In the labyrinthine world of currency trading, money management reigns supreme. It is the bedrock upon which a profitable and sustainable forex trading strategy rests. Only by mastering the nuances of managing capital can traders navigate the volatile waters of the forex market and emerge unscathed.

Image: www.mql5.com

A Prudence Axiomatic

Prudence dictates that you venture into forex trading only with funds you can afford to lose. The lure of quick riches should never obscure the inherent risks involved. Trade with a sum that, if lost, will not disrupt your financial well-being. This prudent approach safeguards against the devastating consequences of reckless overleveraging.

Calculate the optimal position size for each trade based on your chosen risk tolerance. The standard metric for risk control is to risk no more than 1% of your trading account balance on any one trade. This conservative approach ensures that a series of losing trades does not decimate your capital.

Ride the Ebb and Flow

Avoid the pitfall of placing all your eggs in one basket. Diversifying your portfolio across multiple currency pairs mitigates risk. Forex traders often employ currency correlation charts to identify instruments that move in tandem or inverse to each other. Trading this, the correlation helps hedge against market fluctuations.

Implement stop-loss orders to protect your profits. These orders automatically close a trade when the market reaches a predetermined price level, safeguarding your capital from catastrophic losses. Similarly, take-profit orders crystallize gains by exiting trades when the target profit level is achieved.

Risk Management in the Crucible

Successful forex trading requires a deep understanding of risk management and a disciplined approach to implementing these strategies. The pain of loss serves as a harsh but invaluable teacher. Each setback is an opportunity to reassess your risk tolerance, refine your trading plan, and emerge as a more proficient trader.

Image: savecompostersbest.blogspot.com

Seek Expert Counsel

For novice traders, the allure of forex trading can mask its inherent complexity. Seasoned traders often share their insights and strategies, providing invaluable guidance. Consider seeking mentorship from experienced professionals who can help you refine your trading approach and mitigate risks.

FAQs on Forex Money Management

Q: How much capital do I need to start forex trading?

A: This depends on your trading strategy and risk tolerance. Start with a sum you can afford to lose and gradually increase your capital as your experience grows.

Q: What is the optimal position size for a trade?

A: Trade with a position size that limits your risk to 1% of your account balance or less. Use the following formula: Position Size = Risk * (Account Balance / Stop-Loss Level).

Q: How does stop-loss orders help in forex trading?

A: Stop-loss orders prevent excessive losses by automatically closing trades when the market reaches a predetermined price level. They are crucial for risk management.

Q: Is it wise to diversify into multiple currency pairs?

A: Yes, diversifying across multiple currency pairs reduces the impact of fluctuations in any single instrument. Consider using currency correlation charts to identify pairs that move in tandem or inverse to each other.

Q: How do I calculate the risk-reward ratio for a trade?

A: Divide the potential profit by the potential loss to determine the risk-reward ratio. Aim for trades with a positive risk-reward ratio in your favor.

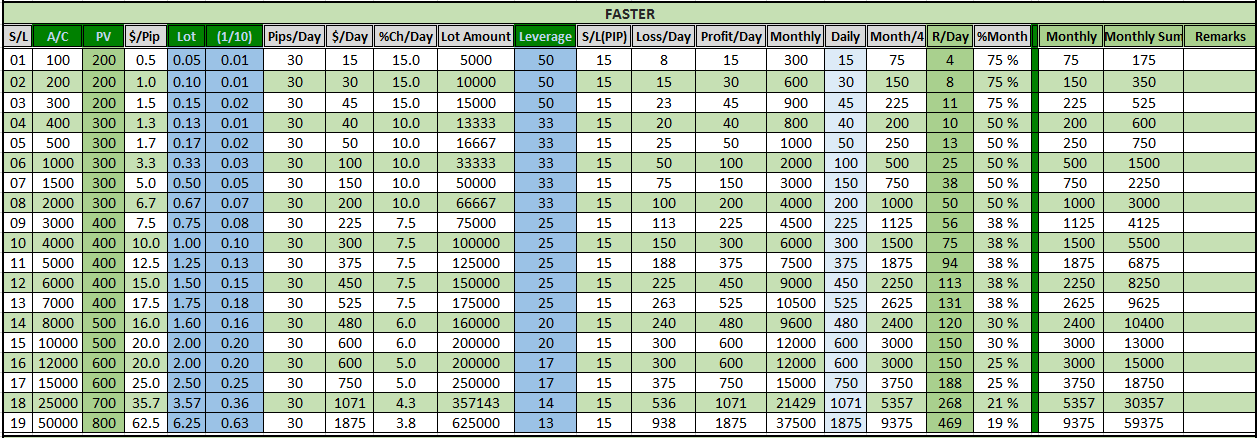

Money Management In Forex Calculator

https://youtube.com/watch?v=Al4vzcbblhc

Conclusion

In the unforgiving arena of forex trading, money management reigns supreme. By understanding the principles outlined above and implementing them diligently, you can mitigate risks and increase your chances of becoming a successful forex trader. Remember, the path to profitability lies not in reckless speculation but in prudent money management. Embrace risk management as a lifelong pursuit, and may your trading endeavors reap bountiful rewards.

Are you intrigued by the intricacies of forex money management? Share your perspectives and engage in thought-provoking discussions in the comments section below.