/loss information can destroy investor trust in a company and its management.

Image: plunhinmeaisub.hatenablog.com

Non Disclosure Of Forex Gain Loss In Books

Conclusion

The non-disclosure of forex gain/loss in financial books is a complex issue that affects both companies and investors. While companies may have legitimate reasons for concealing this information, it is important to consider the potential implications and consequences of such practices. Investors are advised to exercise caution when dealing with companies that do not fully disclose their forex exposures and seek out alternative sources of information to make informed investment decisions.