Introduction

In today’s hyper-connected global marketplace, start-ups in Singapore face the challenge of managing multiple currencies in their international operations. The complexities of foreign exchange rates and the costs associated with traditional banking methods can eat into their bottom line, hindering their growth. Fortunately, there’s a solution that empowers start-ups to simplify their international financial operations: the multi-currency forex card.

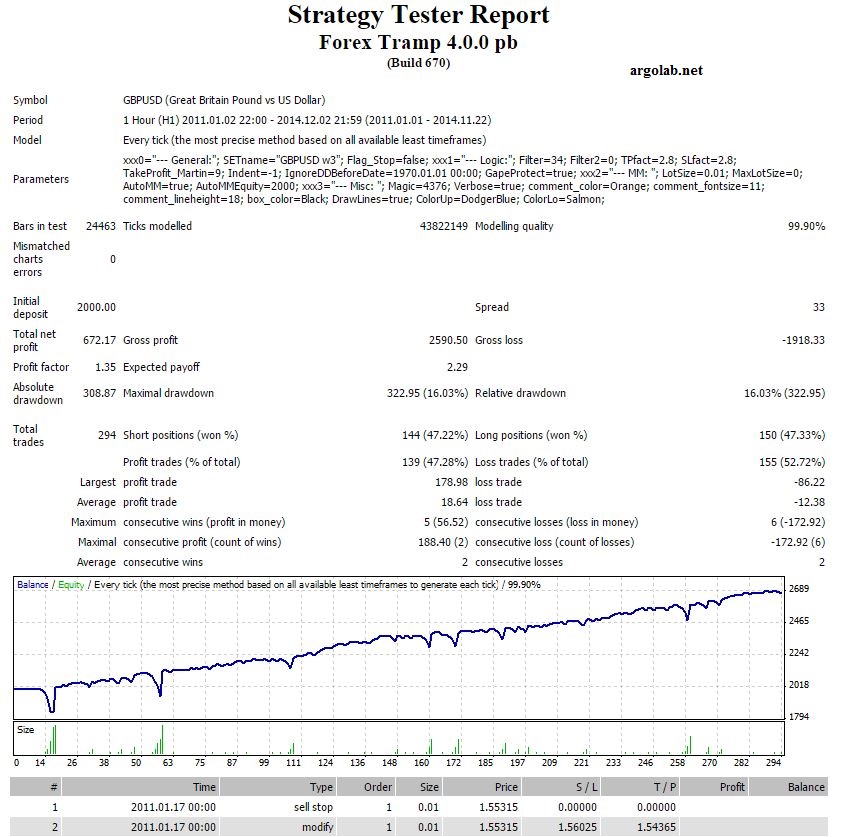

Image: www.fxcracked.com

A multi-currency forex card, or a multi-currency card, offers a convenient and cost-effective way to manage multiple currencies. Let’s delve deeper into its features and how it can revolutionize financial management for Singapore start-ups.

Benefits of Multi-Currency Forex Card for Singapore Start-ups

1. Reduced Currency Conversion Fees: With a multi-currency forex card, you can hold balances in multiple currencies, eliminating the need for frequent currency conversions. This reduces the fees and potential losses associated with traditional currency exchange methods.

2. Transparent and Real-Time Exchange Rates: Access to real-time exchange rates ensures transparency and cost predictability in your international transactions. You can lock in favorable exchange rates, hedging against currency fluctuations, and protect your business from unexpected costs.

3. Centralized Transactions: A single multi-currency forex card for all your international payments streamlines your financial operations. Monitor and manage all transactions from a centralized platform, enhancing efficiency and oversight.

4. Eliminates the Need for Multiple Bank Accounts: With a multi-currency forex card, there’s no need for separate bank accounts for each currency. Consolidate your international finances, reducing the administrative burden and simplifying financial management.

5. Convenient for Employees: Whether it’s business travel expenses or overseas contractors, a multi-currency forex card provides employees with a convenient payment solution. They can make purchases in local currencies without incurring exorbitant transaction fees, ensuring cost control and employee satisfaction.

How to Choose the Right Multi-Currency Forex Card

When selecting a multi-currency forex card for your Singapore start-up, consider the following factors:

- Currencies supported

- Transaction fees

- Currency exchange rates

- Security features

- Customer support

- Reputation and reliability of the card provider

Compare different multi-currency forex card providers to find the one that aligns best with your business needs and offers the most competitive combination of features, fees, and exchange rates.

Image: www.indusind.com

Multi Currency Forex Card In Singapore Startup

Unlocking Growth with Multi-Currency Forex Cards

The benefits of using a multi-currency forex card extend beyond cost savings. It provides Singapore start-ups with greater flexibility, efficiency, and peace of mind in international financial management. Start-ups can allocate resources strategically, invest in growth initiatives, and enhance their global competitiveness by embracing this innovative solution.

In a dynamic, fast-paced business environment, the multi-currency forex card becomes an indispensable tool. It empowers Singapore start-ups to navigate the complexities of foreign currency management, maximize their financial potential, and thrive on the global stage. Embrace this game-changing solution and fuel your start-up’s journey to success.