Gone are the days of carrying multiple currencies and worrying about exchange rates. Enter the Axis Forex Card, your hassle-free solution for managing your finances abroad. Designed to meet the dynamic needs of today’s travelers and businesses, the Axis Forex Card empowers you with the convenience and flexibility you seek.

Image: 25penny.com

Unlock a World of Currency Options

Image: www.chegg.com

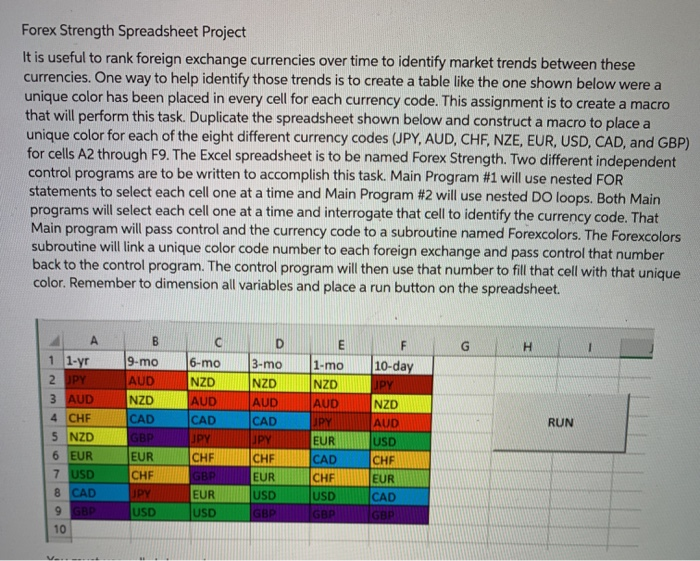

Multicurrency Forex Card Axis Form

Multi-Currency Magic

Load up to 16 currencies simultaneously on your Axis Forex Card, eliminating the need for currency exchange hassle. From Euros to Yen, Pounds to Dollars, carry your currencies of choice at your fingertips and switch between them effortlessly with just a tap or swipe.

Real-Time Exchange Rates

The Axis Forex Card provides real-time exchange rates, ensuring you get the best possible deal on every transaction. No more hidden fees or unfavorable rates – you can trust the transparent pricing to save you both time and money.

Hassle-Free Transactions

Use your Axis Forex Card to make payments worldwide, whether it’s at retail stores, restaurants, or online purchases. Enjoy the convenience of contactless payments, ATM withdrawals, and zero markup fees, making your international transactions a breeze.

Peace of Mind and Security

Travel with the peace of mind that your funds are secure with the Axis Forex Card. With EMV chip technology and 24/7 fraud monitoring, you can protect your money from unauthorized access. Additionally, the card is PIN-protected, ensuring only you can authorize transactions.

Benefits that Matter

Convenience: Manage multiple currencies on a single card, eliminating the need for cash or multiple cards.

Savings: Get real-time exchange rates and avoid hidden fees, saving money on international transactions.

Flexibility: Switch between currencies with ease, allowing you to adapt to changing exchange rates and market conditions.

Security: Trust the EMV chip technology and 24/7 fraud monitoring for enhanced protection against unauthorized access.

**Expert Tips for Using Your Axis Forex Card**

Tip 1: Load the Right Currencies: Research the currencies you’ll need based on your travel itinerary. Consider loading more of the primary currency to avoid running out.

Tip 2: Monitor Exchange Rates: Keep an eye on exchange rates and load currencies when they’re favorable. Use online tools or mobile apps to track rate fluctuations.

**FAQ**

Q: How do I apply for an Axis Forex Card?

A: You can apply online through Axis Bank’s website or visit a branch to complete the application process.

Q: What documents are required for application?

A: Identity proof such as a PAN card, passport, or Aadhaar card is required.

Q: Are there any limits on the amount I can load or spend?

A: Yes, there are maximum limits set by Axis Bank for both loading and spending.

Conclusion

Embrace the smart and convenient way of managing your international finances with the Axis Forex Card. Whether you’re a frequent traveler, an e-commerce enthusiast, or an entrepreneur, the Axis Forex Card provides the freedom and peace of mind you deserve. Simplify your international currency transactions and let the world of endless possibilities unfold.

Ready to unlock a world of currency convenience? Apply for your Axis Forex Card today and experience the difference.