Introduction

In the dynamic and fast-paced world of forex trading, understanding the intricacies of pip earning is crucial for traders to maximize their returns and mitigate risks. Pip earning, the profit or loss realized on a trade, can be a determining factor in a trader’s success. However, limitations in pip earning exist, and traders must be aware of these limitations to optimize their trading strategies. In this article, we will delve into the concept of limited pip earning in forex, exploring its causes, implications, and strategies for overcoming these limitations.

Image: www.windowscentral.com

Understanding Pip Earning Limitations

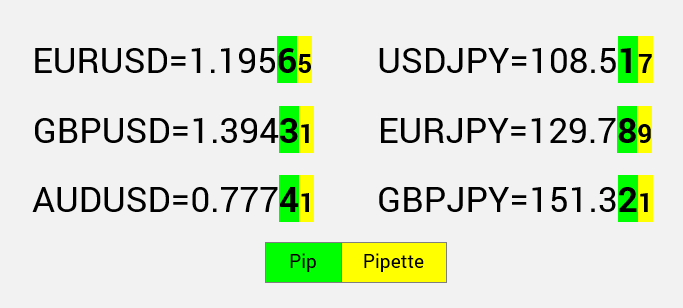

Pip (point in percentage) is a unit of measure that represents the smallest price change in a currency pair. While forex traders aim to make a profit by buying and selling currencies at different prices, there are inherent limitations to the number of pips that can be earned on a single trade. These limitations stem from various factors, including:

-

Market Volatility: Market volatility refers to the fluctuations in currency prices. High volatility can lead to significant pip movements, offering greater earning potential. Conversely, low volatility can restrict pip earning, as price changes are minimal.

-

Broker Spread: Brokers act as intermediaries between traders and the market, facilitating trades. They quote two prices for each currency pair, a bid price and an ask price, with the difference between these prices known as the spread. This spread represents the broker’s commission and can limit pip earning.

-

Slippage: Slippage occurs when an order is executed at a price different from the requested price due to rapid market movements. This can result in fewer pips earned than anticipated and can negatively impact trading performance.

Implications of Limited Pip Earnings

The limitations in pip earning can have several implications for forex traders:

-

Profitability Constraints: Traders may struggle to generate sufficient profits if pip earning is restricted. This can lead to frustration and hinder trading progress.

-

Increased Risk: To compensate for limited pip earning, traders may increase their position size or leverage, which can magnify potential losses.

-

Missed Trading Opportunities: Pip earning limitations can prevent traders from taking full advantage of market movements, leading to missed trading opportunities and reduced profits.

Strategies to Overcome Limitations

Despite these limitations, there are strategies that traders can employ to overcome them and enhance their pip earning potential:

-

Choose Volatile Currency Pairs: Trading currency pairs with higher volatility provides greater pip movement, increasing the potential for larger pip earnings.

-

Negotiate Lower Spreads: Traders can negotiate lower spreads with their brokers by establishing a positive relationship and demonstrating consistent trading volume.

-

Manage Slippage: Using limit orders or trading during less volatile market conditions can help minimize the impact of slippage on pip earnings.

-

Use Scalping Techniques: Scalping involves executing multiple small trades within a short time frame. While each trade yields a small number of pips, it can accumulate significant profits over time.

-

Trading in News Events: Forex news events can trigger large price movements, providing opportunities for substantial pip earnings. However, traders must be prepared to manage the increased volatility and potential risks.

Image: dsrrey.com

Limited Pip Earning In Forex

Conclusion

Limited pip earning is an inherent limitation in forex trading that traders must acknowledge. By understanding the causes and implications of these limitations, traders can develop strategies to overcome them and maximize their profit potential. Choosing volatile currency pairs, negotiating lower spreads, managing slippage, utilizing scalping techniques, and trading during news events can help traders break through these limitations and achieve their trading goals. Remember, while navigating the forex market can be challenging, embracing the complexities and employing effective strategies can lead to success in this dynamic and rewarding field.