The Turkish lira’s precipitous decline in recent months has sent shockwaves through the foreign exchange market, triggering concerns about its far-reaching implications for global financial stability. As the currency continues to weaken against the US dollar and other major counterparts, analysts are grappling with the potential consequences for economies around the world. In this article, we delve into the reasons behind the lira’s fall and explore its impact on the forex market and beyond.

Image: fxpro.news

Unveiling the Underlying Factors

The lira’s slide into devaluation can be attributed to a confluence of factors. Economic imbalances, political uncertainty, and geopolitical tensions have all contributed to the currency’s depreciation.

A widening current account deficit, driven by a surge in imports and a slowdown in exports, has put downward pressure on the lira. Turkey’s reliance on foreign energy imports has exacerbated the deficit, making the country vulnerable to fluctuations in global energy prices.

Political turmoil and a lack of confidence in the government’s economic policies have further eroded the lira’s value. The perception of increased risk in Turkey has deterred foreign investors and contributed to capital outflows.

Geopolitical tensions, particularly with neighboring Syria, have also rattled investors and weighed on the lira’s performance.

Impact on the Forex Market

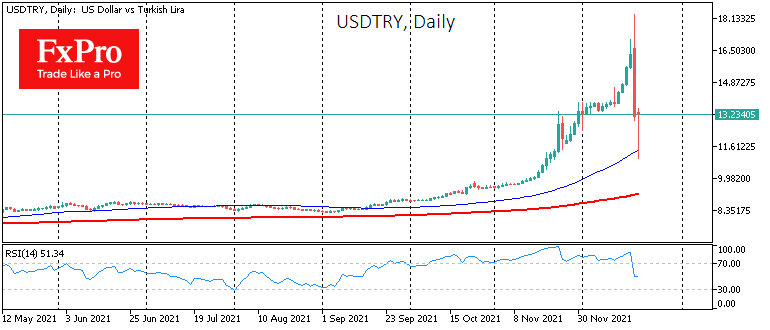

The lira’s depreciation has had a significant impact on the forex market. The currency’s volatility has increased markedly, creating uncertainty and widening bid-ask spreads.

Traders who held long positions on the lira have suffered significant losses, while those who anticipated the decline and shorted the currency have profited. The lira’s weakness has made carry trades less attractive, reducing demand for emerging market currencies and weighing on their values.

The volatility in the lira has also had a ripple effect on other emerging market currencies, raising concerns about contagion and financial instability.

Consequences for Turkey and Beyond

The lira’s fall has had far-reaching consequences for Turkey and its economy.

Inflation: Devaluation typically leads to higher import prices, which can fuel inflation. In Turkey, inflation has already been elevated, and the lira’s fall is expected to exacerbate the problem.

Interest Rates: To curb inflation, the Turkish Central Bank may need to raise interest rates. However, this could further dampen economic growth, which is already facing headwinds.

Economic Growth: A weaker lira makes Turkish exports more competitive, but it also increases the cost of imported goods and raw materials. The overall impact on economic growth is uncertain, but it could lead to a slowdown or even a recession.

Beyond Turkey, the lira’s fall has raised concerns about spillover effects on other emerging markets. A prolonged depreciation could trigger capital outflows and currency declines in other vulnerable economies.

Image: www.pinterest.com

Global Financial Stability Risks

The lira’s volatility and its potential to trigger contagion have raised concerns about global financial stability. If the crisis spreads to other emerging markets, it could lead to a reduction in global growth and asset price declines.

International financial institutions and policymakers are closely monitoring the situation, recognizing the potential risks to the global economy.

Lira Fall Impacts Forex Market

https://youtube.com/watch?v=N0h6rr2lIrA

Lessons and Future Outlook

The lira’s precipitous fall serves as a cautionary tale about the risks of macroeconomic imbalances, geopolitical uncertainty, and reliance on foreign capital.

For Turkey, it is imperative to address the underlying causes of the currency’s depreciation and implement sound economic policies. The government needs to reduce the current account deficit, increase investor confidence, and ease geopolitical tensions.

For investors, the lira’s volatility highlights the importance of risk management and diversification. In a rapidly changing global environment, it is crucial to stay informed about the latest developments that could affect financial markets.

The future outlook for the lira and the forex market remains uncertain. The path of the lira will depend on Turkey’s ability to stabilize its economy, the resolution of geopolitical tensions, and the broader global economic environment. However, it is clear that the lira’s fall has had a profound impact on the forex market and has raised concerns about financial stability.