Introduction

Image: doctornibht.weebly.com

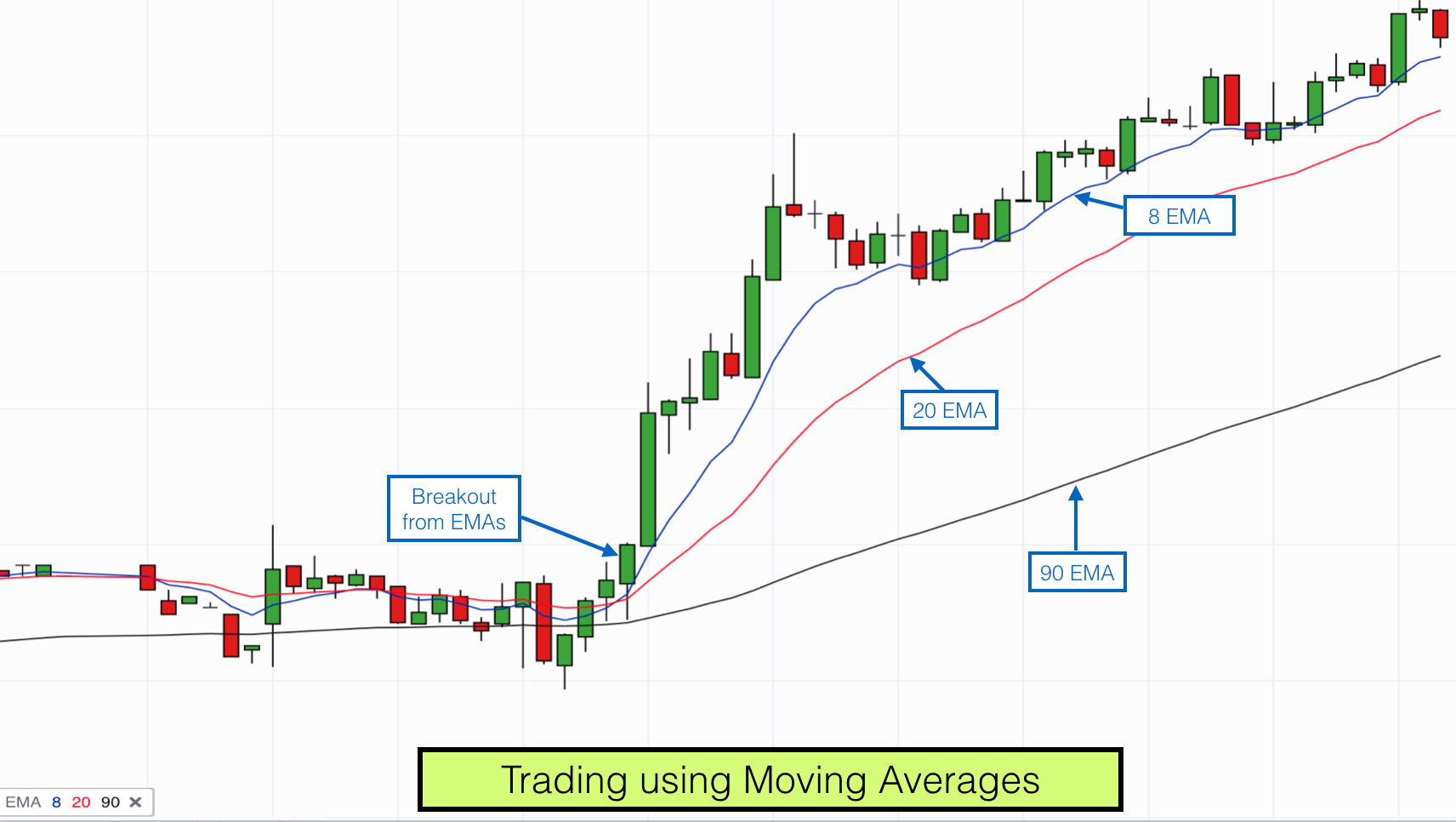

In the tumultuous waters of forex markets, traders seek strategies that offer a beacon of accuracy and a lifeline of control. Amidst the swirling vortex of currencies, the Moving Average (MA) strategy emerges as a guiding light, illuminating the path towards profitable intraday trading decisions. This article will delve into the depths of the MA strategy, arming traders with the knowledge and insights to navigate the forex currents with precision and confidence.

Understanding the Moving Average

The Moving Average is a technical indicator that smoothes out price fluctuations to reveal the underlying trend of an asset. It assigns equal weight to a specified number of past prices, creating a continuous line that represents the average price over that period. The most common types of MAs are Simple Moving Average (SMA), Exponential Moving Average (EMA), and Weighted Moving Average (WMA). Each variation has its unique characteristics, influencing how it reacts to price changes.

Application for Intraday Forex Trading

The MA strategy shines in the dynamic realm of intraday forex trading, where time is of the essence and quick decision-making is paramount. By analyzing the MA, traders can identify potential trading opportunities, monitor their positions, and exit trades at optimal points. The key lies in understanding how the MA interacts with price action.

Trading Signals from Moving Averages

-

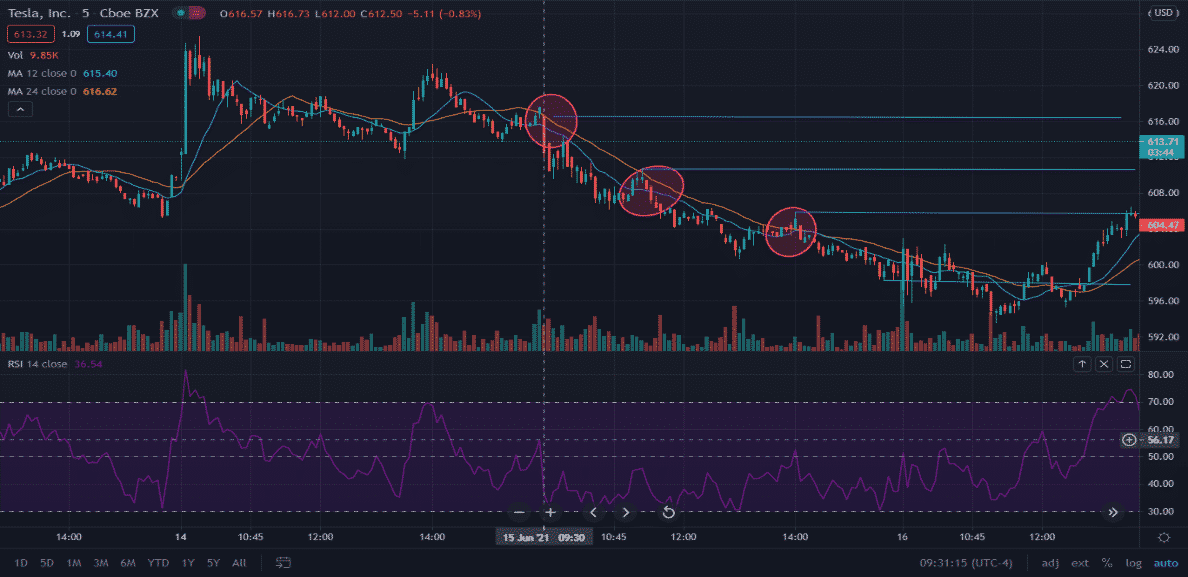

Crossovers: When a shorter-term MA crosses above a longer-term MA, it often signals a bullish trend reversal. Conversely, a downward crossover indicates a bearish reversal.

-

Trend Confirmation: A sustained trend is ascertained when the price stays above or below the MA for an extended period. An uptrend is confirmed when the price repeatedly closes above the MA, while a downtrend is validated when the price remains consistently below the MA.

-

Support and Resistance: MAs can serve as dynamic support and resistance levels. When the price approaches the MA, traders watch for potential bounces or reversals.

Expert Insights and Actionable Tips

-

Choose the Right MA: Experiment with different MA periods to determine which ones suit your trading style and time frame best. Common settings range from 5 to 50 periods.

-

Combine with Other Indicators: Integrate the MA strategy with other technical indicators, such as oscillators or volume indicators, to strengthen the accuracy of your signals.

-

Manage Risk: Set clear stop-loss and take-profit levels to mitigate potential losses. Money management is crucial in trading.

Conclusion

The Moving Average strategy equips traders with a robust tool to navigate the complexities of intraday forex trading. By understanding the nuances of this potent indicator, traders can make informed decisions, ride market trends with confidence, and maximize their profit potential. Embark on this journey of knowledge and empowerment, and may the MA strategy guide you to trading triumphs.

Image: optionstradingiq.com

Moving Average Strategy For Forex Intraday