Introduction:

Stepping into the dynamic world of forex trading can be daunting, especially if you’re unfamiliar with its intricate landscape. But fear not, dear reader, as this comprehensive guide will illuminate the list of forex currencies traded on NSE (National Stock Exchange of India), empowering you to navigate the complexities of this global marketplace with ease and confidence.

Image: se.pimco.com

Understanding Forex Currencies:

Forex, an abbreviation for foreign exchange, encompasses the trading of currencies from different countries, facilitating international trade and facilitating the exchange of goods and services. Currency pairs are central to this process, comprising a base currency against a quote currency, which determines their relative value.

List of Forex Currencies Traded on NSE:

The NSE offers a diverse range of forex currency pairs, providing ample opportunities for traders to capitalize on market movements. Here’s a comprehensive list:

- USD/INR: US Dollar against Indian Rupee

- EUR/INR: Euro against Indian Rupee

- GBP/INR: British Pound against Indian Rupee

- JPY/INR: Japanese Yen against Indian Rupee

- AUD/INR: Australian Dollar against Indian Rupee

- CAD/INR: Canadian Dollar against Indian Rupee

- CHF/INR: Swiss Franc against Indian Rupee

- NZD/INR: New Zealand Dollar against Indian Rupee

Significance of Forex Currencies on NSE:

The trading of these forex currencies on NSE holds immense significance for multiple reasons. India’s vibrant and growing economy attracts significant investment from global entities, leading to increased demand for the Indian Rupee. This, coupled with the robust regulatory framework provided by NSE, has fostered a conducive environment for forex trading.

Tips for Trading Forex Currencies:

-

Research and Analysis: Before venturing into the forex market, it’s imperative to conduct thorough research and stay abreast of economic indicators, geopolitical events, and financial news that can influence currency movements.

-

Risk Management: Managing risk is paramount in forex trading. Utilize stop-loss orders, monitor market volatility, and implement appropriate hedging strategies to safeguard your capital.

-

Technical Analysis: Technical analysis involves studying historical price charts and patterns to identify potential trading opportunities. By utilizing tools like moving averages, support and resistance levels, and trendlines, traders can make informed decisions.

-

Expert Guidance: Consider seeking guidance from experienced forex traders or financial advisors who can provide valuable insights and assistance in managing your trading strategy.

**FAQ:

- **Q:** What is the most traded forex currency on NSE?

**A:**USD/INR (US Dollar against Indian Rupee)

- **Q:** Can I trade forex currencies on NSE if I’m not a resident of India?

**A:**Yes, non-residents can trade forex currencies on NSE, subject to certain regulations and approvals

Conclusion:

Embarking on your forex trading journey on NSE empowers you to tap into a global financial market with immense potential. By understanding the essential forex currencies traded, leveraging our expert tips, and embracing continuous learning, you can navigate this multifaceted arena with confidence and expand your financial horizons.

We would love to hear your thoughts and experiences; share them in the comments below and let us delve into the fascinating world of forex trading together!

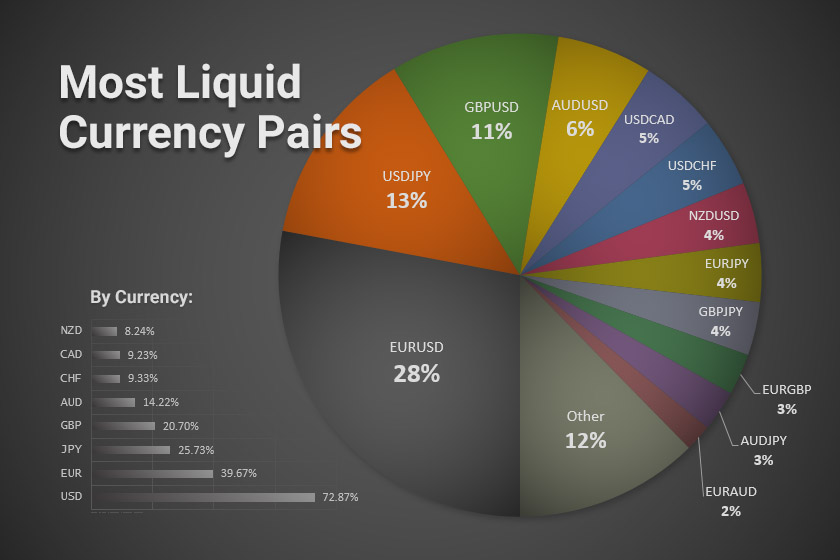

Image: howtotradeonforex.github.io

List Of Forex Currencies In Nse